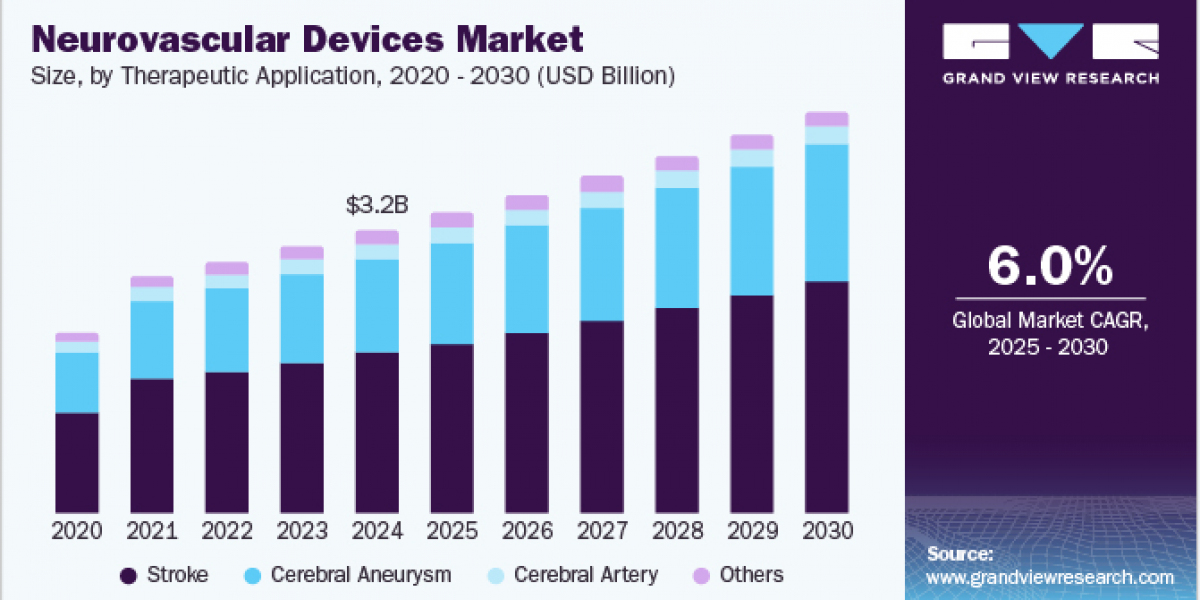

The global neurovascular devices market was valued at USD 3.19 billion in 2024 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.01% from 2025 to 2030. This expansion is largely driven by the rising incidence of neurovascular disorders, continuous advancements in medical technology, and an increasing focus on minimally invasive procedures. As conditions such as strokes, cerebral aneurysms, and Arteriovenous Malformations (AVM) become more prevalent, the demand for effective treatment options continues to escalate.

Interventional neurology devices are essential for diagnosing and treating disorders that impact the central nervous system and brain vasculature. These procedures encompass endovascular techniques, catheter-based interventions, angiography, and fluoroscopy. Catheter angiography, one of the oldest in vivo imaging methods for the brain's vascular system, facilitates the diagnosis of various neurological conditions, including cerebral aneurysms, arteriovenous malformations, intracranial stenosis, arteriovenous fistulas, and vasculitis.

Gather more insights about the market drivers, restrains and growth of the Neurovascular Devices Market

The increasing occurrence of neurovascular diseases, particularly strokes and aneurysms, is a significant factor driving the neurovascular devices market. A variety of neurovascular devices-such as clot retrieval devices, microcatheters, and flow diversion coils-are utilized to tackle these health challenges. According to the Global Stroke Fact Sheet 2022 from the World Stroke Organization (WSO), more than 12.2 million new strokes occur annually, with approximately 25% of individuals over the age of 25 expected to experience a stroke in their lifetime.

Therapeutic Application Segmentation Insights

In 2024, strokes represented the largest market segment, holding a share of around 56.86%. This dominance is attributed to the rising prevalence of hypertension, strokes, and other neurological disorders. The CDC reports that 1 in 6 people worldwide will suffer a stroke during their lifetime, and over 795,000 individuals in the U.S. experience a stroke each year. Strokes are the second leading cause of death globally, resulting in about 140,000 fatalities in the U.S. annually. Various governmental initiatives worldwide are aimed at stroke prevention. Moreover, the focus on minimally invasive techniques for stroke treatment is driving market growth, as these approaches generally result in shorter recovery times and reduced hospital stays compared to traditional open surgeries. Technological advancements, including real-time imaging and advanced robotics, are enhancing the precision and safety of neurovascular interventions, enabling healthcare professionals to perform complex procedures with greater confidence. The introduction of innovative products is also fueling market growth. For example, in January 2023, Infinity Neuro announced that its Inspira aspiration catheters received CE Mark approval and are now available for purchase in Europe. This marks Infinity Neuro's initial product launch, with plans to introduce a wider range of products aimed at treating ischemic and hemorrhagic strokes throughout 2023 and beyond.

The cerebral aneurysm segment is projected to experience the highest CAGR of 6.53% during the forecast period, primarily due to the increasing prevalence of cerebral aneurysms. The Brain Aneurysm Foundation estimates that around 6.5 million people in the U.S. have unruptured brain aneurysms, with approximately 30,000 cases of rupture occurring each year. The growing number of clinical trials and the launch of technologically enhanced products are expected to further propel this segment's growth. For instance, in February 2023, VESALIO announced the successful first use of its NeVa VS device for treating post-aneurysmal subarachnoid hemorrhage (aSAH) cerebral vasospasm in the U.S. Vasospasm is the most common complication following aSAH and is a leading cause of mortality and morbidity. Additionally, in February 2023, EndoStream Medical, a company focused on developing solutions for brain aneurysms, reported the enrollment of the first patient in the TORNADO-US clinical study. This trial will evaluate the Nautilus intrasaccular system for treating cerebral aneurysms. Furthermore, in April 2021, the FDA approved Medtronic's clot-resistant implant for treating brain aneurysms, which is expected to stimulate growth in this segment in the near future.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

![Blake Shelton Weight Loss Gummies US CA [ACV EXTRACT]-FASTEST & EASIEST WAY FOR BURN FAT NATURALLY!](https://f002.backblazeb2.com/file/yoosocial/upload/photos/2023/12/L1jkB4s3AsvsALAHoNSN_27_62772272fed5debe14f60d9cad02be53_image.png)