U.S. Dietary Supplements Market Trends

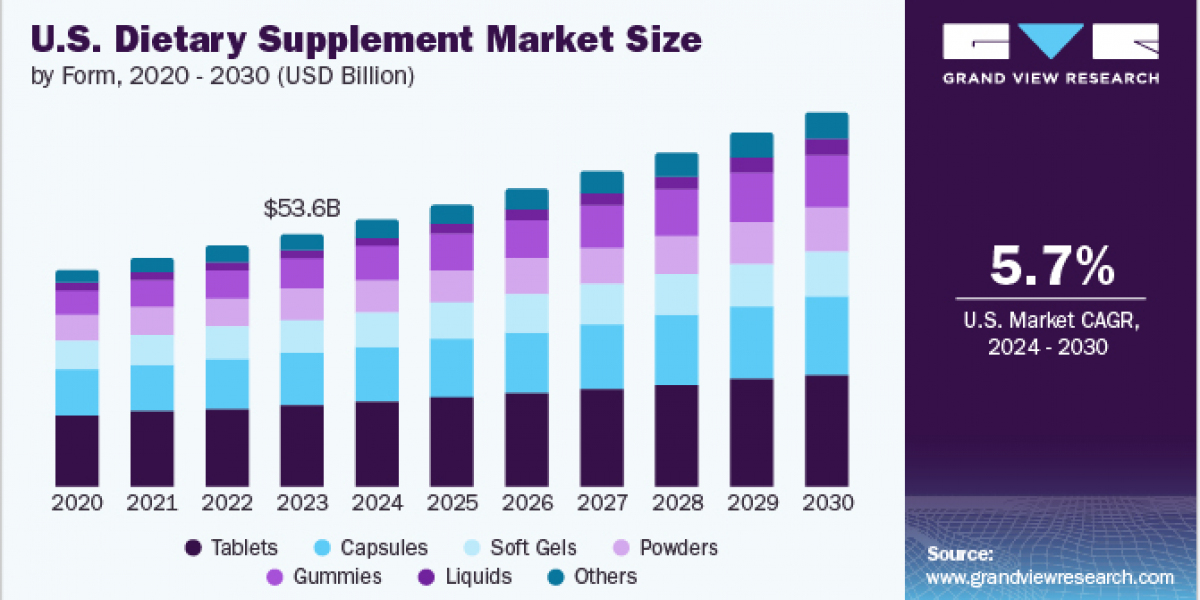

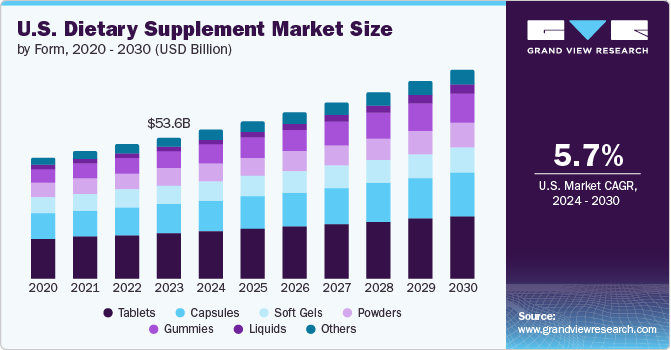

The U.S. dietary supplement market size was estimated at USD 53.58 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2030. The primary factors driving the market growth are the growing population of senior citizens, rising awareness and focus on preventive healthcare, and rising demand for sports nutrition supplements. Additionally, consumers are moving towards self-directed care, which is also expected to drive demand for dietary supplements in the U.S.

Consumers in the U.S. are shifting towards self-directed care, which has helped in shaping the growth of the dietary supplements industry in the country. Consumers are opting for nutraceuticals rather than prescription pharmaceuticals owing to the growing focus on preventive healthcare. The high cost of prescription pharmaceuticals and the reluctance of insurance companies to cover the cost of drugs have further helped the dietary supplements industry solidify its presence in the U.S. market. Increasing hospitalization costs are driving consumers toward nutraceutical and health supplements, further aiding the market growth.

Gather more insights about the market drivers, restrains and growth of the U.S. Dietary Supplements Market

Application-End User Insights

Consumption of energy and weight management supplements among adults accounted for a market share of 67.5% in 2023. In the U.S., the purchase of energy and weight management supplements is driven by the busy, hectic lifestyles of many Americans, making quick and convenient solutions for fatigue appealing. At the same time, a strong cultural emphasis on achieving a certain body type fuels the demand for weight management products. Health and fitness trends promote active lifestyles and the use of supplements to support them, with aggressive marketing and endorsements by celebrities and influencers enhancing their appeal. Consumers are attracted by the potential benefits of these supplements, such as increased metabolism, appetite suppression, and enhanced energy levels.

