Women’s Health And Beauty Supplements Market Growth & Trends

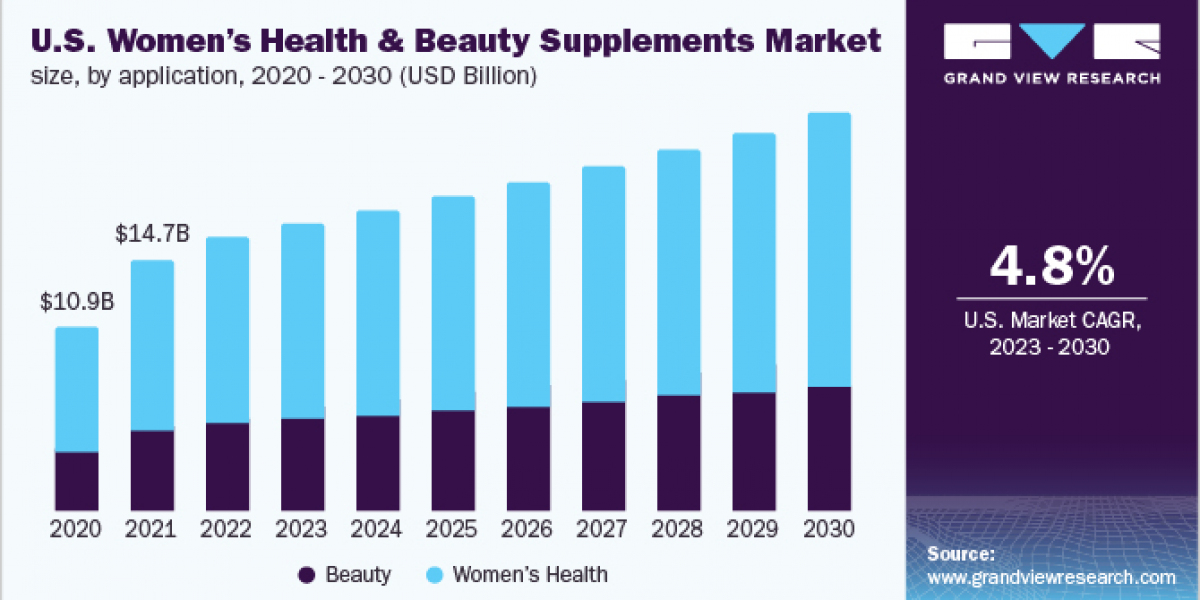

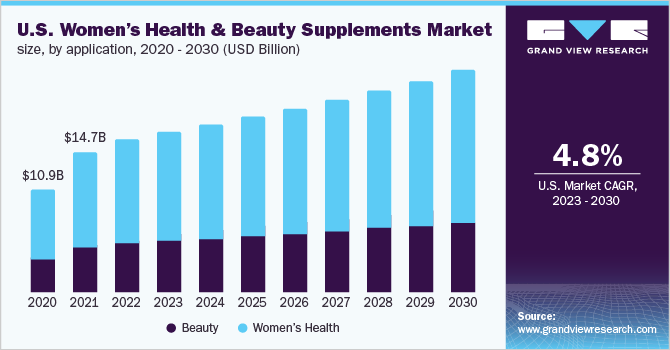

The global women’s health and beauty supplements market size is expected to reach USD 79.29 billion by 2030, expanding at a CAGR of 5.1% during the forecast period, according to a new report by Grand View Research, Inc. The market is anticipated to witness exponential growth opportunities owing to the increasing awareness about healthy living and well-being coupled with an increase in the adoption of an active lifestyle. Moreover, the wide applications of supplements in the treatment of various disorders such as anemia, depression, arthritis, and others are propelling the demand.

Micronutrient deficiencies and nutritional inadequacies are global health issues, specifically in Middle Eastern and Latin American countries. Prominent deficits in iron, folate and vitamin D noted among pregnant women and women of childbearing age are driving the demand for women’s health supplements over the past few years. For instance, the recent research findings of Purdue University show that most women have vitamin and other micronutrients deficiency.

Gather more insights about the market drivers, restrains and growth of the Women’s Health And Beauty Supplements Market

Moreover, the increasing trend of veganism across the globe is anticipated to benefit the demand for herbal supplements over the forecast period. People especially women are shifting their preference toward herbal supplements owing to their long-term benefits and lesser side effects. This trend is facilitating market players to launch herbal remedies. For instance, in October 2022 Pharmactive Biotech Products, S.L.U. launched damiana to enhance sexual function both in women and men. In addition, in December 2021, Nutrilite launched its first range of supplements designed for millennial women. This newly launched product is the right blend of herbal extracts, vitamins, and minerals.

Furthermore, various organic and inorganic growth strategies undertaken by leading market players are projected to offer lucrative growth opportunities for the market. For instance, in August 2022, The Honest Company launched four new women’s wellness products at GNC. These newly launched products are for mood balance, immune support, sleep health, and postnatal health wellness. In addition, in March 2022 , Laboratoire PYC launched two vegan gummy beauty and immune health supplements. The launch was made to cater to the rising demand for nutritional support that offers good taste with added medical benefits.

Women’s Health And Beauty Supplements Market Report Highlights

- The vitamins segment held the largest revenue share in 2023, owing to high demand for vitamins, increasing adoption of healthy lifestyles, and surging trend of preventive healthcare

- The enzymes segment is anticipated to register the fastest CAGR during the forecast period, due to the rising adoption of enzyme-based products and growing awareness among women regarding the benefits associated with enzymatic supplements

- The women’s health segment accounted for the largest market in 2022 due to the robust availability of a number of supplements for different conditions such as digestive health, immune health, and joint health, and the presence of a higher consumer pool

- Based on age group, the age 31-50 segment dominated the market in 2022, whereas the above 70 age segment is anticipated to be the fastest growing over the forecast period

- Based on sales channel, the direct sales channel segment held the largest revenue share in 2022. However, the online segment is projected to grow at a lucrative CAGR during the forecast period

- Middle East and Africa is expected to exhibit the fastest CAGR over the forecast period due to increasing awareness about health and well-being along with nutritional deficiencies

Women’s Health And Beauty Supplements Market Segmentation

Grand View Research has segmented the global women’s health and beauty supplements market based on product, application, age group, consumer group, sales channel, and region:

Women’s Health And Beauty Supplements Product Outlook (Revenue, USD Million, 2018 - 2030)

- Vitamins

- Mineral

- Enzymes

- Botanicals

- Proteins

- Omega-3

- Probiotics

- Others

Women’s Health And Beauty Supplements Application Outlook (Revenue, USD Million, 2018 - 2030)

- Beauty

- Women’s Health

Women’s Health And Beauty Supplements Age Group Outlook (Revenue, USD Million, 2018 - 2030)

- Age 15-30

- Age 31-50

- Age 51-70

- Above 70 years

Women’s Health And Beauty Supplements Consumer Group Outlook (Revenue, USD Million, 2018 - 2030)

- Prenatal

- Postnatal

- PMS

- Perimenopause

- Postmenopause

- Others

Women’s Health And Beauty Supplements Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Online

- Direct Sales

- Pharmacies/Drug Stores

- Other Offline Channels

Women’s Health And Beauty Supplements Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Russia

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Taiwan

- Malaysia

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Order a free sample PDF of the Women’s Health And Beauty Supplements Market Intelligence Study, published by Grand View Research.