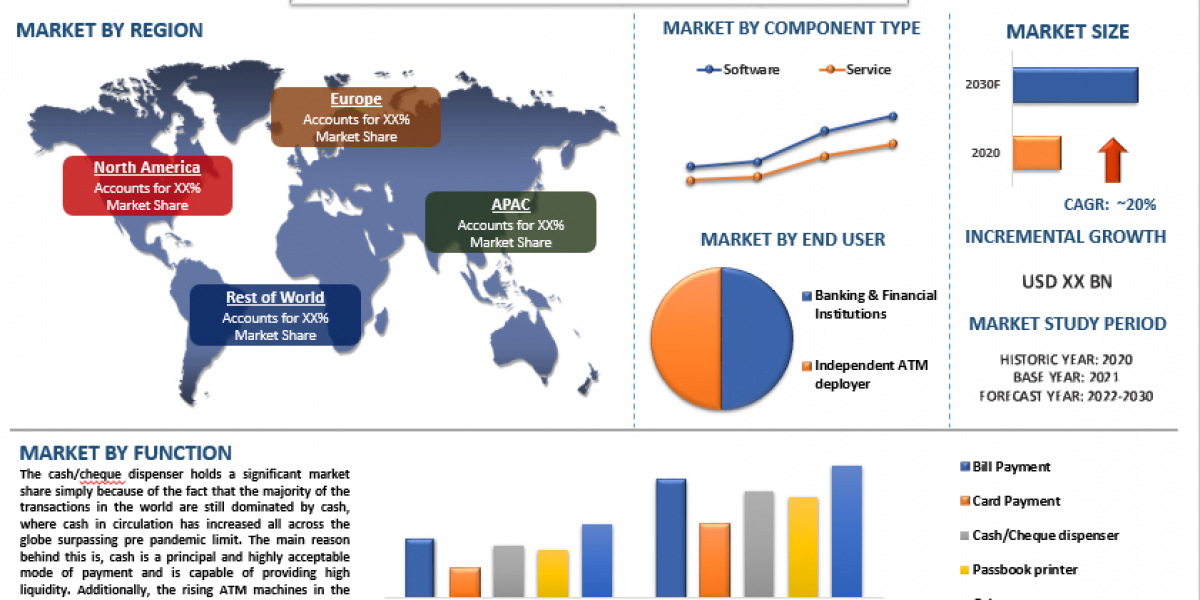

According to a new report published by UnivDatos Markets Insights, the Multivendor ATM Software Market was valued at USD x million in 2021 & is expected to grow at a CAGR of 20% from 2022-2030. The analysis has been segmented into Component Type (Software and Service), End User (Banking & Financial Institutions and Independent ATM deployers), and By Function (Bill payments, Card payment, Cash/Cheque dispenser, Passbook printer, and Others), Region/Country.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=37456

The multivendor ATM software market report has been aggregated by collecting informative data on various dynamics such as market drivers, restraints, and opportunities. This innovative report makes use of several analyses to get a closer outlook on the multivendor ATM software market. The multivendor ATM software market report offers a detailed analysis of the latest industry developments and trending factors in the market that are influencing the market growth. Furthermore, this statistical market research repository examines and estimates the multivendor ATM software market at the global and regional levels.

Key Market Opportunities

Multivendor ATM software is a technology that enables banks to centralize their ATM channel management to a single central command center which enhances their customer experience and commission real-time updates. Additionally, this software is capable of working across different ATM hardware and software, enabling companies to procure their ATM hardware and software components separately from different vendors, eliminating their dependence on any one vendor. Furthermore, usage of this software is growing for the unification of the maintenance of different ATMs using multivendor devices network. Additionally, it enables the banks to extend the ATM features such as customers’ personal area, payments, advertising management, and other financial services by additionally implementing other functions on the multivendor device network. Owing to reasons like these, the demand for Multivendor ATM Software is increasing at an impressive pace. For instance, in March 2021, CMS Infosystems Ltd announced that it has completed the installation of multi-vendor software on 44,467 ATMs, out of the 1,00,000 ATMs contract they had gotten in 2019 from the State Bank of India (SBI) to implement multivendor software.

