Wires And Cables Market Size & Trends

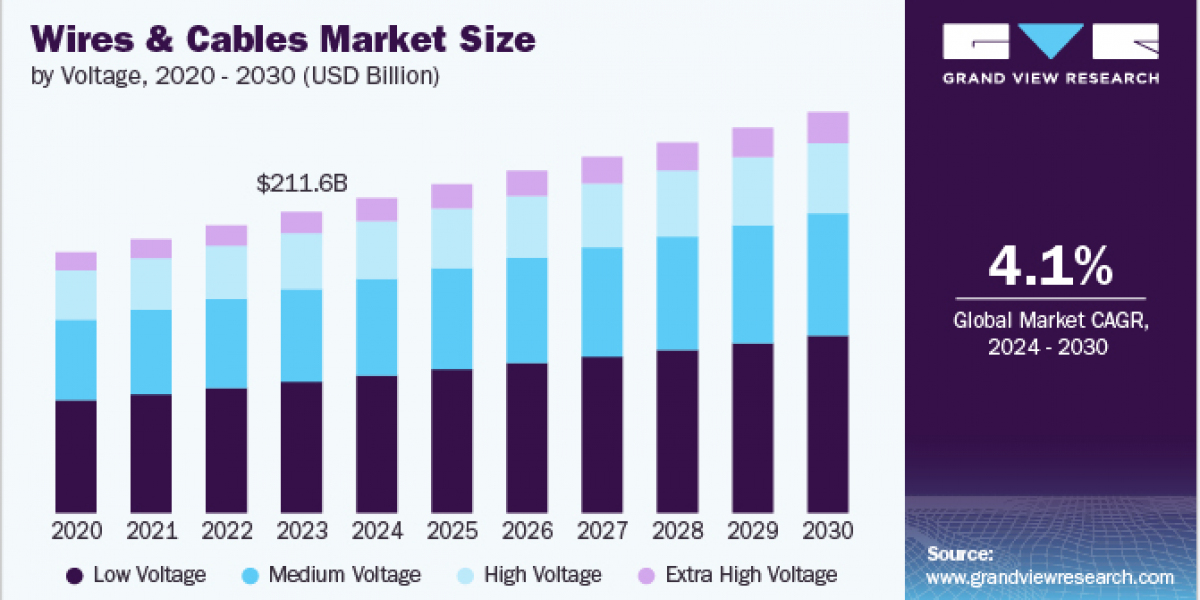

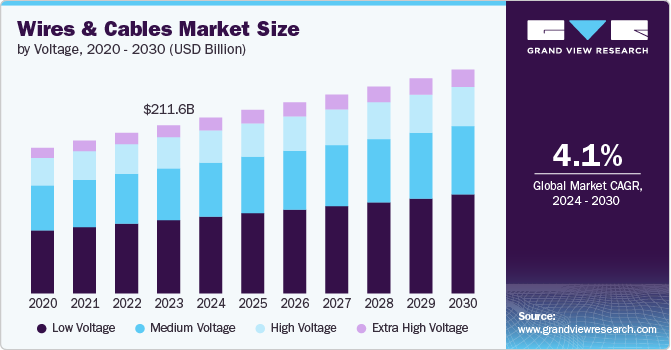

The global wires and cables market size was estimated at USD 211.62 billion in 2023 and is projected to grow at a CAGR of 4.1% from 2024 to 2030. Rising urbanization and growing infrastructure worldwide are some of the major factors driving the market. The said factors have impacted the power and energy demand in commercial, industrial, and residential sectors. Increased investments in smart upgrading the power transmission and distribution systems and development of smart grids are anticipated to drive the market's growth. Implementation of smart grid technology has met the increasing need for grid interconnections, thus resulting in rising investments in the new underground and submarine cables.

The smart grid is an electric grid that includes controls, automation, computers, and innovative equipment & technologies that function together and offer efficient electricity transmission. The functioning of the entire globe depends on the timely delivery of electric supply. Further, the increasing population leads to rise in demand for power. Technological advancement in grids is necessary to reduce the frequency and duration of storm impacts, power outages, and restore service quickly after outages. Smart grid helps generate efficient renewable power, reliable power, reducing carbon print, using a mix of energy sources, working with smart devices and smart homes, and encouraging the use of electric vehicles.

Gather more insights about the market drivers, restrains and growth of the Global Wires And Cables Market

Detailed Segmentation

Voltage Insights

The low voltage segment accounted for the largest revenue share in 2023, with 43.5% market share. Owing to the high usage of low voltage cables in the building wires, LAN cables, appliance wires, distribution networks, and others. These wires and cables support the smart grids in delivering superior electric supplies and offer an improved provision of electric supply for End use consumers. The energy and power sector across the world are experiencing a rapid alteration. Most of the developing and developed countries are experiencing a heavy demand for electricity and are moving towards incorporation of large-scale renewable resources.