Application-ingredients Insights

Usage of Vitamins in energy and weight management supplements accounted for a market share of 35.9% in 2023. Americans consume vitamin supplements for energy and weight management to boost energy levels and support metabolic processes. Additionally, these supplements fill nutritional gaps that may be present in the diet, ensuring adequate intake of essential vitamins. This enhanced energy and metabolic support ultimately improve physical performance and weight management efforts.

Form Insights

Based on form, the market is segmented into tablets, capsules, soft gels, powders, gummies, liquids, and others. The tablet dietary supplements market segment accounted for a revenue share of 32.4% in 2023. Consumers in the U.S. prefer dietary supplements in tablet form because they are convenient, easy to store and transport, and offer excellent stability and shelf-life by protecting active ingredients from light, moisture, and oxygen. Tablets ensure accurate dosages and are cost-effective, making them an economical and reliable choice for consumers.

Type Insights

The Over the Counter (OTC) dietary supplement market segment accounted for revenue share of 76.0% in 2023. OTC sales of dietary supplements in U.S. are anticipated to witness steady growth because of rising consumer awareness regarding the nutritional value and health benefits of these products. Self-medication for the treatment of gastrointestinal and immunity-related issues is another key factor driving the demand for OTC dietary supplements. The convenience of direct purchases and cost-effectiveness are expected to promote the sales of these dietary supplements.

Distribution Channel Insights

Sales through offline channel accounted for a revenue share of 78.0% in 2023. The offline channel is sub divided into supermarkets/hypermarkets, pharmacies, specialty stores, practitioners, and others. Sales through pharmacies accounted for a share of 29.1% in 2023. People in the U.S. purchase dietary supplements from pharmacies because they trust the quality and safety standards of these outlets. Pharmacies offer the guidance of healthcare professionals, ensuring personalized and informed recommendations. Additionally, the authenticity of products is assured, reducing the risk of counterfeit or substandard items. For those with specific medical conditions, pharmacies provide professional supervision, and insurance coverage for necessary supplements is often available, making pharmacies a preferred choice for dietary supplements.

Key U.S. Dietary Supplement Company Insights

The market includes both international and domestic participants. Brand market share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, global expansion, and others. Some of the largest dietary supplement companies including Amway, Bayer AG, GlaxoSmithKline plc have entered into the market. Along with that, in order to improve their efficiency and by using the international distribution channel, the companies have been ruling the industry.

Browse through Grand View Research's Nutraceuticals & Functional Foods Industry Research Reports.

- Omega 3 Supplements Market Size, Share & Trends Analysis Report By Source (Fish, Krill Oil), By Form (Soft Gels, Capsules), By End User (Adults, Infants), By Functionality, By Distribution Channel, And Segment Forecasts, 2020 - 2028

- Gummy Market Size, Share & Trends Analysis Report By Product (Vitamins, Minerals, Dietary Fibers), By Ingredient (Gelatin, Plant-Based Gelatin Substitutes), By End-use (Adults, Kids), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

Recent Developments

- In May 2024, Bayer launched a One A Day social media campaign featuring former NFL star Julian Edelman to combat wellness misinformation. The campaign started running across major social platforms, including Instagram, Facebook, and TikTok. Its primary objective was to inspire individuals to share honest accounts of their wellness experiences, countering the often unrealistic or pseudoscientific claims in online wellness spaces.

- In May 2024, NOW Foods reaffirmed its commitment to independent retailers by launching 20 product sizes exclusively available for sale in brick-and-mortar stores. These specially tailored products, which include popular items like 5HTP, CoQ10, probiotics, and vitamin D, fill a niche between the typical small and large bottle quantities offered by NOW. Each product prominently features an "In store only" logo on its label.In February 2024, Herbalife Nutrition unveiled a new line of food and supplement combinations, dubbed the 'GLP-1 Nutrition Companion', specifically tailored to support the nutritional needs of individuals using GLP-1 and other weight-loss medications. This innovative range features Herbalife's signature protein shake, recognized globally for its quality and effectiveness, along with a carefully curated selection of other nutritional supplements.

- In August 2023, Herbalife Nutrition introduced Herbalife V, a new plant-based supplement line designed to meet the growing demand for plant-based products. These supplements are certified USDA Organic, non-GMO verified, kosher, and certified plant-based and vegan by FoodChain ID.

Order a free sample PDF of the U.S. Dietary Supplements Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database