Digital Pathology Market Size & Trends

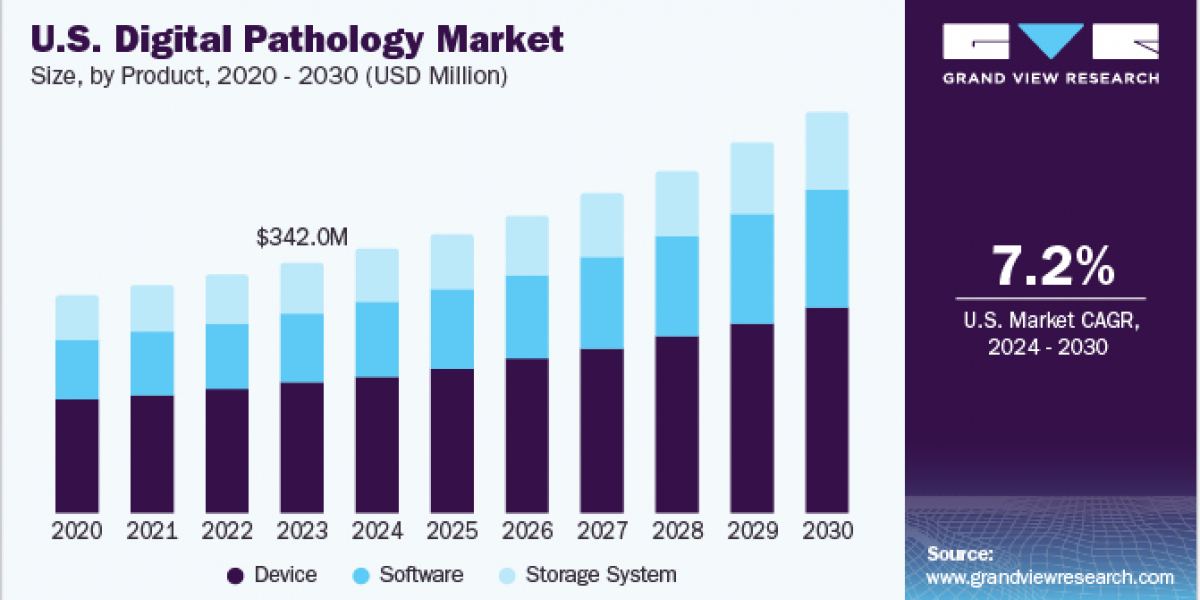

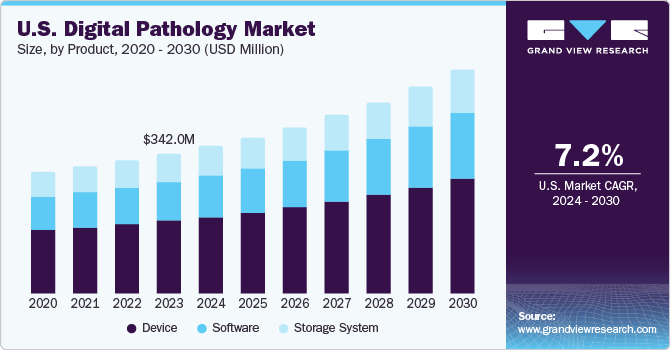

The global digital pathology market size was valued at USD 1.03 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2024 to 2030. This is attributed to rising prevalence of cancer, increasing focus on improving the efficiency of workflow, and growing demand for faster diagnostic tools. Moreover, rising investments in healthcare aided by major key players operating in the market focusing on new launches, increasing adoption of telepathology, and an increasing focus on drug discovery and precision medicine is propelling the market growth.

Rising adoption of healthcare IT solutions is fueling the demand for digital pathology solutions. Organizations are increasingly implementing them to cut costs, streamline processes, overcome resource bottlenecks, and facilitate efficient content sharing. A growing necessity for collaborations and the expanding use of digital documentation across various scientific disciplines also drives the demand. In addition, factors such as heightened adoption to enhance laboratory efficiency, a surge in teleconsultations, and increased applications in companion diagnostics and drug discovery are expected to contribute to the market's growth.

Gather more insights about the market drivers, restrains and growth of the Global Digital Pathology market

Detailed Segmentation:

Product Insights

The device segment held the largest share of 51.72% in 2023 and is anticipated to grow at a lucrative growth rate during the projected period. The device segment includes slide management system and scanner. The segment growth is attributed to increasing adoption of digital pathology in academic research activities with enhanced resolution. For instance, in June 2022, F. Hoffmann-La Roche Ltd. received a CE marking for its VENTANA DP 600 slide scanner, a next-generation, high-capacity slide scanner that generates high-resolution digital images of stained tissue samples to aid in cancer diagnosis and treatment planning

End-use Insights

The hospitals segment dominated the market in 2023 with a share of 36.7%. Hospitals are the most preferred healthcare setting for disease diagnosis and care. Developments in hospital laboratories are crucial to address the evolving needs of patients with more hospitals aiming to provide a wide range of services within their settings. A number of hospitals are implementing digital scanning techniques to improve patient compliance and speed diagnosis. For instance, in March 2023, Ibex (Ibex Medical Analytics) received a PathLAKE contract to provide AI-enabled solutions at 25 NHS to support cancer diagnosis.

