Tin is an essential metal used in a variety of industries, including electronics, packaging, and chemicals. Its primary use is in the production of tinplate for packaging and soldering in electronic components. Due to its corrosion resistance, malleability, and ability to form alloys, tin plays a critical role in the global economy. As such, the price of tin is closely monitored by manufacturers and industries that rely on the metal for their products.

This article explores the factors that influence tin tin price trend analysis, examines historical and recent price movements, and provides insights into the future outlook for the tin market. It also looks at how regional dynamics, such as supply chain disruptions and geopolitical events, impact the price of tin.

Overview of Tin

Tin (chemical symbol: Sn) is a soft, silvery-white metal commonly used in alloys and coatings. It is often found in the mineral cassiterite, from which it is extracted. Tin is used in a range of applications, including:

Key Applications of Tin:

- Soldering in Electronics: Tin is a key component in soldering materials, accounting for a significant portion of global demand due to its low melting point and ability to bond with other metals.

- Tinplate for Packaging: Tin is widely used in producing tinplate, which is essential in the food and beverage industry for making cans and other containers.

- Alloys: Tin is used in various alloys, including bronze (tin and copper), and in the production of pewter.

- Chemical Applications: Tin is used in a variety of chemical processes, including the manufacture of stabilizers for polyvinyl chloride (PVC) and in the production of certain types of glass.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/tin-price-trends/pricerequest

Factors Influencing Tin Price Trends

Several factors influence the price of tin, from supply and demand dynamics to production costs, geopolitical factors, and technological changes. Below are the primary drivers of tin price fluctuations:

1. Global Demand for Tin in Electronics and Packaging:

The electronics industry is the largest consumer of tin, primarily in the form of solder. The demand for tin solder is driven by the production of electronic devices, including smartphones, computers, automotive electronics, and renewable energy technologies. As the world continues to adopt advanced technologies and move toward renewable energy, demand for tin is expected to grow, putting upward pressure on prices.

The packaging industry is another major consumer of tin, particularly for producing tinplate used in cans. Changes in the food and beverage industry, consumer preferences, and packaging trends influence the demand for tin in this sector.

2. Supply Constraints and Mining Production:

Tin production is geographically concentrated, with the largest producers being China, Indonesia, Myanmar, Peru, and Bolivia. The availability of tin is highly dependent on the output from these key mining regions. Any disruptions to mining activities, such as labor strikes, natural disasters, or political instability, can lead to reduced tin supplies and higher prices.

Additionally, tin mining can be affected by environmental regulations and sustainability concerns. For example, increased scrutiny of mining practices in regions like Southeast Asia has led to periodic slowdowns or closures of tin mines, reducing global supply and driving up prices.

3. Energy and Production Costs:

The extraction and processing of tin are energy-intensive activities, and rising energy costs can significantly impact the price of tin. Higher electricity or fuel prices, particularly in tin-producing countries, can raise the cost of mining and refining tin, resulting in higher prices for the metal.

Moreover, labor costs and technological advancements in mining and refining processes also affect the overall production cost of tin. While technological innovations may reduce costs in the long term, initial investments in advanced mining equipment or cleaner production methods can temporarily increase production costs and influence prices.

4. Stockpiles and Inventories:

The level of tin stockpiles and inventories held by producers, consumers, and traders significantly impacts the short-term price movements of tin. Low inventories can lead to price spikes when demand increases unexpectedly, while higher stock levels typically stabilize or reduce prices. Organizations such as the International Tin Association (ITA) and metal exchanges like the London Metal Exchange (LME) play a critical role in managing stockpiles and providing market data on tin supply and demand.

5. Geopolitical Events and Trade Policies:

Geopolitical events, such as trade disputes, tariffs, and sanctions, can affect the tin market by disrupting supply chains and altering trade flows. For instance, Indonesia, one of the largest tin producers, has imposed export restrictions on raw tin ore to encourage domestic refining and value addition. Such policies can reduce the global supply of tin and lead to price increases.

In addition, political instability or conflicts in tin-producing regions like Myanmar or the Democratic Republic of the Congo (DRC) can affect mining operations and limit the availability of tin in the global market. Trade wars or tensions between major economies, such as the U.S. and China, can also affect the movement of tin across borders, influencing prices.

6. Technological Advancements and Sustainability:

Technological advancements in tin recycling and the development of new substitutes for tin in certain applications, such as lead-free solder, can influence demand and prices. While recycling tin can help reduce the reliance on primary tin mining, the recycling rate for tin remains relatively low compared to other metals.

Sustainability concerns are increasingly affecting the tin industry. As consumers and manufacturers demand more eco-friendly and sustainable products, there is growing pressure on tin producers to adopt cleaner and more responsible mining practices. This shift may increase production costs in the short term but could create more sustainable pricing structures in the long term.

