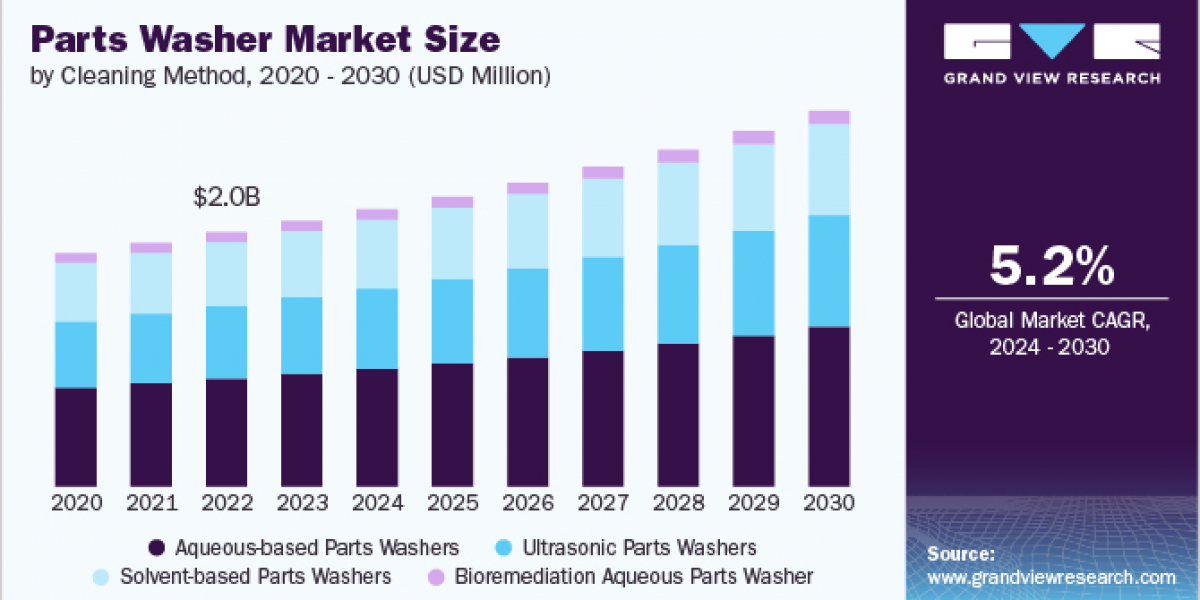

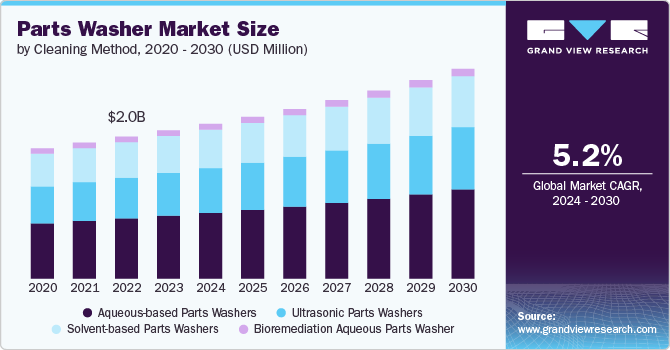

Parts Washer Market Size & Trends

The global parts washer market size was estimated at USD 2,137.1 million in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. The market is driven by governments’ and international bodies' stringent environmental regulations and standards. These regulations necessitate using environment friendly cleaning solvents and processes in various industries, including automotive, aerospace, manufacturing, and maintenance operations. For instance, companies in the automotive sector are increasingly adopting aqueous-based parts washers over traditional solvent-based systems to meet environmental standards and improve their sustainability practices. This shift not only helps reduce hazardous waste but also significantly lowers workers' exposure to harmful chemicals, thereby driving the demand for advanced parts washing solutions.