Type Insights

The human pathology segment held the largest share of around 60.0% in 2023. The adoption of digital pathology to reduce turnaround time for disease diagnosis and enhance lab productivity is fueling segment growth. In addition, the rising prevalence of chronic diseases in humans has increased the demand for digital pathology.

Regional Insights

North America dominated overall market in 2023 with a share of 40.7% due to increasing government initiatives leading to the development of technologically advanced pathologies, continual deployment of R&D investments, rising adoption of digital imaging, and presence of key market players in the region focusing on providing better solutions to the population. For instance, in March 2023, PathAI launched AISight, a digital pathology platform across the U.S. in 13 leading health systems, reference laboratories, medical centers, and independent pathology organizations to participate in Early Access Program. Moreover, increasing usage of digital pathology in academic research and disease diagnosis is propelling the market growth.

Application Insights

The academic research segment dominated the market in 2023 with a share of 45.7% and is anticipated to remain dominant from 2024 to 2030 owing to the continual research in the development of cancer therapies and high adoption of digital pathology in various research studies. A number of academic research institutes are collaborating with digital pathology providers to incorporate the technology into research activities. In November 2022, the University Medical Center Utrecht entered into a partnership with Paige for the deployment of the company’s application in clinical use and to conduct a clinical health economics study to support reimbursement and adoption of AI applications in pathology.

Key Companies & Market Share Insights

The market is experiencing notable growth owing to rising collaboration, mergers, and product launches. Few notable players in the market includes Leica Biosystems Nussloch GmbH (Danaher), Olympus Corporation, Hamamatsu Photonics, Inc., and F. Hoffmann-La Roche Ltd; CellaVision;Hangzhou Zhiwei Information Technology Co. Ltd. (Morphogo);aetherAI; Morphle Labs, Inc.; Visiopharm A/S; etc.

- In July 2022, CellaVision introduced the DIFF-Line, a workflow system designed specifically for low-volume hematology laboratories, at the AACC Convention, Chicago, U.S. This solution consists of three instruments, including the CellaVision DC-1, RAL SmearBox, and RAL StainBox, which are used for smearing, staining, and analyzing peripheral blood smears. This technology was made available in the European markets in July 2022, with plans to expand to other regions in the same year.

- In February 2020, Scopio Labs, a company dedicated to advancing digital microscopy, announced the launch of ScopioVet Digital Cytology System in the United States and Canada. It is the first true end-to-end solution for veterinary digital cytology, consisting of Scopio's proprietary microscopy imaging system, an intuitive pathology consultation service and powerful AI tools that automate routine diagnostic tests.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

- AI In Oncology Market Size, Share & Trends Analysis Report By Component Type (Software Solutions, Hardware), By Cancer Type (Breast Cancer, Lung Cancer), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Medical Document Management Systems Market Size, Share & Trends Analysis Report By Product (Solution, Service), By Application (On-Premise, Cloud based), By Delivery Mode, By End Use, By Region, And Segment Forecasts, 2024 - 2030

Key Digital Pathology Companies:

- Leica Biosystems Nussloch GmbH (Danaher)

- Hamamatsu Photonics, Inc.

- Koninklijke Philips N.V.

- Olympus Corporation

- Hoffmann-La Roche Ltd.

- Mikroscan Technologies, Inc.

- Inspirata, Inc.

- Epredia (3DHISTECH Ltd.)

- Visiopharm A/S

- Huron Technologies International Inc.

- ContextVision AB

- CellaVision

- HANGZHOU ZHIWEI INFORMATION TECHNOLOGY CO. LTD. (MORPHOGO)

- West Medica Produktions- und Handels- GmbH (West Medica)

- aetherAI

- IBEX (IBEX MEDICAL ANALYTICS)

- SigTuple Technologies Private Limited

- Morphle Labs, Inc

- Bionovation Biotech, Inc.

Digital Pathology Market Segmentation

Grand View Research has segmented the global digital pathology market based on product, type, application, end-use, and region:

Digital Pathology Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Device

- Storage System

Digital Pathology Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Human Pathology

- Veterinary Pathology

Digital Pathology Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Drug Discovery & Development

- Academic Research

- Disease Diagnosis

Digital Pathology End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Biotech & Pharma Companies

- Diagnostic Labs

- Academic & Research Institutes

Digital Pathology Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- ROE

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- RoAPAC

- Latin America

- Brazil

- Mexico

- Argentina

- RoLATAM

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Order a free sample PDF of the Digital Pathology Market Intelligence Study, published by Grand View Research.

Recent Developments

- In October 2023, Pramana and Gestalt announced the availability of an integrated AI-powered platform and digital pathology solutions, combining digital pathology, AI, image analysis, and DICOM into a streamlined, single, comprehensive offering.

- In September 2022, Paige entered into collaboration with OptraSCAN for streamlining the adoption of digital pathology technology in the European Union, U.S., and UK. The aim of this partnership is to enhance workflows of oncology and pathology by reducing the barriers to digitizing glass pathology slides.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database