Installation Insights

The overhead installation segment accounted for the largest revenue share in 2023. Overhead installation technique is the most widely used approach across the world. The overhead approach of wires and cables are easiest and cheapest form of installation. Overhead installation techniques is mostly adopted in countries with lower population. However, countries with high risk of natural calamities such as earthquakes, floods tend to have overhead cables installation.

End-use Insights

The energy and power segment accounted for the largest revenue share in 2023. Several technological upgrades such as shifting the old transmission lines to high/extra high voltage lines to avoid the transmission losses are being made in the electricity T&D ecosystem. These changes aim at making the ecosystems stable in contradiction of the alternating nature of renewable sources of energy. Moreover, the introduction of new methodologies such as synchronized charging of electric vehicles and net metering for solar homes have aggressively affected the utilities sector. However, this growing renewable power capacity and energy generation have further augmented the need of countries to interrelate their transmission systems.

Regional Insights

The wires and cables market in North America is primarily driven by modernization of power grids, increased investment in renewable energy, and the expansion of data centers. Infrastructure upgrades and the adoption of electric vehicles (EVs) are also contributing to the rising demand for specialty cables. The region’s focus on smart technologies and IoT further propels the growth of fiber-optic cables for high-speed communication.

Key Wires And Cables Company Insights

The market is highly competitive and concentrated, with the top three companies accounting for the majority revenue share in 2023. Belden Inc.; Nexans; and Fujikura Ltd. are some of the dominant market players. The vendors in the market focus on expanding their customer base to obtain a competitive edge. Therefore, key companies take various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in July 2024, Prysmian S.p.A completed the acquisition of Encore Wire Corporation, a U.S.-based cable producer. This combined entity is strategically positioned to drive electrification and digital transformation across North America, including the expansion of data centers and power grid enhancements.

Strategic initiatives taken by prominent companies in the wires and cables parasol have positively impacted the market growth. For instance, In April 2023, Nexans acquired Reka Cables, a company specializing in the production of high, medium, and low-voltage cables used in building applications, power distribution networks, and onshore wind projects. This acquisition combined the expertise of both companies, ensuring continued innovation and sustainability in delivering safe and reliable cables across the Nordic region.

Browse through Grand View Research's HVAC & Construction Industry Research Reports.

- Excavator Market Size, Share & Trends Analysis Report By Vehicle Weight (< 10, 46 >), By Engine Capacity (Up To 250 HP, More Than 500 HP), By Type (Wheel, Crawler), By Drive Type (Electric, ICE), By Region, And Segment Forecasts, 2024 - 2030

- Smart Infrastructure Market Size, Share & Trends Analysis Report By Offering (Products, Services), By Type, By End-user (Residential, Non-residential), By Region, And Segment Forecasts, 2024 - 2030

Key Wires And Cables Companies:

The following are the leading companies in the wires and cables market. These companies collectively hold the largest market share and dictate industry trends.

- Belden Inc.

- Encore Wire Corporation

- Finolex Cables.

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- KEI Industries Limited.

- LEONI AG

- LS Cable & System Ltd.

- Nexans

- NKT A/S

- Prysmian S.p.A

- Sumitomo Corporation

- Southwire Company, LLC

- Amphenol TPC.

- American Wire Group

- CommScope, Inc.

- CommScope, Inc.

- Shanghai Shenghua Cable (Group) Co., Ltd.

- TE Connectivity

Wires And Cables Market Segmentation

Grand View Research has segmented the global wires and cables market report by voltage, installation, end use, and region:

Wires And Cables Voltage Outlook (Revenue, USD Billion, 2018 - 2030)

- Low Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

Wires And Cables Installation Outlook (Revenue, USD Billion, 2018 - 2030)

- Overhead

- Underground

Wires And Cables End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Aerospace & Defense

- Building & Construction

- Oil & Gas

- Energy & Power

- IT & Telecommunication

- Automotive

- Others

Wires And Cables Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- KSA

- UAE

- South Africa

Order a free sample PDF of the Wires And Cables Market Intelligence Study, published by Grand View Research.

Recent Developments

- In June 2024, a French subsea power cable manufacturer, Nexans, completed the acquisition of La Triveneta Cavi s.p.a., an Italian company specializing in medium and low-voltage cables. This acquisition marks a major advancement in Nexans' strategy to establish itself as a dedicated electrification player.

- In April 2024, Finolex Cables introduced a series of eco-safe wires under the FinoGreen brand, which is expected to comprise about 5% of the company’s wire business. The new FinoGreen line features flame-retardant and halogen-free industrial cables specifically designed to reduce safety risks in electrical installations and prevent accidents, particularly fires.

- In April 2024, Amphenol TPC, a prominent provider of high-performance cables, connectors, wire, and assemblies for harsh industrial environments, announced the launch of ATPC Medium Voltage Cables. The new cables enhance the company's existing medium voltage cable range, offering additional options for insulation, conductor, and jacket materials.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.