Disposable Medical Gloves Market Trends

The global disposable medical gloves market size was estimated at USD 6.93 billion in 2023 and is expected to grow at a CAGR of 8.9% from 2024 to 2030. The growing demand for safety and security at healthcare workplaces and rising healthcare expenditure are expected to have a positive impact on industry growth. Growing awareness of safety and health measures associated with the treatment of patients and emergency response incidents is further anticipated to augment the demand for disposable medical gloves in the healthcare sector. Furthermore, the risks related to on-the-job transmission of bloodborne pathogens and germs have led to an increased adoption of gloves in medical & healthcare facilities.

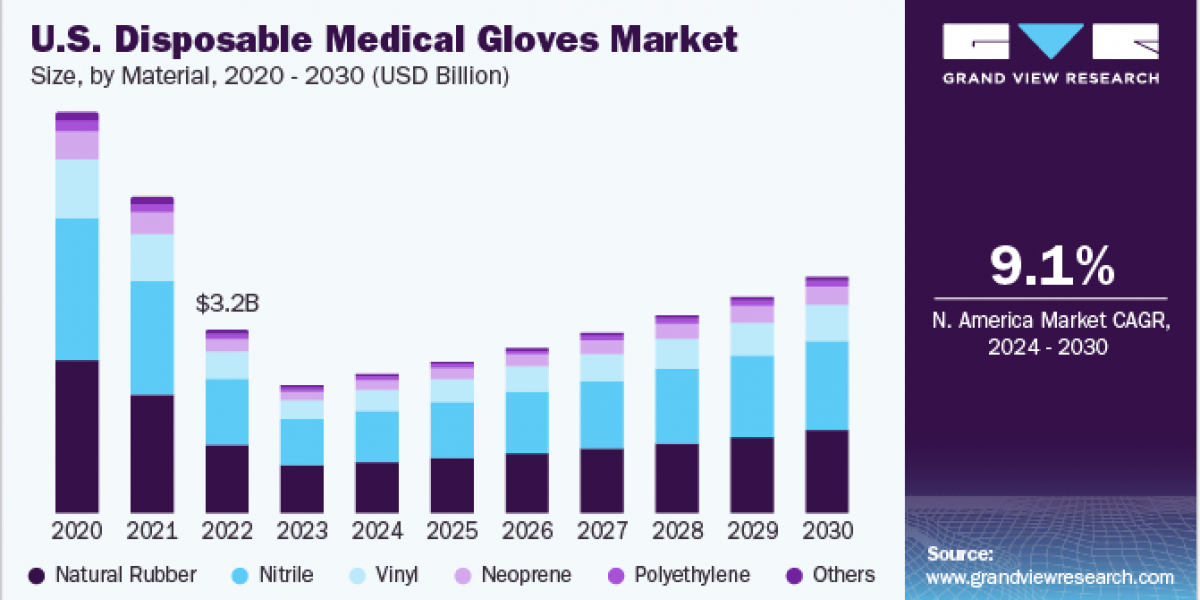

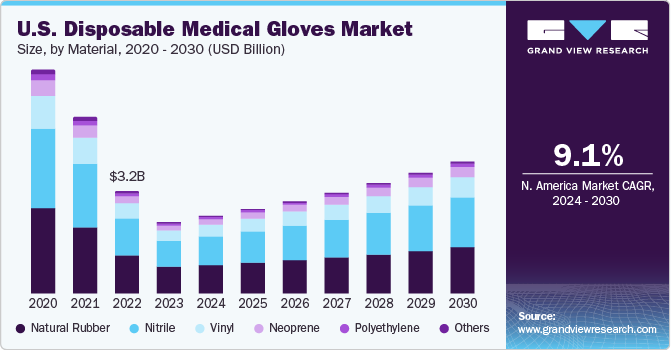

The market in the U.S. is undergoing a transition owing to the rising prevalence of chronic diseases, which has increased the number of hospital visits and re-admissions. This, in turn, is positively impacting the product demand in hospitals. The growing number of surgical procedures performed in the U.S. including cesarean section, appendectomy, coronary artery bypass graft (CABG), carotid endarterectomy, and circumcision, is expected to boost product demand.

Gather more insights about the market drivers, restrains and growth of the Global Disposable Medical Gloves Market

Material Insights

The natural rubber material segment dominated the market in 2023 with a share of 37.2% of the overall revenue. Disposable medical gloves made of natural rubber or latex are tactile and are used in applications, such as medical procedures and surgery. Furthermore, they are flexible and easy to use, making them excellent for working with water-based or biological materials. All these factors are expected to boost industry demand over the forecast period.