The rising growth in the parts washer market is largely attributed to the expanding automotive, aerospace, and manufacturing sectors, which require high levels of cleanliness and precision in component maintenance and manufacturing processes. As these industries grow, the demand for efficient, effective, and environmentally friendly parts cleaning solutions also increases. Additionally, the push towards sustainability and stricter environmental regulations has led companies to seek out parts washers that utilize safer, water-based cleaning solutions instead of traditional solvent-based methods. This shift not only aligns with regulatory compliance but also enhances workers' safety and reduces environmental impact. Moreover, technological advancements led to the development of automated and customized parts washers, further driving market growth by offering time and cost efficiencies to businesses aiming to maintain high-quality standards in their operations.

Gather more insights about the market drivers, restrains and growth of the Global Parts Washer Market

Drivers, Opportunities & Restraints

A notable trend in the parts washer market is the increasing adoption of eco-friendly and water-based cleaning solutions over traditional solvent-based cleaners. This shift is largely driven by the growing awareness of environmental issues and the stringent regulations regarding chemical use and disposal. For example, companies in sectors such as automotive and aerospace are now prioritizing the use of aqueous parts washers that utilize water and biodegradable detergents to minimize their environmental footprint.

Cleaning Method Insights

“The demand for ultrasonic parts washer segment is expected to grow at a significant CAGR of 5.7% from 2024 to 2030 in terms of revenue”. The aqueous-based parts washers cleaning method segment led the market and accounted for 42.5% of the global market revenue share in 2023. Aqueous-based parts washers use water-based cleaning solutions instead of solvents, reducing or eliminating the use of hazardous chemicals that can pose risks to human health and the environment.

Operation Type Insights

The demand for automatic operation type segment is expected to grow at a significant CAGR of 5.7% from 2024 to 2030 in terms of revenue. The automatic operation type segment led the market and accounted for 51.2% of the global market revenue share in 2023. One of the factors surging the demand for automatic parts washers is their efficiency and consistency in cleaning processes. These washers carry out standardized cleaning procedures that can be precisely replicated, ensuring uniform cleanliness across all parts.

End-use Insights

“The demand for electronics segment is expected to grow at a significant CAGR of 6.3% from 2024 to 2030 in terms of revenue” The automatic end use segment led the market and accounted for 32.3% of the global market revenue share in 2023. Parts washers are used in the automotive industry for cleaning components such as engine blocks, transmission parts, and brake components. These parts often require meticulous cleaning to remove machining oils, metal shavings, and other contaminants that could impair performance or compromise safety.

Product Insights

“The demand for spray cabinet parts washer segment is expected to grow at a significant CAGR of 6.0% from 2024 to 2030 in terms of revenue” The conveyor parts washer product segment led the market and accounted for 35.6% of the global market revenue share in 2023. Conveyor parts washers are designed to handle high-volume cleaning operations, allowing manufacturers to clean significantly more parts in a shorter timeframe than manual cleaning methods. Several conveyor parts washers can perform the equivalent of two days' worth of manual cleaning in just three hours, substantially boosting productivity.

Regional Insights

North America region accounted for 20.7% of the global market share in 2023. The growth of industrial manufacturing activities in North America amplifies the demand for reliable cleaning solutions. Automotive production in the region was estimated to be 19.1 million units in 2023, as per the International Organization of Motor Vehicle Manufacturers. Industries such as automotive, aerospace, electronics, and pharmaceuticals increasingly rely on parts washers to maintain stringent cleanliness standards and ensure product quality. The scalability and adaptability of parts washers make them indispensable tools for supporting production expansions and diversification across various sectors.

Key Parts Washer Company Insights

Some of the key players operating in the market include CRC Industries, NCH Corporation, among others.

