Palladium, a precious metal in the platinum group, is highly valued for its catalytic properties, making it essential in industries such as automotive, electronics, and jewelry. Primarily used in catalytic converters for vehicles to reduce harmful emissions, palladium has seen significant price fluctuations over recent years, driven by a combination of supply constraints and rising demand, particularly from the automotive sector. As environmental standards become more stringent worldwide, the demand for palladium remains strong, pushing prices to record levels.

This article delves into the trends that have shaped Palladium Price Trend, analyzing historical data, factors impacting pricing, regional market differences, and the future outlook for palladium.

1. Historical Overview of Palladium Prices

Over the past two decades, palladium prices have shown substantial volatility due to shifts in supply and demand, as well as the broader macroeconomic environment.

Early 2000s to 2010: Steady Demand Growth

Palladium prices remained relatively stable in the early 2000s as demand from the automotive industry was steady. However, increased mining activity in Russia and South Africa, the two primary producers, helped maintain a steady supply to meet this demand, keeping prices relatively moderate.

2010 to 2019: Supply Challenges and Price Spikes

The 2010s marked a period of sharp price increases for palladium. Tightening emissions standards led to an uptick in palladium demand for catalytic converters, especially in gasoline vehicles, while production faced challenges. Limited mining output from key producers, combined with growing automotive sector demand, led to significant price appreciation.

2020 to Present: Pandemic Disruptions and Market Rebound

The COVID-19 pandemic initially disrupted palladium production and demand. However, the subsequent recovery of the automotive industry, along with supply chain constraints and geopolitical tensions, has driven palladium prices to all-time highs. Environmental regulations have further fueled demand for palladium, making it a key component in reducing vehicle emissions globally.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/palladium-price-trends/pricerequest

2. Factors Driving Palladium Prices

Several critical factors influence palladium prices, including its supply-demand balance, market conditions, geopolitical dynamics, and technological shifts.

a) Supply Constraints and Mining Challenges

Palladium is primarily sourced from South Africa and Russia, accounting for nearly 80% of global production. Geopolitical tensions, labor strikes, and regulatory challenges in these regions often result in supply disruptions, adding volatility to palladium prices. In South Africa, mining disruptions due to power shortages and labor strikes have frequently impacted supply. Russia, another significant producer, has faced economic sanctions and trade restrictions, which further affect global palladium supply.

b) Demand from the Automotive Sector

The automotive industry accounts for approximately 85% of global palladium demand, as the metal is crucial in manufacturing catalytic converters for gasoline vehicles. As countries implement stricter emissions standards to combat climate change, demand for palladium continues to grow. In regions where diesel vehicles are less prevalent (like North America and Asia), gasoline-powered vehicles are dominant, increasing the demand for palladium over other platinum group metals (PGMs) typically used in diesel catalytic converters.

c) Technological Advances and Alternatives

Advances in catalytic converter technology and research into alternatives such as platinum and recycled palladium are important factors. Although platinum can substitute palladium to some extent, automotive manufacturers have found it challenging to replace palladium completely due to its superior catalytic properties in gasoline engines. However, as technology advances and sustainability becomes a priority, recycling and substitution may help offset demand for newly mined palladium.

d) Geopolitical Risks and Market Speculation

Palladium markets are particularly sensitive to geopolitical risks, especially given that a large portion of supply comes from politically sensitive regions. Sanctions, tariffs, or other economic restrictions involving major producers like Russia can quickly disrupt supply, leading to price spikes. Market speculation and investor activity in commodities markets also contribute to price volatility.

e) Impact of Sustainability and Recycling Efforts

With the shift towards sustainable practices, recycling palladium from old catalytic converters has become increasingly significant. Recycling offers a secondary supply source, helping to stabilize prices and reduce dependence on mining. However, recycling alone cannot meet the high demand, as recovery rates and availability of recyclable materials remain limited.

3. Palladium Price Trends by Region

The price trend for palladium varies by region, influenced by differences in automotive market dynamics, regulatory policies, and production capacities.

North America

In North America, where gasoline-powered vehicles dominate, demand for palladium is consistently high. The region’s stringent emissions regulations contribute to robust demand for palladium in catalytic converters, which has sustained high prices. Additionally, the limited recycling capacity in the region often necessitates imports, further driving up prices.

