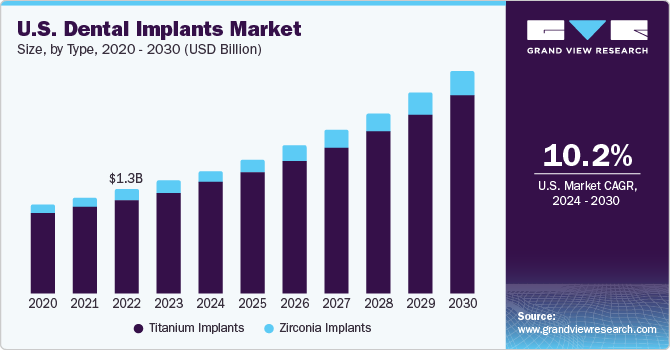

The global dental implants market was valued at USD 4.99 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.8% from 2024 to 2030. This growth can be attributed to the increasing use of dental implants across various therapeutic areas, alongside a rising demand for prosthetics. Prosthetics are vital in driving the demand for dental implants, particularly in oral rehabilitation, which aids in restoring both the oral function and facial aesthetics for patients.

Patient and dental surgeon acceptance of dental implants is on the rise, largely due to the disadvantages associated with removable prosthetics. These disadvantages include discomfort, an unnatural appearance, and ongoing maintenance requirements. In contrast, prosthetics that are mounted on dental implants do not interfere with soft tissues and offer enhanced aesthetics, further contributing to the expected growth of the industry.

The market did experience a minor disruption during the COVID-19 pandemic, particularly in the second and third quarters of 2020, due to supply chain challenges and the temporary closure of dental clinics. However, by the second quarter of 2020, dental procedures began to resume, leading to a complete recovery of the market by 2021. Notably, companies such as Straumann, which offers a diverse range of implants and implant solutions including Neodent, Medentika, and Anthogyr, reported an increase in their market share from 27% to 29% between 2020 and 2021. This growth indicates that the company significantly expanded its customer base and geographical reach in the aftermath of the pandemic.

Gather more insights about the market drivers, restrains and growth of the Dental Implants Market

Implant Type Segmentation Insights

The global dental implants industry is categorized into two main types: titanium implants and zirconium implants. In 2022, the titanium segment accounted for a dominant share of over 91.55% of the total revenue, largely due to the extensive use of titanium in dental implants. One of the primary advantages of titanium is its biocompatibility, which makes it an ideal material for this application.

The crude form of titanium contains various metals, including ilmenite, iron, vanadium, zirconium, silicon, and magnesium. To obtain pure titanium, a chemical synthesis process is employed, involving a series of extraction and purification reactions that transform crude titanium intermediates into pure titanium ingots. It is important to note that titanium dioxide, a byproduct of this process, is highly toxic to the human body and must be eliminated from the final titanium implant.

Looking ahead, the zirconium segment is expected to be the fastest-growing product category during the forecast period. Zirconium possesses similar properties to titanium, making it a viable alternative. Titanium implants can be designed as either one-piece or two-piece systems, whereas zirconium implants are exclusively available as one-piece systems. The two-piece implants offer enhanced features, such as the ability to support overdentures effectively. Additionally, implants are produced in various sizes, both in length and width, allowing for customization based on the patient’s bone dimensions.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.