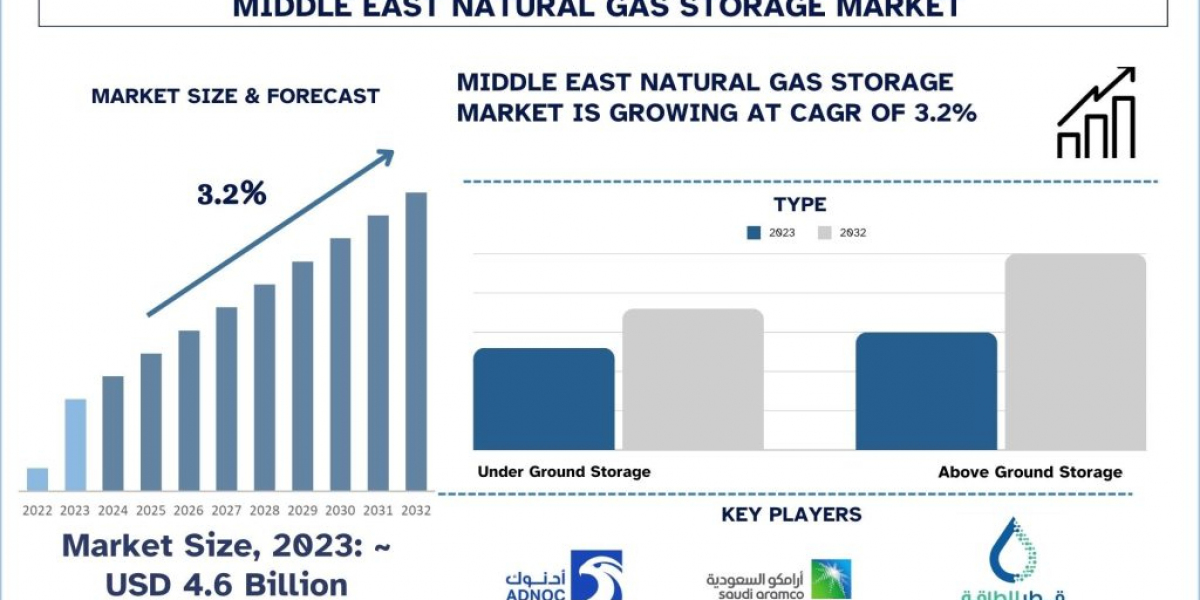

According to a new report by Univdatos Market Insights, the Middle East Natural Gas Storage Market was valued at USD 4.6 Billion in 2023 and growing at a CAGR of 3.2%. Middle Eastern regions considered to be highly endowed with hydrocarbons are witnessing major changes in the natural gas storage market. Due to increasing global trends towards the use of clean energy sources, natural gas is now considered a transition fuel between hydrocarbons and renewable energy. This change has forced the Middle Eastern countries to increase not only their production of natural gas but also storage. This focus on energy security, export maximization, and catering to the increasing domestic demand pressures have encouraged capital investments and advancement in natural gas storage in the region.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=65134

The Strategic Importance of Natural Gas Storage

Natural gas storage is very important in maintaining supply rates when demand is volatile, especially in areas that experience seasonal fluctuations in demand. For the countries in the Middle East natural gas is very essential in the generation of electricity, in the industrial processes, and in chemical manufacturing industries. As the demand for liquefied natural gas increases across the world, the capacity to store and manage the abundant natural gas resources in the region has become a significant advantage.

Earlier, underground storage such as in the depleted oil and gas fields and salt caves has been the most popular due to its large storage and security features that it offers at reasonable costs. Above-ground storage is also being advanced to complement the underground storage, especially in regions where conditions for underground facilities are unfavorable.

Recent Developments in Key Middle Eastern Countries

Qatar: Expanding LNG Storage and Export Capabilities

Qatar has remained one of the most prominent LNG players in the global market with considerable recent plans for boosting of storage and exports capacity. The North Field Expansion Project can be considered a key project for the development of Qatar as this will help the country to improve its LNG production capacity up to 126 MTPA by 2027 from the current level of 77 MTPA. This condition requires additional creation of storage facilities to address the challenge of immense volumes of gas.