Asia-Pacific

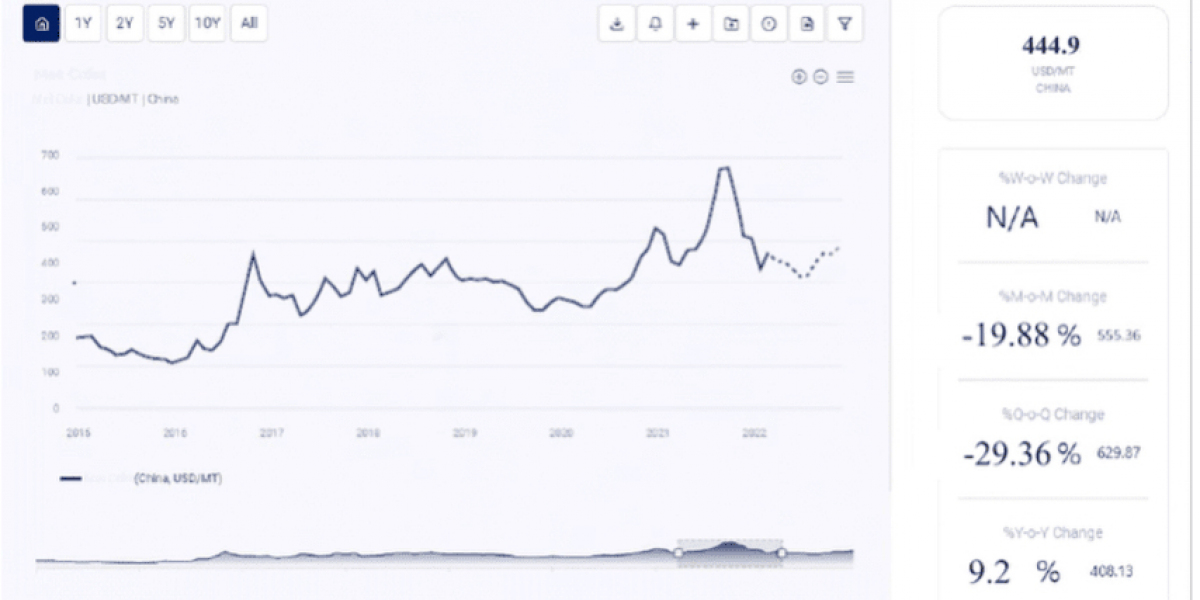

The Asia-Pacific region, particularly China, has seen significant growth in palladium demand due to the expansion of the automotive market and stricter emissions standards. As China implements new environmental policies, the demand for palladium in catalytic converters is expected to continue growing. However, the region’s focus on electric vehicles (EVs) may eventually temper the demand for palladium, as EVs do not require catalytic converters.

Europe

Europe’s automotive sector traditionally favored diesel engines, which use more platinum than palladium. However, following the “Dieselgate” emissions scandal and subsequent regulatory shifts, European markets have shifted towards gasoline engines, increasing demand for palladium. Additionally, rising EV adoption in Europe may reduce palladium demand in the longer term.

4. Future Outlook for Palladium Prices

a) Projected Demand in the Automotive Industry

As emissions regulations continue to tighten globally, demand for palladium is likely to remain strong in the short term. However, the gradual transition towards EVs, particularly in Europe and China, could moderate demand growth over the next decade.

b) Innovations in Catalytic Converter Technology

Ongoing research and development efforts to reduce the amount of palladium required in catalytic converters are expected to impact demand. Auto manufacturers are exploring more cost-effective options, including partial substitution with platinum and improvements in recycling efficiency. These advances could help alleviate some of the pressure on palladium demand and prices in the future.

c) Growing Role of Recycling

Recycling palladium from end-of-life catalytic converters is becoming an increasingly important factor in supply. As recycling technologies improve, secondary palladium supply is expected to expand, potentially stabilizing prices. However, recycling will only provide partial relief for the supply gap, as the current recycling infrastructure is not enough to offset rising demand entirely.

d) Geopolitical Tensions and Supply Chain Risks

Geopolitical factors will continue to impact palladium prices, particularly as global tensions influence the operations of major producers in Russia and South Africa. Given the concentration of palladium production in these regions, any disruption—whether from trade sanctions, labor issues, or regulatory changes—could lead to rapid price fluctuations.

5. Strategic Alternatives and Substitutes

The high price of palladium has incentivized research into alternative materials and strategic substitutes.

Platinum as a Potential Substitute

Platinum, another member of the platinum group metals, can substitute palladium in catalytic converters for certain vehicle types. While it has traditionally been used in diesel engines, research is ongoing to optimize platinum’s use in gasoline engines as well. Although platinum’s catalytic efficiency in gasoline vehicles is currently lower than palladium, advances in catalytic technology could make platinum a more viable substitute, potentially easing demand for palladium.

Impact of Electric Vehicles (EVs)

The rise of electric vehicles, which do not require catalytic converters, poses a long-term threat to palladium demand. As more countries implement policies to encourage EV adoption, the demand for catalytic converters—and therefore palladium—may decline. However, until EVs achieve widespread adoption, the palladium market is expected to remain robust due to the persistent demand from gasoline-powered vehicles.

6. Summary and Conclusion

The price of palladium has been marked by considerable volatility over the past decade due to a mix of rising demand, limited supply, and geopolitical factors. Driven primarily by the automotive industry’s reliance on catalytic converters, palladium prices are expected to remain strong in the short term. However, trends in recycling, technological advancements, and the shift toward electric vehicles may impact palladium demand over the long term.

For industries and investors reliant on palladium, understanding these dynamics is essential. As the global focus on sustainability and emission reduction intensifies, palladium’s role in the automotive and industrial sectors will continue to evolve. By closely monitoring these trends, stakeholders can make informed decisions and navigate the complex, fluctuating market for palladium with greater confidence.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA & Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA