Electric Motor Sales Market Size & Trends

The global electric motor sales market size was valued at USD 182.65 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.5% from 2024 to 2030. An increase in awareness regarding green vehicles among customers has been a key factor driving the market. Besides this, a rising number of government incentives to encourage sales of green vehicles for safeguarding the environment from carbon emissions is expected to provide a fillip to the market. Electric motors have been observing several advancements in technology over the past few years, owing to which its demand is gaining traction. Additionally, the advent of better insulation materials has improved operational efficiency and the product's life, which has subsequently driven the market. The market is estimated to witness noteworthy growth over the forecast period owing to an increase in automobile production over the forecast period.

The product is used in fans, pumps, compressors, machine tools, domestic appliances, electric cars, HVAC applications, power tools, and automated robots. These high-efficiency motors are gaining importance, owing to various factors. These include long operating life, low maintenance, energy consumption, and a high tolerance for fluctuating voltages, thus enabling cost savings. Countries such as Brazil, the U.S., Argentina, China, and India are major markets, with a high adoption rate for energy-efficient products in both the industrial and agricultural sectors.

Gather more insights about the market drivers, restrains and growth of the Global Electric Motor Sales market

Motor Type Insights

In terms of revenue, the AC motor segment dominated the electric motor market and accounted for the largest revenue share of more than 70.0% in 2023. This high share is attributable to AC motors' extensive applications ranging from irrigation pumps to modern-day robotics. Furthermore, they are smaller, cheaper, and lighter in weight and are also extensively used in HVAC equipment. The adoption of electric AC motors in the automotive industry has increased exponentially, owing to the advent of highly efficient and low-cost electronics, accompanied by improvements in permanent magnetic materials. Increasing demand for them in various industries, including chemicals, paper and pulp, cement, and wastewater treatment, is likely to further contribute to the growth of the segment. Growing sales of electric vehicles and the subsequent scope of the machine type are also expected to spur the segment's growth over the forecast period.

Power Output Insights

In terms of revenue, the Fractional Horsepower (FHP) output segment dominated the market and accounted for the largest revenue share of more than 86.0% in 2023. This high share is attributable to its wide array of use-cases in all household appliances, ranging from vacuum cleaners to coffee machines and refrigerators. They are also used in industrial equipment as they prove to be suitable for operations in a heavy industrial environment. These motors have numerous advantages, including high starting torque and stability over electric current fluctuations.

Power Rating Insights

In terms of revenue, the 2.2 kW to 375 kW segment dominated the electric motor sales market in 2023. These electric motors find widespread use in heavy-duty industrial processes, manufacturing equipment, and large-scale machinery. This segment is anticipated to retain its dominance over the forecast period. The rising industrial automation and the adoption of advanced manufacturing technologies are driving demand for high-power electric motors in various industries such as automotive, aerospace, manufacturing, and energy.

Voltage Insight

In terms of revenue, the medium voltage (Between 690 V to 45 kV) segment dominated the electric motor sales market in 2023 owing to several key factors, including increasing industrialization, growing urbanization worldwide, and expansion of renewable energy infrastructure. These motors are essential for powering heavy-duty machinery, pumps, compressors, and HVAC systems in industrial and commercial settings.

Application Insights

In terms of revenue, the motor vehicles segment dominated the electric motor sales market and accounted for the largest revenue share of 39.3% in 2023. This high share is attributable to the increased adoption of electric motors in the automotive industry. An average commercial car has more than 40 electric motors ranging from low power to high. Further, the advent of low-cost and highly efficient electronics, coupled with improvements in permanent magnetic materials, drives the market in the automotive industry.

