AI In Oncology Market Size & Trends

The global AI in oncology market size was estimated at USD 2.80 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 28.92% from 2024 to 2030. The growth of the market is attributed to increasing prevalence of cancer, technological advancement in cancer diagnostics & healthcare infrastructure, and an increasing demand for early and accurate diagnosis of cancer.

The growing initiatives undertaken by public and private organizations to invest in research and development (R&D) for introduction of novel technologies are further anticipated to fuel the market growth. For instance, in October 2022, Tempus, a company specializing in precision medicine and AI, recently announced a program called Tempus+. This proprietary program utilizes real-world data to power collaborative precision oncology research. A community of researchers, including Baylor College of Medicine, Allegheny Health Network, Stanford Cancer Center, Rush University Medical Center, TriHealth, and others, is already using the Tempus+ program to advance their research. Furthermore, increasing product approval of AI-associated medical devices is anticipated to boost market growth. In January 2024, the U.S. FDA approved the first AI medical device, DermaSensor, to detect skin cancer.

Gather more insights about the market drivers, restrains and growth of the Global AI In Oncology Market

Detailed Segmentation:

Survey Insights

- The individuals who participated in the survey were writers of articles or review articles related to AI and cancer that were published between September 20, 2020, & September 20, 2022. These articles were indexed in WoS SCI-EXPANDED.

- Out of the 25,000 researchers invited to participate in the study, only 1,030 responded, resulting in a response rate of 4.12%.

End-use Insights

Based on end-use, the hospitals segment led the market with a largest revenue share of 48.2% in 2023. The growth is attributed to the rising adoption of AI-powered solutions by hospitals, the increasing number of companies entering the market to cater to cancer care in hospitals, and positive responses from patients, the market is anticipated to grow significantly during the forecast period.

Component Type Insights

Based on component type, the hardware segment held the largest revenue share of 39.6% in 2023. Medical device manufacturers use AI technologies to innovate products to help healthcare providers enhance patient care. One of the major advantages of AI in medical devices is its capability to learn from real-world data and experience and improve its performance. Hence, several key players are investing in launching and advancing AI-based cancer therapy solutions. Moreover, governments are undertaking initiatives to promote the growth of AI-based medical devices.

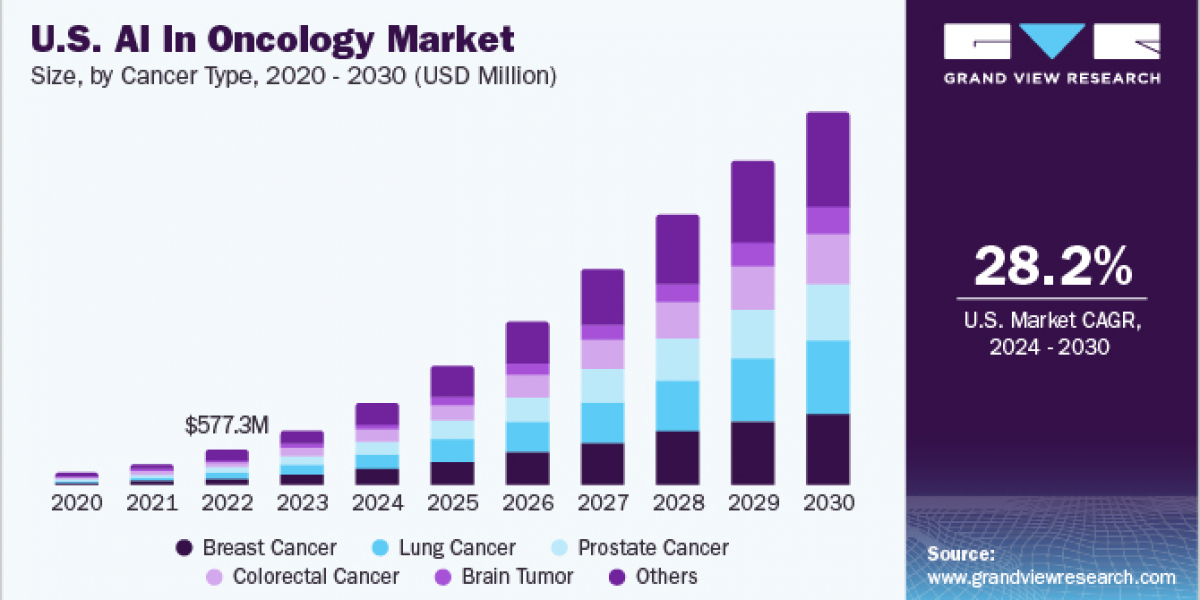

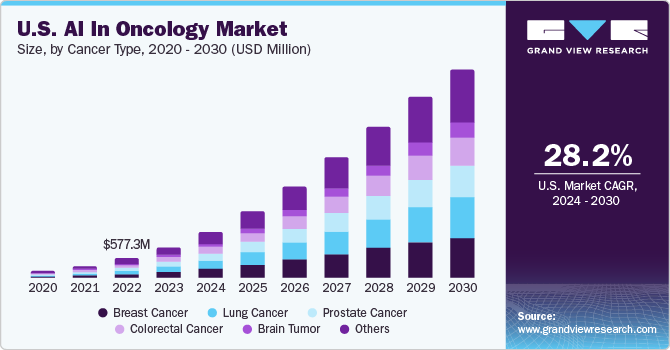

Cancer Type Insights

Based on cancer type, breast cancer is the single biggest cancer type holding the largest revenue share in 2023. The dominance of this segment is attributed to increasing prevalence of breast cancer among the population. According to the American Society of Clinical Oncology in 2020, around 2,261,419 new cancer cases were diagnosed globally, and most cases are seen in the U.S. with an estimated 297,790 new breast cancer cases in 2023. Growing cases amongst the population are propelling the need for introduction of technologically advanced products in the market, further propelling the market growth.

