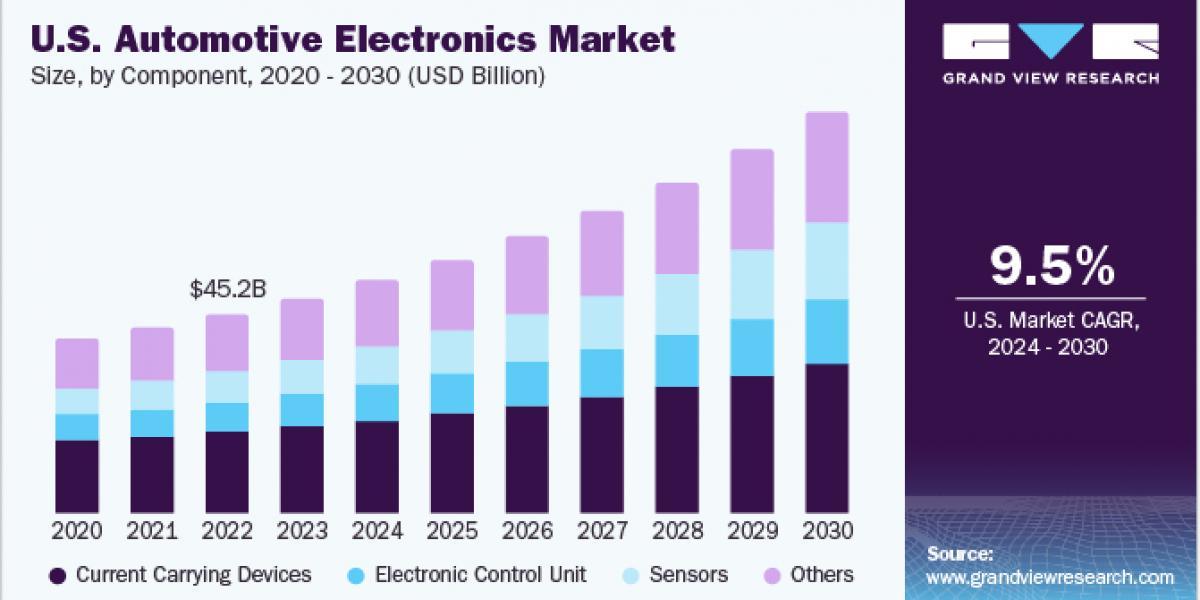

The global automotive electronics market was valued at approximately USD 262.60 billion in 2023 and is expected to experience significant growth, with a compound annual growth rate (CAGR) of 8.8% from 2024 to 2030. This growth is primarily driven by the increasing integration and widespread adoption of advanced safety systems in vehicles, which include technologies such as automatic emergency braking, airbags, parking assistance systems, and lane departure warning systems. These technologies are designed to improve road safety by reducing accidents, and as they become more prevalent, they are expected to fuel higher demand for automotive electronics throughout the forecast period. In addition to these safety features, other innovations such as emergency call systems, alcohol ignition interlocks, and accident data recorders are gaining traction for their role in enhancing the safety of in-vehicle passengers. These developments are playing a significant role in propelling market growth.

Another key factor contributing to the expansion of the automotive electronics market is the rising popularity of electric vehicles (EVs). As an increasing number of consumers shift from traditional gasoline-powered vehicles to electric alternatives, the demand for electronic systems within these vehicles has surged. The growing adoption of EVs has led to an increased need for specific electronic components, such as battery management systems and electric powertrains. Beyond consumer interest in electric vehicles, government regulations and funding initiatives have also positively impacted the automotive electronics market, creating a supportive environment for further growth. These initiatives are designed to promote the transition to electric vehicles, which in turn requires advanced electronics to ensure the efficient operation and safety of these new vehicles.

Gather more insights about the market drivers, restrains and growth of the Automotive Electronics Market

Government-imposed safety regulations have played a pivotal role in driving the demand for automotive electronics. These regulations have compelled automakers worldwide to enhance the safety features of their vehicles, leading to a greater reliance on automotive electronics to meet these standards. In addition to improving safety, these regulations have also contributed to the development of new technologies such as electric vehicles, which offer enhanced efficiency and reduced emissions. For instance, China has implemented regulations aimed at reducing energy consumption in passenger cars and promoting the sales of new energy vehicles, including fully electric and plug-in hybrid models. Similarly, governments in other countries are offering various incentives, such as reductions in annual tonnage taxes and automobile tax exemptions, to encourage the adoption of electric vehicles and further stimulate the demand for automotive electronics.

Application Segmentation Insights

In 2023, the safety systems segment held the largest share of the automotive electronics market in terms of revenue. The increasing demand for safe, efficient, and convenient driving experiences, coupled with stricter safety regulations, has driven growth in this segment. Key manufacturers like Continental AG, DENSO Corporation, Infineon Technologies AG, and Robert Bosch GmbH are actively developing safety systems tailored to the needs of both light and heavy commercial vehicles. The growing focus on vehicle safety, along with the rising number of road accidents, has contributed to the segment's growth. For example, in March 2023, Hyundai Motor India Limited launched a new version of the Hyundai Verna, featuring a level 2 Advanced Driver Assistance System (ADAS) and 65 advanced safety features. These features include Hyundai's Smart Sense safety suite, which incorporates automated sensing technologies such as radars and cameras that detect obstacles, providing corrective warnings and actions to enhance overall safety.

The Advanced Driver Assistance System (ADAS) segment is expected to experience the highest CAGR over the forecast period. Several factors contribute to this expected growth, including government regulations mandating the inclusion of safety features and increasing public awareness about the importance of passenger comfort and safety. Moreover, there is a growing consumer preference for cutting-edge technologies, which is driving demand for ADAS in vehicles. As the automotive industry embraces technological advancements, ADAS features such as blind-spot detection, lane-keeping assistance, and collision warning are becoming increasingly common. These features not only enhance the safety and comfort of drivers and passengers but also improve vehicle performance by reducing downtime. ADAS systems can alert vehicle owners to potential issues, ensuring early detection and maintenance, which contributes to the overall performance and longevity of vehicles.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.