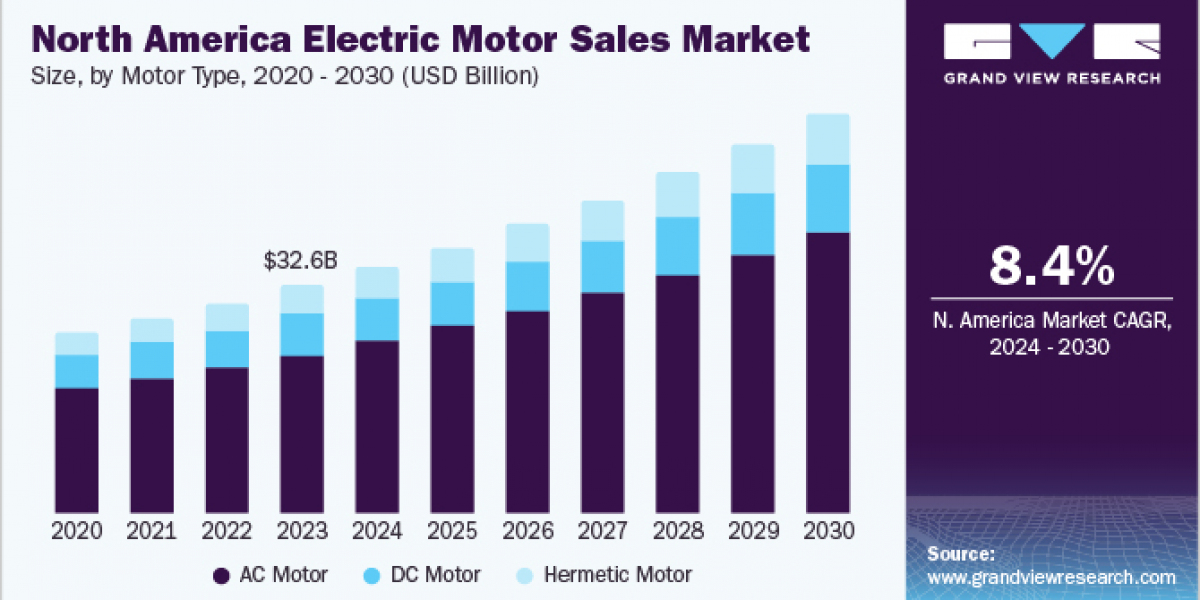

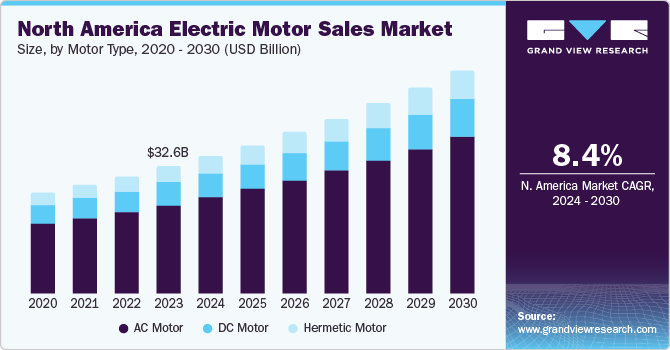

Regional Insights

Asia Pacific dominated the electric motor market and accounted for the largest revenue share of more than 50.0% in 2023. This is attributable to advancements in the agriculture sector and enormous investments in industrialization in countries, including China, India, South Korea, and Australia. Further, the increasing production and sales of electric vehicles in countries including China and Japan as well as the presence of established OEMs such as Honda Motor Co., Ltd., Hyundai Motor Company, Toyota Industries Corporation, and Nissan Motor Corporation are estimated to boost the growth prospects of the market in this region. The market is expected to witness the highest CAGR from 2024 to 2030.

Key Companies & Market Share Insights

- Some of the key players operating in the market include Ametek, Inc. and ABB Ltd. among others.

- Ametek Inc. is a leading global manufacturer of electronic instruments and electromechanical devices, with a significant presence in the Electric Motor Sales market. The company specializes in the design and production of precision motion control solutions, including high-performance motors and drive systems. Ametek's commitment to innovation and advanced technologies has established it as a key player in the industry.

- ABB Ltd. is a renowned multinational corporation known for its expertise in power and automation technologies. In the Electric Motor Sales market, ABB offers a comprehensive range of motors, drives, and control solutions. The company's commitment to sustainability and energy efficiency aligns with the growing demand for eco-friendly electric motors. ABB's global reach and extensive research and development capabilities make it a prominent choice for customers seeking reliable and advanced electric motor solutions.

- Allied Motion Technologies, Inc. and Franklin Electric Co., Inc. are some of the emerging market participants in the target market.

Browse through Grand View Research's Electronic Devices Industry Research Reports.

- Computer Numerical Control Machines Market Size, Share & Trends Analysis Report By Type (Lathe Machines, Milling Machines, Laser Machines), By End-use (Automotive, Industrial, Construction Equipment), By Region, And Segment Forecasts, 2023 - 2030

- Power Electronics Market Size, Share & Trends Analysis Report By Material, By Device, By Application (ICT, Consumer Electronics, Power, Aerospace & Defense), By Region, And Segment Forecasts, 2024 - 2030

Key Electric Motor Sales Companies:

- ABB Ltd.

- Allied Motion Technologies, Inc.

- Ametek Inc.

- Johnson Electric Holdings Limited

- Nidec Motor Corporation

- Franklin Electric Co., Inc.

- Regal Rexnord Corporation

- Schneider Electric

- Siemens

- ORIENTAL MOTOR USA CORP

Electric Motor Sales Market Segmentation

Grand View Research has segmented the global electric motor sales market on motor type, power output, power rating, voltage, application, and region:

Electric Motor Sales Motor Type Outlook (Revenue, USD Billion, 2017 - 2030)

- AC Motor

- DC Motor

- Hermetic Motor

Electric Motor Sales Power Output Outlook (Revenue, USD Billion, 2017 - 2030)

- Integral HP Output

- Fractional HP Output

Electric Motor Sales Power Rating Outlook (Revenue, USD Billion, 2017 - 2030)

- Less than 1 kW

- 1 kW to 2.1 kW

- 2.2 kW to 375 kW

- More than 375 kW

Electric Motor Sales Voltage Outlook (Revenue, USD Billion, 2017 - 2030)

- Low Voltage (Below 690 V)

- Medium Voltage (Between 690 V to 45 kV)

- High Voltage (Above 45 kV)

Electric Motor Sales Application Outlook (Revenue, USD Billion, 2017 - 2030)

- Industrial Machinery

- Motor Vehicles

- HVAC Equipment

- Aerospace & Transportation

- Household Appliances

- Others

Electric Motor Sales Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa (MEA)

- UAE

- KSA

- South Africa

Order a free sample PDF of the Electric Motor Sales Market Intelligence Study, published by Grand View Research.

Recent Developments

- In July 2023, General Electric Vernova’ Solar & Storage Solutions partnered with Fortune Electric to develop Battery Energy Storage Solutions (BESS) in Taiwan. The purpose is to use electric motors in the storage system to keep a control on the energy flow, manage charging and discharging of batteries, and ensure smooth integration of the stored energy.

- In May 2023, ABB Limited announced the acquisition of Siemens low voltage NEMA motor business. This acquisition will enable ABB to strengthen its position as NEMA motor manufacturer, and provide its offering in the NEMA motor sector.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database