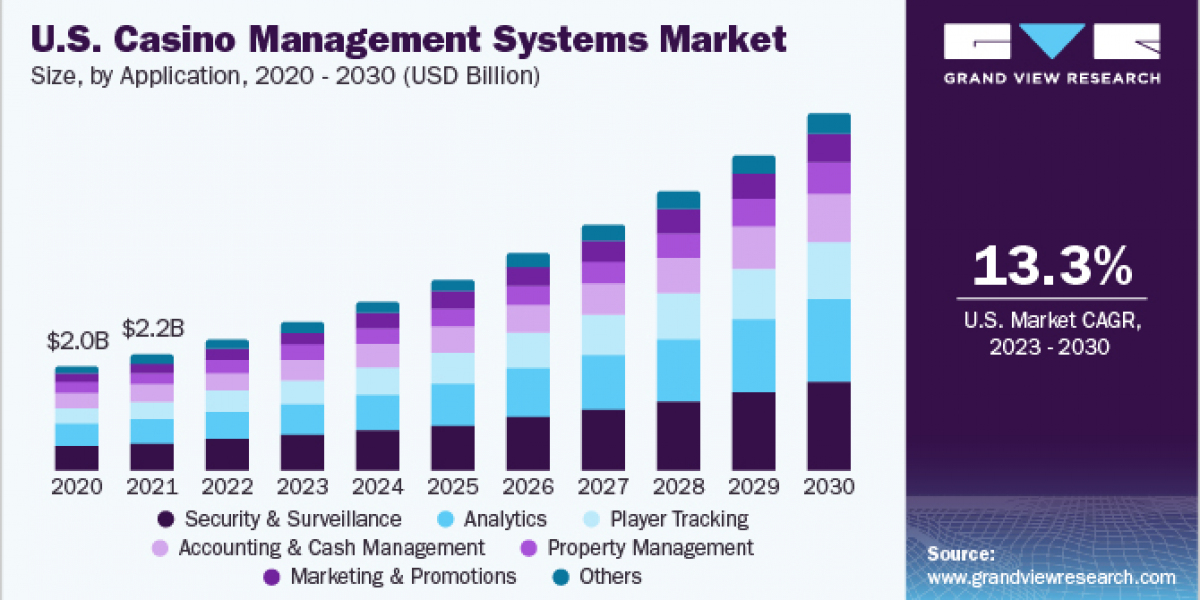

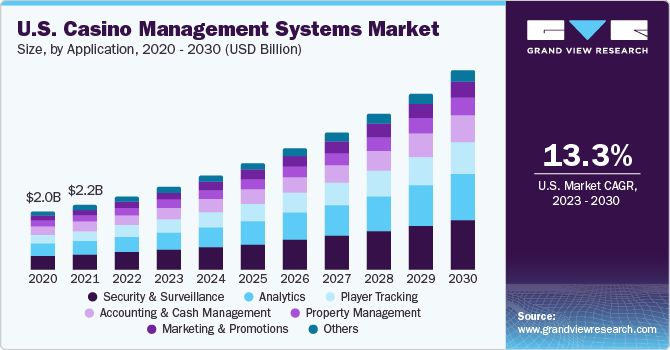

The global casino management systems market was valued at USD 7.16 billion in 2022 and is projected to experience robust growth at a compound annual growth rate (CAGR) of 14.9% from 2023 to 2030. This growth is primarily driven by the increasing demand for innovative technologies within the gaming industry, which is expected to enhance the appeal and efficiency of casino management systems. Moreover, the ongoing legalization of gambling and the rising number of gaming establishments are anticipated to significantly contribute to market expansion in the near future. The growing prevalence of gambling clubs around the globe is also creating favorable conditions for the growth of the casino management systems market. For example, according to the American Gaming Association (AGA), there were 979 gaming clubs in the U.S. as of 2018, making it the country with the highest number of casinos worldwide.

In recent years, the industry has undergone considerable transformation, particularly regarding technological advancements and the overall gaming experience provided to patrons. Casinos increasingly rely on customer retention strategies and are focused on enhancing service quality to offer a more personalized experience. To achieve this, gaming clubs utilize a variety of disparate systems that gather extensive data on both customers and floor operations. Casino management systems serve as a centralized platform to aggregate this data from various systems, enabling gaming club operators to streamline their operations and improve customer retention rates effectively.

Gather more insights about the market drivers, restrains and growth of the Casino Management Systems Market

Application Segmentation Insights

The security and surveillance segment represented the largest revenue share of 23.4% in 2022. Surveillance systems in gaming clubs are specifically designed to reduce instances of cheating, theft, and other criminal activities occurring on the gambling floor and throughout the entire resort. Video surveillance solutions help operators optimize their floor operations, ensuring profitability. Additionally, advancements in automated security systems are anticipated to further drive demand for these technologies in the upcoming years.

Casinos handle a substantial volume of monetary transactions, which unfortunately attracts various forms of fraud and spoofing attacks. This has led to an increased adoption of security and surveillance systems. Such systems employ a range of technologies, including facial recognition, license plate recognition, and various analytical tools, enabling operators to effectively prevent fraud, theft, and cheating within the gaming environment. Companies that provide casino management solutions are consistently seeking to enhance and implement new technologies to address these security challenges. Ensuring a safe and secure gaming environment is a primary concern for gaming club operators, which is a key factor driving the adoption of security and surveillance solutions.

In contrast, the analytics segment is projected to be the fastest-growing area, with a compound annual growth rate (CAGR) of 16.2% during the forecast period. This growth can be attributed to the increasing implementation of advanced systems in gaming operations and casino management, which collect a wide variety of data that can be analyzed to generate valuable insights. Analytical tools allow operators to understand customer behavior, game preferences, spending habits, and win/loss probabilities. These insights enable gaming club operators to provide a personalized gaming experience, which enhances customer retention rates and drives operational efficiency.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.