Report Overview

The global aquafeed market size was valued at USD 72.5 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.4% from 2023 to 2030. The product demand is anticipated to be driven by its increasing consumption in the cultivation of various aquatic species, such as tilapia, carp, catfish, and salmon. The global industry is highly fragmented owing to the presence of many players, such as BioMar Group, Cargill, Inc., and Charoen Pokphand Foods PCL. These market players are focused on mergers & acquisitions, partnerships, portfolio expansions, and collaborations to strengthen their presence in the value chain. For instance, Cargill has recently launched a new line of plant-based aquafeed called “Ewos Naturligvis” in Norway. The product is made from sustainable ingredients, such as wheat, soy, and corn, and it is designed to provide optimal nutrition to fish while minimizing the environmental impact.

The industry is expected to witness brisk growth on account of the rising fish farming activities. There is an increasing preference for natural and organic feed products among manufacturers, which has now become the new industry trend. This is anticipated to drive the market for plant-based aquafeed in the coming years. These aquafeed products are manufactured using both traditional as well as modern technology-driven processes.

The traditional method is still widely used despite its low effectiveness and slow speed. The production technique varies according to the demand and requirement of the consumers in the local as well as global market. There is an increase in direct human consumption of fish as it is a low-fat protein when compared to other types of meat, such as cattle and poultry. This rise in consumption is due to the availability of a variety of fish in the retail market. Also, it offers several health benefits, such as enhancing cognitive development in children, lowering the fat level in the body, and assisting in reducing the threat of cardiovascular diseases.

Gather more insights about the market drivers, restrains and growth of the Global Aquafeed Market

Form Insights

The dry form type segment dominated the global industry in 2022 and accounted for the maximum share of more than 42.70% of the overall revenue. This is attributed to its ability to increase the feed conversion ratio of fish. The segment is estimated to expand further at the fastest growth rate maintaining its leading position throughout the forecast period as the dry form feed is highly palatable. Wet feeds are also a commonly used form of aquafeed products. It contains moisture levels in the range of 45%-70%.

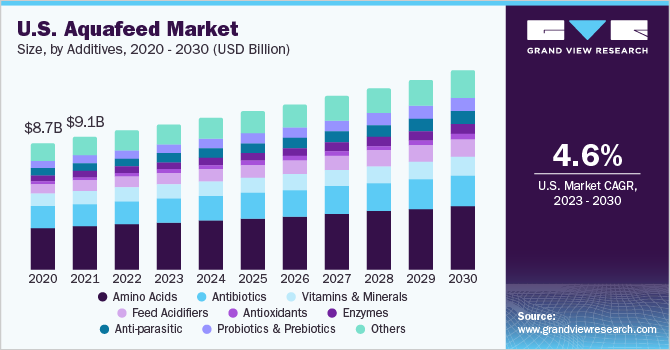

Additive Insights

The amino acids segment dominated the industry in 2022 and accounted for the maximum share of more than 32.80% of the overall revenue. This high share is attributed to its advantages, such as enhancing immunity, increasing larval performance, optimizing the efficiency of metabolic transformation in fish, increasing tolerance to environmental stresses, mediating efficiency and timing of spawning, and improving fillet taste and texture when added in aquafeed. In addition to amino acids, antibiotics are also widely used additives in aquafeed. They promote better growth by improving overall health and are used to maximize productivity and efficiency.

Feed Insights

The grower feed segment dominated the industry in 2022 and accounted for the maximum share of more than 34.25% of the overall revenue. Its high share is attributed to its rising usage in animals, which are between the age group of 6 to 20 weeks, to fulfill their dietary requirements. This type of feed is given to the animal until they are ready to start reproducing and laying eggs. Switching from starter to grower feed is necessary as excessive protein content may cause long-term liver or kidney issues. In addition, finisher feeds are also used widely after grower feeds. Finisher feeds are usually given to adult fish/animals that are more than 20 weeks old.

Application Insights

The carp application segment dominated the global industry in 2022 and accounted for the maximum share of more than 25.00% of the overall revenue. The high share of this segment is attributed to the rising consumption of this species as it promotes overall health, boosts immunity, improves heart health, lowers the risk of chronic diseases, and protects gastrointestinal functions. Catfish, being a sustainable fish species, is farmed in freshwater ponds using rice, corn, and soybean as aquafeed. It is the preferred group of farmed aquaculture species due to its ease of farming in less-than-ideal climatic conditions.

Regional Insights

The Asia Pacific region dominated the global industry in 2022 and accounted for the largest share of more than 44.10% of the overall revenue. The regional market is estimated to expand further at the fastest growth rate maintaining its dominant position throughout the forecast period. This is attributed to the substantial growth of the regional aquaculture sector. In addition, the availability of cheap labor, inducing conditions to promote the growth of aquaculture, and the presence of natural resources in the region will boost the growth.

Key Companies & Market Share Insights

The competition in the global industry is highly dependent on the product portfolio, geographical location, and the number of sellers. The aquafeed producers are engaged in constant R&D activities to develop numerous natural and organic aquafeed to be used in the cultivation of various species. For example, BioMar has developed a range of plant-based aquafeed products that are made from sustainable raw materials, such as peas and canola. These feed manufacturers are working on improving their product portfolios as well as undertaking several activities including the production of poultry products, farming, feeding, and marketing to cut down their operational costs and to produce feed with higher nutritional value.

Browse through Grand View Research's Animal Feed and Feed Additives Industry Research Reports.

- Amino Acids Market Size, Share & Trends Analysis Report By Type, By Source (Plant-based, Animal Based, Chemical Synthesis) By Grade, By End-use, And Segment Forecasts, 2024 - 2030

- Yeast Ingredients Market Size, Share & Trends Analysis Report By Product (Yeast Extracts, Yeast Autolysates, Yeast Beta-Glucan Yeast Derivatives, Others), By Application (Food, Feed, Others), By Region, And Segment Forecasts, 2023 - 2030

Some of the prominent players in the global aquafeed market include:

- Cargill, Inc.

- BioMar Group

- Ridley Corp. Ltd.

- Aller Aqua

- BENEO

- Alltech

- Aker Biomarine

- Charoen Pokphand Foods PCL

- Skretting

- Purina Animal Nutrition LLC

- Dibaq Aquaculture

- INVE Aquaculture

- Avanti Feeds Ltd.

- Biostadt India Ltd.

- The Waterbase Ltd.

Aquafeed Market Segmentation

Grand View Research has segmented the global aquafeed market report on the basis of form, additives, feed, application, and region:

Aquafeed Form Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

- Dry

- Moist

- Wet

Aquafeed Additives Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

- Amino Acids

- Antibiotics

- Vitamins & Minerals

- Feed Acidifiers

- Antioxidants

- Enzymes

- Anti-parasitic

- Probiotics & Prebiotics

- Others

Aquafeed Feed Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

- Starter Feed

- Grower Feed

- Finisher Feed

- Brooder Feed

Aquafeed Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

- Carp

- Rainbow Trout

- Salmon

- Crustaceans

- Tilapia

- Catfish

- Sea Bass

- Grouper

- Others

Aquafeed Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Denmark

- Asia Pacific

- China

- India

- Japan

- Vietnam

- Thailand

- Indonesia

- Australia

- Central & South America

- Brazil

- Argentina

- Chile

- Ecuador

- Middle East & Africa

- South Africa

- Egypt

Order a free sample PDF of the Aquafeed Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database