Loyalty Management Market Size & Trends

The global loyalty management market size was estimated at USD 10.67 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.2% from 2024 to 2030. Loyalty management platforms offer businesses the necessary tools to design, implement, and manage effective loyalty programs. The rapid digital transformation in the retail industry is driving the adoption of loyalty management solutions in this sector. Innovative digital loyalty and engagement platforms, including mobile apps and online platforms, are helping retail businesses engage with customers across various touchpoints. Digital loyalty cards, personalized offers, and mobile wallets are some significant tools of modern loyalty programs that are driving their demand in retail industries. These factors would further market growth.

Loyalty management software assists businesses in fostering long-term relationships with existing customers by encouraging repeated business and building brand loyalty. This strategy involves the implementation of loyalty programs, rewards, and incentives to motivate customers to make recurring purchases. Loyalty management software also allows businesses to go beyond mere transactions and build an emotional connection between the brand and its customers. By offering exclusive discounts, special offers, and VIP treatment, organizations can incentivize customers to stay loyal to their brand for a longer period. Therefore, the primary focus of loyalty management programs is to retain and nurture the customer base, as loyal customers tend to be more profitable and act as brand advocates. These factors are expected to drive market growth.

Gather more insights about the market drivers, restrains and growth of the Global Loyalty Management Market

Offering Insights

The solution segment accounted for the largest share of over 58% in 2023 in the market. The segment growth can be attributed to the increasing use of loyalty management solutions by various end-use industries to launch and manage loyalty programs. Loyalty management solutions offer various features, such as tracking & analytics; flexible Deployment Programming Interface (API); and compliance with regulations, such as the Payment General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and Card Industry Data Security Standard (PCI DSS).