Application Insights

Based on application, the diagnostics segment held the largest revenue share of 38.1% in 2023. Cancer diagnostics is an essential starting point for designing relevant therapeutic strategies and clinical management, and its AI-based advancement makes it more efficient and effective. Several companies are developing approaches for early diagnosis that include screening patients at risk with no symptoms & appropriately and rapidly investigating those who do. For instance, in December 2023, Dedalus S.p.A. partnered with Ibex Medical Analytics to launch an end-to-end AI-powered digital pathology solution to detect cancer.

Regional Insights

North America dominated the AI in oncology market with a revenue share of 43.6% in 2023, due to presence of well-developed digital infrastructure, favorable regulatory & reimbursement policies, and rising government initiatives to boost the adoption of AI technology in the healthcare industry. The rising prevalence of various cancers is propelling the need for development of advanced therapeutics and diagnostics which is further enabling growth of the regional market. In November 2021, Sanofi entered into collaboration with Owkin Inc. and invested USD 180 million in Owkin’s AI for advancement of the oncology pipeline.

Key AI In Oncology Company Insights

Key players are adopting new product development, partnership, and merger & acquisition strategies to increase their market share. Market players such as Azra AI; IBM; Siemens Healthcare GmbH; Intel Corporation; and others dominated the market. These key players have been developing novel technologies to cater to different end-use applications. For instance, in January 2023, Massive Bio announced the plans to adopt AI use in oncology with development and launch of drug matching product in 2023. Furthermore, key participants in the industry are embracing the strategy of introducing new products to sustain a competitive advantage within the market. For instance, in January 2020, ConcertAI launched eurekaHealth 3.0, combining use-case-aligned RWD and AI technologies to develop real-world evidence services and insights for oncology clinical development.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

- Accountable Care Solutions Market Size, Share & Trends Analysis Report By Component (Software, Services), By Solution, By Delivery Mode, By End Use (Providers, Payers), By Region, And Segment Forecasts, 2024 - 2030

- Anesthesia Information Management Systems Market Size, Share & Trends Analysis Report By Solutions, By End-use (Hospitals, Ambulatory Surgery Centers), By Region, And Segment Forecasts, 2024 - 2030

Key AI In Oncology Companies:

The following are the leading companies in the AI in oncology market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these AI in oncology companies are analyzed to map the supply network.

- Azra AI

- IBM

- Siemens Healthcare GmbH

- Intel Corporation

- GE HealthCare

- NVIDIA Corporation

- Digital Diagnostics Inc.

- ConcertAI

- Median Technologies

- PathAI

AI In Oncology Market Segmentation

Grand View Research has segmented the global AI in oncology market based on component type, cancer type, application, end-use, and region:

AI In Oncology Component Type Outlook (Revenue, USD Million, 2018 - 2030)

- Software Solutions

- Hardware

- Services

AI In Oncology Cancer Type Outlook (Revenue, USD Million, 2018 - 2030)

- Breast Cancer

- Lung Cancer

- Prostate Cancer

- Colorectal Cancer

- Brain Tumor

- Others

AI In Oncology Application Type Outlook (Revenue, USD Million, 2018 - 2030)

- Diagnostics (Pathology, Cancer Radiology)

- Radiation Therapy (Radiotherapy)

- Research & Development (Drug design, development process, etc.)

- Chemotherapy

- Immunotherapy

AI In Oncology End-use Type Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals

- Surgical Centers & Medical Institutes

- Others (Pharmaceutical Companies, Research Institutes & Training Centers)

AI In Oncology Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Order a free sample PDF of the AI In Oncology Market Intelligence Study, published by Grand View Research.

Recent Developments

- In January 2024, NVIDIA Corporation partnered with Deepcell to accelerate the use of generative AI in single-cell research for stem cells, cancer, and cell therapies

- In January 2024, PathAI launched six more oncology indications for PathExplore, an AI-powered pathology panel used for spatial analysis of tumor microenvironment (TME)

- In December 2023, ConcertAI acquired CancerLinQ, previously a subsidiary of the American Society of Clinical Oncology (ASCO). Concurrently, ASCO has entered into a multiyear cooperation agreement with CancerLinQ. The new partnership seeks to build on CancerLinQ’s original mission, launched by ASCO in 2013, to improve cancer care and expedite clinical research. The venture will leverage real-world data, analytics, next-generation AI, and other advanced technologies to enhance and expand CancerLinQ’s capabilities

- In November 2023, GE Healthcare launched MyBreastAI suite, a platform that integrates three AI applications from software developed by iCAD to help with breast cancer detection and workflows

- In November 2022, Azra AI partnered with Massive Bio to improve cancer clinical care through early identification and targeted treatment options for patients

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database