These loans usually range from a number of hundred to a few thousand dollars, relying on the lender's policies and the borrower's financial scenario. The repayment period usually spans from two weeks to a month, aligning with the student’s pay cycle. It’s necessary for faculty kids to fastidiously assess their capability to repay the mortgage within the allotted time-frame to keep away from falling into a cycle of d

For new debtors contemplating payday loans, adopting accountable borrowing practices is crucial. Creating a budget to handle bills and plan for repayments can help prevent falling right into a debt cycle. Before taking on a payday loan, consider whether or not it’s a necessity or if there are various solutions obtaina

Before resorting to payday loans, college students should think about other financial options. Options such as personal loans from credit score unions or banks, borrowing from pals or family, and even exploring part-time job opportunities could present safer and more sustainable financial reduct

Next, contemplate working with a financial advisor or credit counselor who can provide customized insights based on specific financial circumstances. Their experience can significantly improve the borrower's capability to effectively repair their cre

Utilizing on-line platforms for securing Student Loan payday loans presents several advantages. First and foremost, the appliance course of is usually simplified and may be accomplished from the consolation of one’s home, saving effort and time. Many lenders provide quick approval choices, permitting college students to entry funds once they need them m

With partaking articles and user-generated content, BePick stands out as a trusted supply for locating essential financial merchandise tailored to your corporation needs. The critiques help highlight each the professionals and cons of various Mobile Loan options, making certain that potential debtors have the information they want to decide on correc

Fast Access to Capital: Loans can typically be secured inside days, enabling companies to respond promptly to money move points.

Flexible Use of Funds: Unlike conventional loans which may be earmarked for particular purposes, money move loans permit companies to deploy funds where they're needed most.

Helps Maintain Operations: Ensuring payroll and operational prices are met helps businesses keep away from disruptions and maintain productivity.

These advantages spotlight why many companies turn to cash circulate help loans as a critical resource during difficult financial occasi

n Yes, there are risks involved with cash circulate help loans, primarily associated with high-interest rates and short repayment phrases. If not managed properly, businesses can discover themselves in a cycle of debt. Additionally, businesses may face penalties for late payments or early compensation, impacting money circulate. It is crucial to carefully evaluation mortgage terms and assess your capacity to repay before borrow

The Application Process

Applying for an urgent payday loan online is generally a simple and fast process. Applicants typically fill out a kind on the lender's web site, offering primary data such as name, address, and income details. It’s important to make sure all info is accurate to prevent delays. Once the applying is submitted, the lender evaluates your information and decides whether to approve or deny the mortg

Additionally, many faculties supply emergency funds or resources via financial aid places of work that students can tap into throughout tough occasions. Scholarships and grants are additionally great alternate options that do not require payback and might alleviate the burden of tuition and other expen

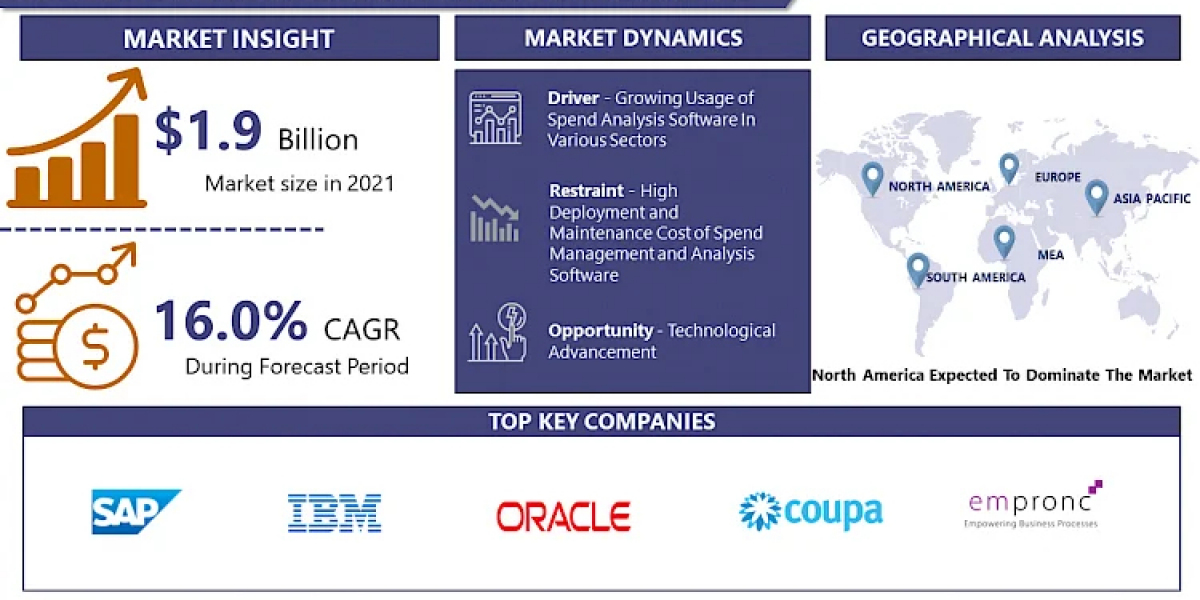

Cash flow assistance loans are designed to assist businesses handle their money flow challenges by providing fast access to capital when wanted. These loans can supply a buffer during slow gross sales periods or in times of surprising expenses. With quite a few options available, it’s essential for entrepreneurs to assess the best lending answer for his or her monetary wants. In this text, we are going to explore the types of cash move assistance loans, their advantages, eligibility criteria, and compensation concerns, along with a short introduction to BePick, a priceless useful resource for detailed info and reviews on money circulate help lo

In today's fast-paced world, unexpected expenses can arise at any second. For new debtors exploring choices to handle these emergencies, payday loans are more and more seen as a viable solution. Companies like 베픽 offer complete info and evaluations on payday loans specifically designed for newcomers to this monetary avenue, empowering users with the knowledge necessary to make informed decisi

In right now's monetary panorama, many individuals face challenges with their credit score scores, which may have an result on their capability to safe loans, mortgages, and even employment. Credit restore loans on-line are emerging as a preferred resolution for individuals seeking to boost their credit ratings and regain monetary stability. This comprehensive information will delve into what credit repair loans are, how they work, their professionals and cons, and very important considerations one should remember whereas navigating the net Credit Loan score restore mortgage marketplace. It will also highlight a priceless useful resource, the Becpic website, which offers detailed data and critiques associated to credit score repair loans onl

Wilburn Chiodo

1 Blog posts