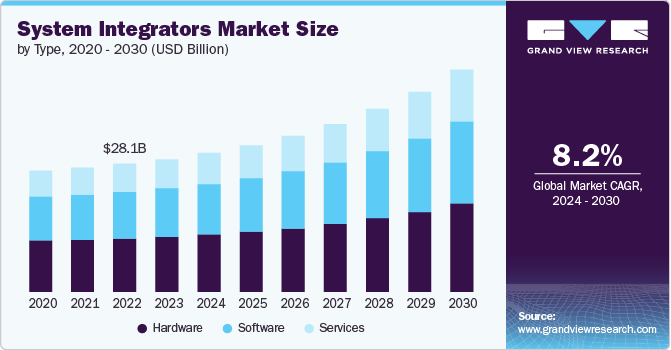

System Integrators Market Size & Trends

The global system integrators market size was estimated at USD 29.10 billion in 2023 and is expected to grow at a CAGR of 8.2% from 2024 to 2030. The market is witnessing significant growth driven by several key factors. The rise of digital transformation initiatives across industries is a major catalyst as businesses increasingly seek to streamline operations, enhance connectivity, and improve efficiency through integrated technology solutions. The growing demand for IoT, AI, and cloud-based services is pushing companies to partner with system integrators to manage complex deployments and integrations of new technologies with legacy systems.

Major industries, including manufacturing, healthcare, BFSI, and automotive, are increasingly relying on system integrators for automation, data management, and cybersecurity needs, driving market expansion. Governments and enterprises globally are also investing heavily in smart city projects, digital infrastructure, and industry 4.0 initiatives. Thus, these factors are significantly contributing to market growth.

Gather more insights about the market drivers, restrains and growth of the Global System Integrators Market

Type Insights

Hardware accounted for the largest market share of over 41% in 2023. The hardware market segment is driven by the rising need for advanced infrastructure across various industries, including telecommunications, BFSI, healthcare, and education. As businesses shift towards more interconnected systems, the demand for robust networking hardware, servers, and data storage solutions continues to rise.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share of over 58% in 2023. The growing demand for customized, end-to-end integration solutions drives the segment's growth. Large enterprises often operate complex IT environments, requiring advanced solutions for integrating diverse technologies across multiple departments. A key trend in this segment is adopting cloud-based services, as large organizations seek to enhance agility and scalability while reducing operational costs.

Vertical Insights

The IT & Telecom segment accounted for the largest market share of over 20% in 2023. The IT & Telecom segment within the market is experiencing significant growth, driven primarily by the rapid digital transformation across industries and the increasing adoption of cloud-based solutions. With enterprises migrating to the cloud and enhancing their networks, the demand for system integrators to manage complex IT infrastructure and ensure seamless integration between legacy systems and modern technologies is rising.

Regional Insights

The system integrators market in North America held a market share of over 38% in 2023. The market is growing rapidly, driven by the increasing demand for digital transformation across industries like healthcare, manufacturing, and financial services. The region’s focus on adopting advanced technologies such as AI, machine learning, and IoT fuels the need for system integrators to connect these complex systems and ensure seamless functionality. The widespread shift to cloud computing and edge technologies further enhances opportunities for integrators, especially as organizations seek to modernize legacy systems and improve operational efficiency.

Key System Integrators Company Insights

The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Browse through Grand View Research's IT Services & Applications Industry Research Reports.

- Content Moderation Services Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Content Type, By Deployment, By Organization Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- ARM-Based Servers Market Size, Share, & Trends Analysis Report By Core Type (ARM Cortex-A Core, ARM Cortex-M Core), By OS, By Processor, By Application, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

Key System Integrators Companies:

The following are the leading companies in the system integrator market. These companies collectively hold the largest market share and dictate industry trends.

- Jitterbit Inc.

- John Wood Group PLC

- ATS Automation Tooling Systems Inc.

- Avanceon

- JR Automation

- Tesco Controls, Inc.

- Burrow Global LLC

- Prime Controls LP

- MAVERICK Technologies LLC

- BW Design Group

System Integrators Market Segmentation

Grand View Research has segmented the global system integrators market report based on type, enterprise size, vertical, and region:

- Type Outlook (Revenue; USD Billion, 2018 - 2030)

- Hardware

- Software

- Services

- Enterprise Size Outlook (Revenue; USD Billion, 2018 - 2030)

- SMEs

- Large Enterprises

- Vertical Outlook (Revenue; USD Billion, 2018 - 2030)

- Telecommunication & IT

- Defense & security

- BFSI

- Oil & gas

- Healthcare

- Transportation

- Retail

- Others

- Regional Outlook (Revenue: USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

Order a free sample PDF of the System Integrators Market Intelligence Study, published by Grand View Research.

Recent Developments

- In December 2023, MDS System Integration, a subsidiary of Midis Group, acquired a majority stake in Smplid, a company specializing in digital transformation and IT solutions. This acquisition aims to strengthen MDS's digital solutions capabilities, enhance its service offerings, and expand its customer base. The partnership aligns with MDS’s strategy to lead in the digital transformation space, providing innovative and comprehensive IT solutions across various sectors.

- In November 2023, Accenture and Workday announced the expansion of their strategic partnership, aimed at helping organizations reinvent their finance functions to become data-driven, agile, and customer-centric. By leveraging their combined expertise, the two companies will collaborate on developing a suite of advanced, data-led finance solutions designed to meet the evolving needs of businesses in the software and technology, retail, and media sectors.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database