- CRC Industries is a global supplier of specialty chemicals for maintenance, repair, and operation professionals. The company offers a comprehensive selection of products tailored to its customers' diverse maintenance and repair requirements. Their product line includes cleaners, lubricants, corrosion inhibitors, protective coatings, degreasers, greases, additives, and specialized products designed to address specific customer needs in maintaining and repairing equipment and assets. These products are designed to address issues in the automotive, industrial, electrical, marine, and aviation markets. One of their key product lines includes parts washers, designed to clean and de-grease parts effectively for various industries, including automotive, manufacturing, and maintenance facilities. CRC Industries trademarked brands include CRC, SmartWasher, K&W,Sta-Lube, Marykate, Weld-Aid, and Evapo-Rust.

- The company offers products and services for commercial, institutional, and industrial maintenance. It is one of the largest global companies selling its products through direct marketing. It has branch offices and manufacturing plants on 6 continents and distributes its extensive and varied product line in over 50 countries. The company operates under segments including plumbing, industrial and institutional maintenance, parts washing, lubrication, and biologicals. Due to its strong global presence, the company is well-positioned to serve diverse markets worldwide.

Browse through Grand View Research's Advanced Interior Materials Industry Research Reports.

- Ammunition Market Size, Share & Trends Analysis Report By Caliber, By Small Ammunition Product (Rimfire, Centerfire), By End-use (Civil & Commercial, Defense), By Cartridge, By Region, And Segment Forecasts, 2024 - 2030

- Precast Concrete Market Size, Share & Trends Analysis Report By Product (Structural Building Components, Transportation Products), By Application (Residential, Commercial, Infrastructure), And Segment Forecasts, 2024 - 2030

Key Parts Washer Companies:

The following are the leading companies in the parts washer market. These companies collectively hold the largest market share and dictate industry trends.

- Bio-Circle Surface Technology GmbH

- Walter Surface Technologies Inc

- Safety-Kleen Systems

- Heritage-Crystal Clean, Inc

- Safetykleen

- CRC Industries

- NCH Corporation

- SBS Ecoclean Group

- Karcher Professional Wash Systems

- Valiant TMS

- Cleaning Technologies Group

- The MART Corporation

- Service Line, Inc.

- PROCECO Ltd.

- Rozone

- Cleanway

- Waste Management NZ Limited

- Vollrath Manufacturing Services

- Ultrasonic Power Corporation

- DENIOS

Parts Washer Market Segmentation

Grand View Research has segmented the global parts washer market based on cleaning method, operation type, end-use, product, and region:

Parts Washer Cleaning Method Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

- Solvent-based parts washers

- Aqueous-based parts washers

- Ultrasonic parts washers

- Bioremediation Aqueous parts washer

Parts Washer Operation Type Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

- Manual

- Semi-automatic

- Automatic

Parts Washer End-use Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

- Automotive

- Military/Defence

- Industrial manufacturing

- Electronics

- Food & Beverage

- Others

Parts Washer Product Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

- Spray Cabinet Parts Washer

- Conveyor Parts Washer

- Rotary Drum Parts Washer

- Vertical Jet Machines

Parts Washer Regional Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- Italy

- UK

- Spain

- Asia Pacific

- China

- India

- Japan

- Thailand

- Singapore

- South Korea

- Australia

- New Zealand

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Order a free sample PDF of the Parts Washer Market Intelligence Study, published by Grand View Research.

Recent Developments

- In November 2023, Safetykleen introduced Purified Cleaning Technology, a groundbreaking innovation that revolutionizes the cleaning industry by setting new standards for speed, efficiency, and environmental responsibility. This pioneering technology addresses the growing demand for faster, more efficient, and sustainable cleaning solutions by integrating three key elements: water purification, improved formula chemistries, and automatic dosing. The technology ensures unparalleled cleaning efficacy, reduces energy consumption, and maintains consistent cleaning quality throughout the service cycle, empowering businesses to achieve cleaner, safer, and more sustainable environments.

- In March 2022, Valiant TMS acquired a 60,000 ft² facility in Querétaro, Mexico, to further expand its global capacity and better serve the growing commercial trucks & automotive sector in the region. Located in Parque Industrial Querétaro (PIQ), this facility is a thriving hub for industrial and technology companies, offering state-of-the-art infrastructure and services.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database