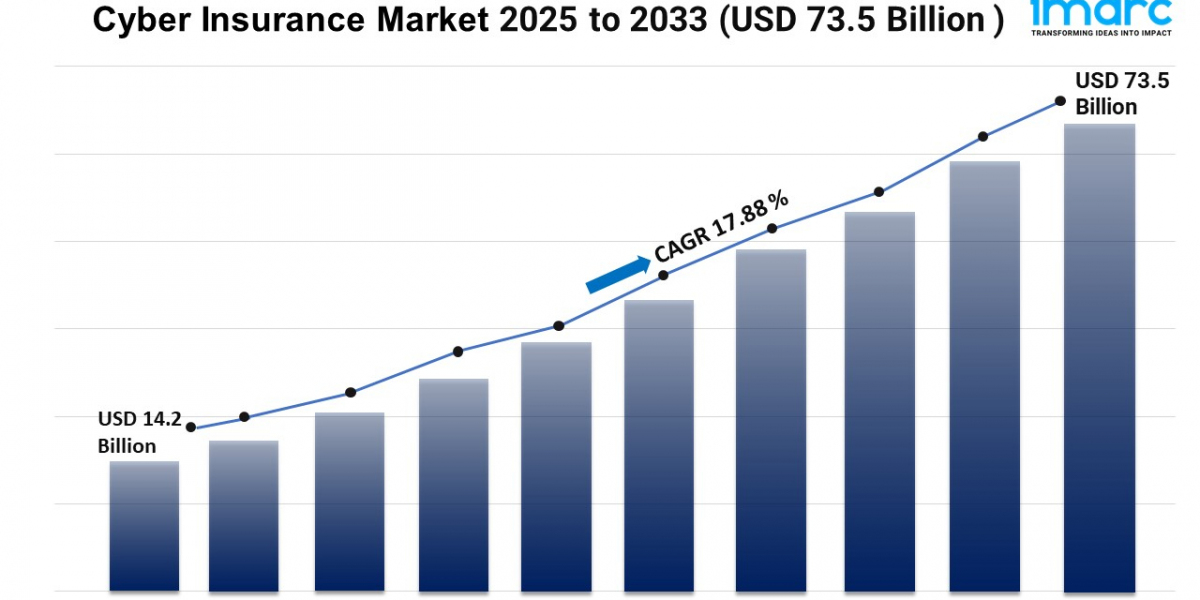

Global Cyber Insurance Market Statistics: USD 73.5 Billion Value by 2033

Cyber Insurance Industry

Summary:

- The global cyber insurance market size reached USD 14.2 Billion in 2024.

- The market is expected to reach USD 73.5 Billion by 2033, exhibiting a growth rate (CAGR) of 17.88% during 2025-2033.

- North America leads the market, accounting for the largest cyber insurance market share.

- Solution accounts for the majority of the market share in the component segment.

- Stand-alone holds the largest share in the cyber insurance industry.

- Large enterprises remain a dominant segment in the market, as they possess more notable assets and data that need protection.

- BFSI represents the leading end use industry segment.

- The rising cybersecurity threats is a primary driver of the cyber insurance market.

- The increasing awareness among businesses and the growing need for risk management solutions are reshaping the cyber insurance market.

Industry Trends and Drivers:

- Rising cybersecurity threats:

The rising prevalence and sophistication of cyberattacks, including ransomware, phishing, and data breaches, are prompting businesses to consider cyber insurance a vital part of their risk management strategies. Organizations across various sectors face a broad spectrum of cyber threats, with both large corporations and smaller enterprises being at risk. Smaller businesses, in particular, often lack the resources to invest significantly in cybersecurity infrastructure, rendering them more susceptible to attacks. Additionally, the swift transition to digital transformation, driven by remote work trends and the adoption of cloud technologies, is increasing the attack surface for cybercriminals. As a result, it has become crucial for businesses to obtain insurance coverage to protect against potential financial losses.

- Increasing awareness among businesses:

The growing awareness of the financial and operational risks associated with cyber incidents is driving up the demand for cyber insurance. High-profile breaches and ransomware attacks are impacting organizations, making cybersecurity a critical business priority. These incidents underscore the potential for significant financial losses, including expenses related to business interruption, data recovery, and compensation for clients. Consequently, business leaders are increasingly acknowledging the importance of taking proactive steps to mitigate these risks. Insurers are responding by creating more customized and industry-specific policies that cater to the unique challenges faced by various sectors, such as finance, healthcare, and retail. These tailored solutions are especially attractive to small and medium-sized enterprises (SMEs), which are recognizing the necessity of affordable, scalable coverage.

- Growing need for risk management solutions:

The cyber insurance market is thriving due to the growing emphasis on risk management within organizations. As cybersecurity rises to the level of boardroom discussions, companies are prioritizing strategies to mitigate risks and ensure business continuity in the event of a cyber incident. This shift is driving an increased adoption of cyber insurance as an integral part of a comprehensive risk management framework. Insurers are introducing more advanced products that not only cover financial losses but also offer risk assessment tools, threat intelligence, and incident response services. These additional services assist businesses in bolstering their overall cybersecurity posture, making insurance policies more appealing. Furthermore, companies are using cyber insurance to provide reassurance to stakeholders, including investors and clients, that they are actively managing cyber risks.

Request for a sample copy of this report: https://www.imarcgroup.com/cyber-insurance-market/requestsample

Cyber Insurance Market Report Segmentation:

Breakup By Component:

- Solution

- Services

Solution exhibits a clear dominance in the market due to the increasing need for comprehensive cybersecurity measures and proactive risk management.

Breakup By Insurance Type:

- Packaged

- Stand-alone

Stand-alone represents the largest segment attributed to its dedicated, extensive coverage tailored to address the unique risks associated with cyber incidents.

Breakup By Organization Size:

- Small and Medium Enterprises

- Large Enterprises

Large enterprises hold the biggest market share, as they possess more notable assets and data that need protection.

Breakup By End Use Industry:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

BFSI accounts for the majority of the market share, driven by the high exposure to cyber risks and the critical need to safeguard sensitive financial data and transactions.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market owing to its advanced technological infrastructure, higher incidence of cyber-attacks, and stringent regulatory requirements mandating robust cybersecurity measures.

Top Cyber Insurance Market Leaders:

The cyber insurance market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Allianz Group

- American International Group Inc.

- AON Plc

- AXA XL

- Berkshire Hathaway Inc.

- Chubb Limited (ACE Limited)

- Lockton Companies Inc.

- Munich ReGroup or Munich Reinsurance Company

- Lloyd's of London

- Zurich Insurance Company Limited

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163