In 2023 the company unveiled several new LNG storage tanks through the North Field East (NFE) project. These tanks are built to keep LNG at such low temperatures to allow the storage of huge volumes of natural gas in the tanks to easily export the resource. Qatar has been keen on investing in the increase of production and storage facilities in support of its goal of being the largest exporter of LNG in the world to meet the energy demand specifically of Asia and Europe.

Saudi Arabia: Diversifying Energy Resources with Natural Gas

Saudi Arabia, long dependent on oil exports, is shifting some of its attention to natural gas as part of its Vision 2030, which is designed to lessen the reliance of the Saudi economy on oil. The developments in the Kingdom of Saudi Arabia’s natural gas sector include the exploration and production of unconventional gas reserves like the Jafurah Basin, which is one of the Giant Unconventional Gas Fields globally.

To facilitate this growth, Saudi Arabia is in the process of developing new storage facilities. Some of the leading efforts in this regard are being made by the Saudi Arabian Oil Company commonly known as Saudi Aramco which aims at constructing massive subterranean gas storage centers. These are important projects to handle domestic demand, especially in the power generation sector that is forecasted to shift from oil to natural gas. Furthermore, these storage facilities will facilitate Saudi Arabia’s plans to become a major exporter of LNG.

United Arab Emirates: Enhancing Strategic Gas Reserves

The UAE has been keen on increasing its storage of natural gases for local use as well as for export markets. In 2023, Abu Dhabi National Oil Company (ADNOC) revealed that it had achieved the finalization of a large underground gas storage project in the Al Dhafra region. This storage facility, one of the biggest of such facilities in the region, will be designed with a capacity to hold up to 50 billion cubic feet of natural gas which will act as a strategic reserve for the UAE in a bid to help regulate the supply and increase on the security of the energy supply.

Invoking the storage of natural gas is in line with ADNOC’s strategic plan towards diversifying the UAE’s natural gas portfolio and exploring and enhancing the production of onshore and offshore natural gas fields and the development of LNG export stations.

Oman: Leveraging Natural Gas for Economic Growth

Due to the large reserves of natural gas in Oman, the storage facilities have also been in the process of being developed for the domestic and export markets. Over the last decade, Oman has concentrated on developing their LNG storage and export initiatives mainly through Oman LNG. The government has also been looking for the possibility of underground storage of natural gas to meet the demand of industries and the power sector.

The Future of Natural Gas Storage in the Middle East

As for the outlook, the Middle East natural gas storage market is forecasted to grow due to the rising demand for natural gas in both regional and global markets. With many countries in the region striving to diversify their energy mix, the role of natural gas as the source of energy that is cleaner than oil will become more noticeable. To facilitate this, more investments would be required in storage infrastructure to accommodate the growing production and export of LNG.

Furthermore, the global shift towards attaining net-zero emissions is likely to affect the natural gas storage in the Middle East. As a cleaner source of energy compared to coal and oil, natural gas will require techniques to reduce methane leakage in storage and look for methods of incorporating high levels of renewable energy into the consumption portfolio.

Click here to view the Report Description & TOC https://univdatos.com/report/middle-east-natural-gas-storage-market/

Conclusion:

The Middle East natural gas storage market is going through considerable shifts due to the region’s centrality to energy security, economic development, and leadership in the global energy sector. Realizations of storage activities have become equally significant over the recent years, especially within the gulf markets consisting of Qatar, Saudi Arabia, the UAE, Oman, and Iran which hold enormous unprocessed natural gas reserves. Further, the changing dynamics in the market will also depend on up gradation of technology and dynamic geopolitics of the region in determining the fate of natural gas storage in the Middle East. The commitment to develop and upgrade storage facilities across the region also proves that the region will continue being relevant in the global natural gas market in the years to come.

Related Energy & Power Market Research Report

India Heat Transfer Fluids Market: Current Analysis and Forecast (2024-2032)

Gear Motors Market: Current Analysis and Forecast (2024-2032)

India Gas Insulated Switchgear Market: Current Analysis and Forecast (2024-2032)

Fuel Flexible Boiler Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos Market Insights

Email - contact@univdatos.com

Contact Number - +1 9782263411

Website - https://univdatos.com/

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/