Solution Insights

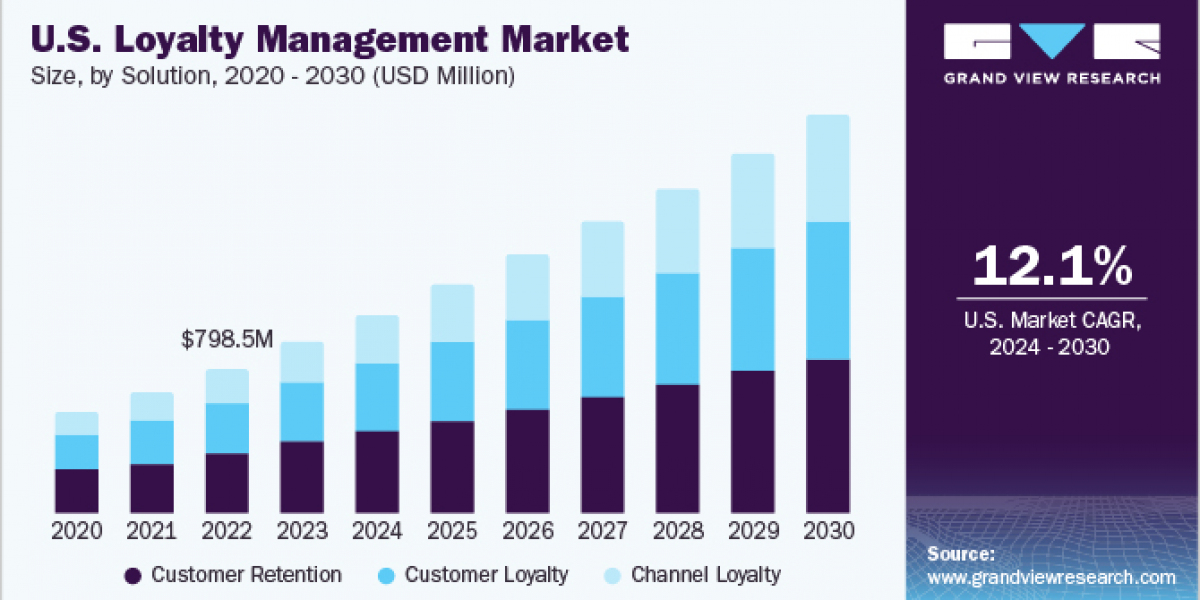

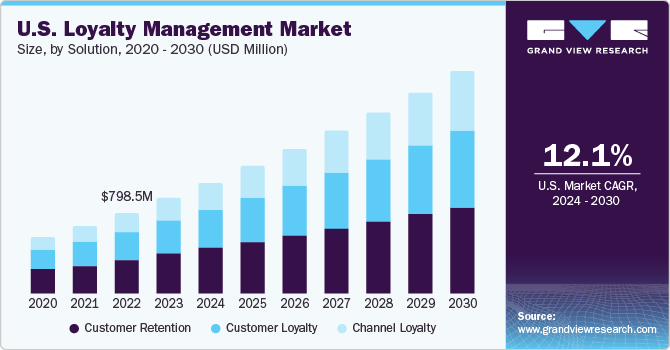

The customer loyalty segment accounted for the largest share of over 39% in 2023. The shifting focus of various end-user companies on increasing customer loyalty amid growing competition is driving the segment growth. Many businesses are establishing strategic partnerships with other businesses to enable their customers to earn multiple rewards. For instance, in October 2022, Starbucks Coffee Company partnered with Delta Air Lines to provide loyalty programs for Starbucks Rewards and Delta SkyMiles members. At every eligible purchase at Starbucks, the members earn 1 USD/mile, which can be applied to their flight ticket from Delta Air Lines.

Services Insights

Professional services are typically offered by specialized loyalty management solution providers or consultants with expertise in customer relationship management and marketing aspects. These services involve the development and implementation of effective loyalty program strategies tailored to the specific needs and goals of a business. This includes the design of reward structures, customer segmentation, and the integration of technology platforms to facilitate seamless program execution.

Operator Insights

In the Business-to-Business (B2B) segment, loyalty management solutions play a crucial role in facilitating and optimizing loyalty programs for large businesses. The loyalty programs specialize in developing and implementing loyalty solutions that cater to the unique needs and dynamics of B2B relationships. Their services often encompass the design and execution of loyalty programs tailored to foster long-term, mutually beneficial partnerships between businesses.

Deployment Insights

The on-premise segment accounted for the largest share of over 51% in 2023. The segment growth can be attributed to the high adoption among large- and medium-sized businesses. Several businesses prefer on-premise solutions because of the ease of customization during implementation. On-premise solutions provide advanced data security, making it convenient to comply with various government regulations. The on-premise deployment also provides organizations with greater control over sensitive data while allowing them to roll out a personalized network for loyalty management programs that best meet their needs. The cloud segment is anticipated to grow at a CAGR of 9.8% from 2024 to 2030.

Organization Size Insights

The large enterprises segment accounted for the largest share of over 62% in 2023. The segment growth can be attributed to the emphasis of these companies on increasing their customer retention rate by offering incentives and rewards. Furthermore, large-scale enterprises are making significant investments in customer loyalty solutions to maintain their position in the competitive industry. When implementing loyalty management solutions, large-scale enterprises focus on factors, such as the need for simplicity of framework coordination, better adaptability, and data protection. Their higher financial capability allows them to implement advanced loyalty management solutions, which bodes well for segment growth.

Vertical Insights

The retail & consumer goods segment accounted for the largest share of over 21% in 2023. The significant growth of the retail & consumer goods segment can be attributed to the increasing internet penetration rate and growing preference for mobile apps for making purchases and related decisions. Furthermore, consumer goods companies and retailers are utilizing loyalty programs in web deployments and digital e-commerce to retain existing customers and attract new customers. Various brands are launching loyalty programs to stay ahead of the competition and increase their customer base.