COVID-19 Impact

The Covid-19 pandemic has had a significant impact on the multivendor ATM software market. As governments enforced strict lockdowns across the globe and halted economic activities all over, manufacturers had to shut down their operations, further escalating into a labor crisis and unemployment problem, which directly impacted the ATM software market due to decreasing cash transactions and people being afraid of going to public places like ATM counters and increasing preference for digital payments, further halted the new investments that were planned to happen by the financial sector in this infrastructure because of uncertainty associated with the situation, which impacted the topline and further capex from the stakeholders active in this market.

Segmentation Details:

· Based on component type, the market is bifurcated into software and services. Out of the two, the software segment holds a significant market share in 2021.

· Based on end users, the market is bifurcated into Banking & Financial Institutions and Independent ATM deployers. Among the two, independent ATM deployers (brown-label ATMs and white-label ATMs) are going to grow at a significant CAGR during the forecasted period.

· Based on function, the market is segmented into bill payment, card payment, cash/cheque dispenser, passbook printer, and others. The cash/cheque dispenser holds a significant share of the market in 2021.

Multivendor ATM Software Market Geographical Segmentation Includes:

· North America (U.S., Canada, and the Rest of North America)

· Europe (Germany, UK, Spain, France, Italy, Rest of Europe)

· Asia-Pacific (China, Japan, India, and Rest of Asia-Pacific)

· Rest of the World

The multivendor ATM software market in the Asia Pacific region held the largest market share and is expected to maintain its growth throughout the forecast period. The market is mainly driven by the fact that the Asia Pacific region mostly consists of emerging economies which are some of the fastest growing economies in the world in the current times and cash circulation normally spikes during periods of elevated economic activity, with people needing more money for transactions which directly increases the ATM deployments. Furthermore, usage of ATMs for non-financial transactions such as balance inquiries, chequebook requests, payment of taxes, funds transfers, etc has increased indicating that day-to-day usage extends beyond cash withdrawals. For instance, as per the SBIs brown label ATM service provider, cash transactions account for 60% of the overall transaction volume and the remaining 40% is used for non-cash transactions.

Competitive Landscape

The degree of competition among prominent global companies has been elaborated by analyzing several leading key players operating worldwide. The specialist team of research analysts sheds light on various traits such as global market competition, market share, most recent industry advancements, innovative product launches, partnerships, mergers, or acquisitions by leading companies in the multivendor ATM software market. The major players have been analyzed by using research methodologies such as Porter’s Five Forces Analysis for getting insight views on global competition.

Click here to view the Report Description & TOC https://univdatos.com/report/multivendor-atm-software-market/

Recent Developments:

· On January 2023, Hitachi Terminal Solutions India Pvt Ltd. announced that it is going to perform capacity addition in its existing 1,08,000 sq ft ATMs or cash recycling machine (CRM) manufacturing facility in Bengaluru, where it is planning to triple its current monthly production capacity from 1000 CRMs.

· On July 2021, KAL, an independent ATM software company, and EVO Payments, a global payments technology and services provider, announced a new ATM service. The solution combines KAL’s Kalignite software suite with EVO’s payments infrastructure. It enables banks and IADs (independent ATM deployers) to rapidly deploy ATMs to any European location. KAL’s multivendor software allows ATM deployers to select machines from over 40 vendors, while EVO’s infrastructure delivers the durability and card scheme compliance expected from a world-class ATM solution.

Key questions resolved through this analytical market research report include:

• What are the latest trends, new patterns, and technological advancements in the multivendor ATM software market?

• Which factors are influencing the multivendor ATM software market over the forecast period?

• What are the global challenges, threats, and risks in the multivendor ATM software market?

• Which factors are propelling and restraining the multivendor ATM software market?

• What are the demanding global regions of the multivendor ATM software market?

• What will be the global market size in the upcoming years?

• What are the crucial market acquisition strategies and policies applied by global companies?

• What are the descriptive profiles of key companies along with their SWOT analysis?

We understand the requirement of different businesses, regions, and countries, we offer customized reports as per your requirements of business nature and geography. Please let us know If you have any custom needs.

Related Telecom & IT Market Research Report

Industrial Automation Market: Current Analysis and Forecast (2024-2032)

India Metaverse Market : Current Analysis and Forecast (2024-2032)

India AR/VR Market: Current Analysis and Forecast (2024-2032)

Third-Party Risk Management Market: Current Analysis and Forecast (2024-2032)

Asset Tokenization Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos Market Insights

Email - contact@univdatos.com

Contact Number - +1 9782263411

Website - https://univdatos.com/

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/