Application Insights

The examination disposable medical gloves application segment led the market in 2023. Growing demand for these products in the medical sector, on account of higher demand in hospitals, dental applications for regular checkups, and patient visits, is expected to drive industry growth. The surgical segment is expected to witness significant growth over the forecast period. Rising incidences of chronic diseases, such as heart disease and cancer, which frequently necessitate medical procedures and operations for treatment, are predicted to drive product demand in surgical applications.

Product Insights

The powdered disposable medical gloves product segment led the market in 2023. The powder, typically cornstarch or calcium carbonate, serves as a lubricant, making it easier for users to slide the gloves onto their hands. This feature is particularly beneficial in fast-paced environments, such as healthcare settings, where healthcare professionals need to quickly put on gloves for patient care tasks.

End-use Insights

The hospital end-use segment led the market in 2023 on account of the rapidly growing geriatric population, especially in developed countries, coupled with the rising prevalence of hospital-acquired and other infections, such as hepatitis and AIDS. Primary care physicians provide primary care services to a specific patient population.

Regional Insights

North America led the market and accounted for the largest share of 36.9% in 2023. Rising instances of chronic illnesses, including obesity, are likely to further increase healthcare expenditure, thereby benefiting the market growth. The region is characterized by the presence of several major disposable gloves manufacturers, including 3M, Kimberly-Clark Corporation, Cardinal Health, and Medicom, among others, which is likely to benefit market growth over the forecast period.

Key Disposable Medical Gloves Company Insights

The market has been characterized by the presence of a wide array of large-scale and small-scale manufacturers, thereby resulting in a significant level of concentration. In addition, the global UV disinfection equipment market consists of various international as well as domestic players who are engaged in the designing, developing, and marketing of a diversified array of disposable medical gloves. Key players in the market are focusing on various strategies, including acquisition, regional expansion, and product innovation, to achieve competitive advantage and, thereby, develop a strong foothold in the industry.

For instance, in February 2022, Kimberly-Clark Worldwide, Inc. launched the Kimtech Opal Nitrile Gloves, designed to protect against chemical splash and microbial hazards. These gloves offer efficiency by being latex-free and devoid of vulcanizing agents, minimizing the risk of skin reactions associated with Type I & Type IV allergies typically linked to glove usage.

Browse through Grand View Research's Smart Textiles Industry Research Reports.

- Industrial Protective Clothing Market Size, Share & Trends Analysis Report By Product (Heat & Flame Protection, Chemical Defending, Clean Room Clothing, Mechanical Protective Clothing), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Textile Market Size, Share & Trends Analysis Report By Raw Material (Wool, Chemical, Silk), By Product (Natural Fibers, Polyester), By Application, By Region, And Segment Forecasts, 2024 - 2030

Key Disposable Medical Gloves Companies:

The following are the leading companies in the disposable medical gloves market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these disposable medical gloves companies are analyzed to map the supply network.

- Ansell Ltd.

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Supermax Corporation Berhad

- Kossan Rubber Industries Bhd.

- Cardinal Health

- Semperit AG Holding

- Rubberex

- Dynarex Corporation

- B. Braun Melsungen AG

Disposable Medical Gloves Market Segmentation

Grand View Research has segmented the global disposable medical gloves market based on material, product, application, end-use, region:

Disposable Medical Gloves Material Outlook (Revenue, USD Billion, 2018 - 2030)

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

Disposable Medical Gloves Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Powdered

- Powder-free

Disposable Medical Gloves Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Examination

- Surgical

Disposable Medical Gloves End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Home Healthcare

- Outpatient/Primary Care Facilities

- Others

Disposable Medical Gloves Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Russia

- Spain

- UK

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Australia

- Thailand

- Malaysia

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Order a free sample PDF of the Disposable Medical Gloves Market Intelligence Study, published by Grand View Research.

Recent Developments

- In April 2022, Unigloves launched a new biodegradable disposable nitrile gloves named BioTouch. Such launches are expected to augment the market growth during the forecast period

- In November 2022, Vizient, Inc. signed an agreement with SafeSource Direct, LLC, the manufacturer of personal protective equipment (PPE), for chemo-rated nitrile gloves. The agreement aims to establish 12 operational lines producing more than 2 billion gloves yearly by January 2024

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database