Regional Insights

North America held the major share of over 34% of the loyalty management market in 2023. The regional growth can be attributed to the high adoption of loyalty management solutions in the region, led by significant competition in a majority of industries. North America is characterized by the presence of major loyalty management providers, namely Aimia, Inc., Bond Brand Loyalty, Inc., ICF International Inc., Kobie Marketing, and TIBCO Software, which are significantly investing in R&D to develop advanced loyalty management solutions and increase their customer bases, contributing to the regional market growth.

Key Loyalty Management Company Insights

Some of the key players operating in the market include Oracle Corporation, Salesforce, Inc., and IBM Corporation.

- Oracle Corporation specializes in providing technological solutions and enterprise software. The CrowdTwist loyalty and engagement solution offered by the company provides customers with a flexible SaaS platform, customizable loyalty programs, and superior customer engagement opportunities

- Salesforce, Inc. is an enterprise software provider, which offers customer management software suites through the cloud platform. The Loyalty Management solution offered by the company is a standalone product, which can be integrated across various ecosystems. It helps organizations create more intelligent and personalized engagements with their customers, enhances Customer Lifetime Value, and boosts positive ROI

Browse through Grand View Research's IT Services & Applications Industry Research Reports.

- Data Center Physical Security Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Data Center Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Live Commerce Market Size, Share & Trends Analysis Report By Product (Fashion & Apparel, Beauty & Personal Care), By Resolution (Social Media Platforms, Dedicated E-Commerce Platforms), And Segment Forecasts, 2024 - 2030

Key Loyalty Management Companies:

The following are the leading companies in the loyalty management market. These companies collectively hold the largest market share and dictate industry trends.

- Aimia Inc.

- BOND BRAND LOYALTY INC.

- Brierley+Partners

- IBM Corporation

- Comarch SA

- Five Stars Loyalty Inc.

- ICF International Inc.

- Kobie Marketing

- The Lacek Group

- Martiz Holdings Inc.

- Oracle Corporation

- Salesforce Inc.

- SAP SE

- AnnexCloud

- Tibco Software Inc.

Loyalty Management Market Segmentation

Grand View Research has segmented the loyalty management market based on offering, solution, services, operator, deployment, organization size, vertical, and region:

Loyalty Management Offering Outlook (Revenue, USD Billion, 2018 - 2030)

- Solution

- Service

Loyalty Management Solution Outlook (Revenue, USD Billion, 2018 - 2030)

- Channel Loyalty

- Customer Loyalty

- Customer Retention

Loyalty Management Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Professional Services

- Consulting

- Implementation

- Support & Maintenance

- Managed Services

Loyalty Management Operator Outlook (Revenue, USD Billion, 2018 - 2030)

- Business-to-Business

- Business-to-Customers

Loyalty Management Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On-premise

- Cloud

Loyalty Management Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Small & Medium Enterprise (SME)

- Large Enterprise

Loyalty Management Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

- Transportation

- IT & Telecommunication

- BFSI

- Media & Entertainment

- Retail & Consumer Goods

- Hospitality

- Others

Loyalty Management Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Order a free sample PDF of the Loyalty Management Market Intelligence Study, published by Grand View Research.

Recent Developments

- In January 2023, IBM Corporation announced IBM Partner Plus, a program to reimagine the way the company engages with its business partners by providing unprecedented access to the company’s resources and incentives. The program envisaged fueling growth for both new and incumbent partners, including technology providers, resellers, and independent software vendors, by putting them in a position to control their earning potential

- In March 2023, Salesforce, Inc. announced a partnership with Polygon, a blockchain platform for Non-Fungible Token (NFT)-based loyalty program. The partnership envisaged Salesforce Inc. assisting its clients in transitioning to Polygon by providing a management platform that would allow them to develop token-based loyalty programs

- In August 2023, Comarch SA announced a partnership with Virgin Active, a health club based in South Africa, to enhance Virgin Active’s retention, members’ experience, and engagement. With the introduction of the new Virgin Active Rewards program and Virgin Active App, the company was looking forward to making leading a healthy lifestyle easier and more accessible to its members

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database