Historical Price Trends of Tin

1. Pre-2020 Market Stability:

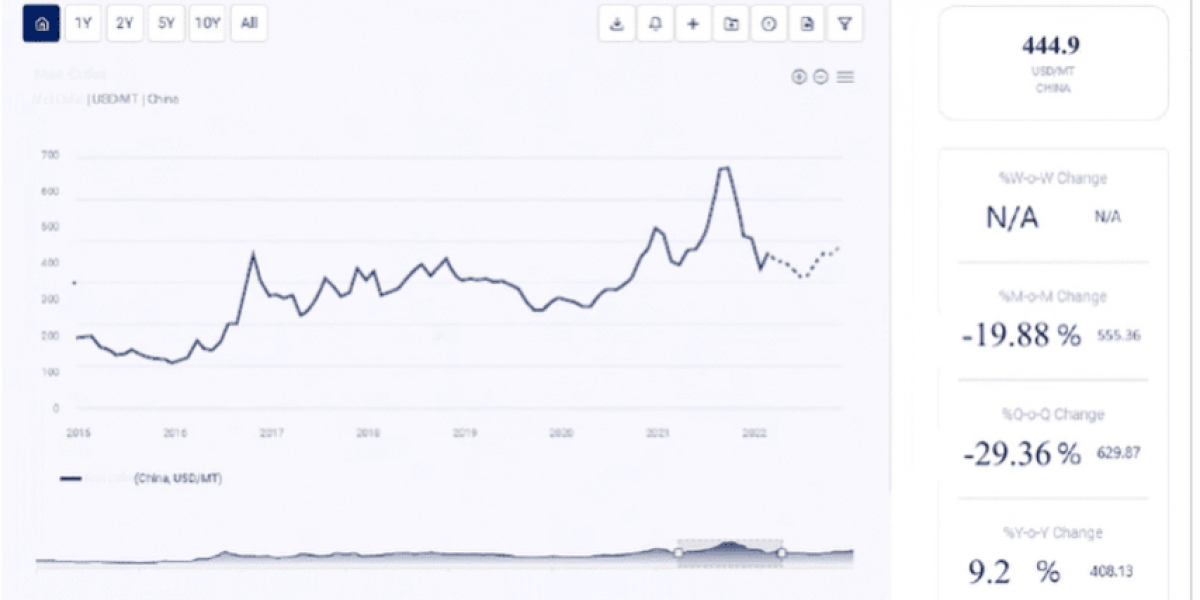

Before the COVID-19 pandemic, tin prices were relatively stable, with fluctuations driven primarily by supply and demand dynamics in the electronics and packaging industries. From 2016 to 2018, tin prices experienced a steady rise due to strong demand from the electronics sector and disruptions in supply from key producers, particularly in Southeast Asia.

In 2019, tin prices began to decline as global economic growth slowed, especially in China, the largest consumer of tin. Trade tensions between the U.S. and China and a slowdown in the global electronics market contributed to weaker demand for tin, causing prices to soften.

2. Impact of COVID-19 Pandemic:

The COVID-19 pandemic in 2020 had a significant impact on the global tin market. Industrial production slowed, and demand for consumer electronics and packaging products initially declined as lockdowns and restrictions affected global supply chains. Tin prices fell sharply in the first half of 2020 as a result of reduced industrial activity and uncertainty in the market.

However, the recovery began in the latter half of 2020 as demand for electronics surged due to the rise of remote work, e-learning, and increased consumer spending on electronic devices. The packaging industry also recovered as demand for packaged food and beverages increased. As demand outpaced supply, tin prices began to rise again, with supply chain disruptions in tin-producing countries contributing to the price increase.

3. Post-Pandemic Recovery and Recent Trends:

In 2021 and 2022, tin prices surged to multi-year highs due to strong demand from the electronics and packaging industries. The continued growth of the renewable energy sector, particularly in solar panel production, further boosted demand for tin solder. Meanwhile, supply chain disruptions, labor shortages, and political instability in key tin-producing regions led to reduced tin production, contributing to a supply-demand imbalance.

By the end of 2022, tin prices had reached record highs, driven by a combination of high demand and tight supply. The geopolitical tensions between major tin producers and consumers, coupled with rising energy costs, exacerbated the situation, leading to continued price volatility.

4. 2023 and Beyond:

In 2023, tin prices remained elevated due to ongoing supply chain challenges, strong demand from the electronics and renewable energy sectors, and geopolitical uncertainties in key tin-producing regions. The shift toward greener energy solutions, such as electric vehicles (EVs) and renewable energy technologies, is expected to sustain strong demand for tin in the coming years.

However, there is also increased focus on improving tin recycling and finding substitutes for tin in certain applications. These efforts may help ease supply pressures in the long term, potentially stabilizing prices.

Regional Price Trends of Tin

1. Asia-Pacific:

The Asia-Pacific region, particularly China, Indonesia, and Myanmar, is the largest producer and consumer of tin. China’s demand for tin is driven by its massive electronics and manufacturing sectors, which account for a significant portion of global tin consumption. Indonesia, one of the world’s largest tin producers, has periodically restricted tin exports to encourage domestic processing, leading to supply disruptions and price fluctuations in the region.

Myanmar is another key player in the global tin market, though political instability and conflicts have affected its tin production in recent years, contributing to regional supply shortages and higher prices.

2. North America:

In North America, tin prices are largely influenced by demand from the electronics and packaging industries. The U.S. is a significant consumer of tin, particularly in the production of electronic devices and tinplate for food and beverage packaging. Trade policies, such as tariffs on imported metals, have impacted tin prices in the region. Additionally, North America relies on imports for much of its tin supply, making it susceptible to price fluctuations driven by global market conditions.

3. Europe:

In Europe, tin is widely used in the electronics and automotive industries, especially with the growing demand for electric vehicles and renewable energy technologies. The region’s focus on sustainability has also increased demand for tin in the production of solar panels and other green technologies. Europe is a net importer of tin, and any disruptions in supply chains from key producers like Southeast Asia or South America can lead to price volatility in the region.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Number: USA & Canada — Phone no: +1 307 363 1045 | UK — Phone no: +44 7537 132103 | Asia-Pacific (APAC) — Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA