Journal entries are the backbone of any accounting system. They serve as a chronological record of all transactions a business makes, allowing for the systematic review and analysis of financial activities. This foundational concept is especially crucial when dealing with payroll liabilities, an area fraught with complexities and nuances.

One must grasp the double-entry accounting system to understand journal entries properly. In this system, every transaction impacts at least two accounts: one account is debited, and another is credited, maintaining the accounting equation's balance. This dual effect is what makes the recording of payroll liabilities a critical and sometimes challenging task for businesses.

Components of Payroll Liabilities

Payroll liabilities encompass various elements beyond just the gross wages or salaries owed to employees. It includes taxes withheld from employees, such as federal income tax, state income tax, and Social Security and Medicare taxes, which are obligations that the employer must remit to the government on behalf of their employees.

Furthermore, payroll liabilities also involve contributions to employee benefits, including

health insurance premiums, retirement plan contributions, and any other deductions that result from voluntary employee programs. These components add layers of complexity to recording payroll liabilities, as each requires specific attention and accuracy in journal entries.

It's also essential to understand that employer payroll taxes, which are additional taxes the employer is responsible for, like the employer's share of Social Security and Medicare taxes, federal and state unemployment taxes, also form part of payroll liabilities. These costs must be meticulously accounted for to ensure compliance with tax laws and to provide an accurate picture of a company's financial health.

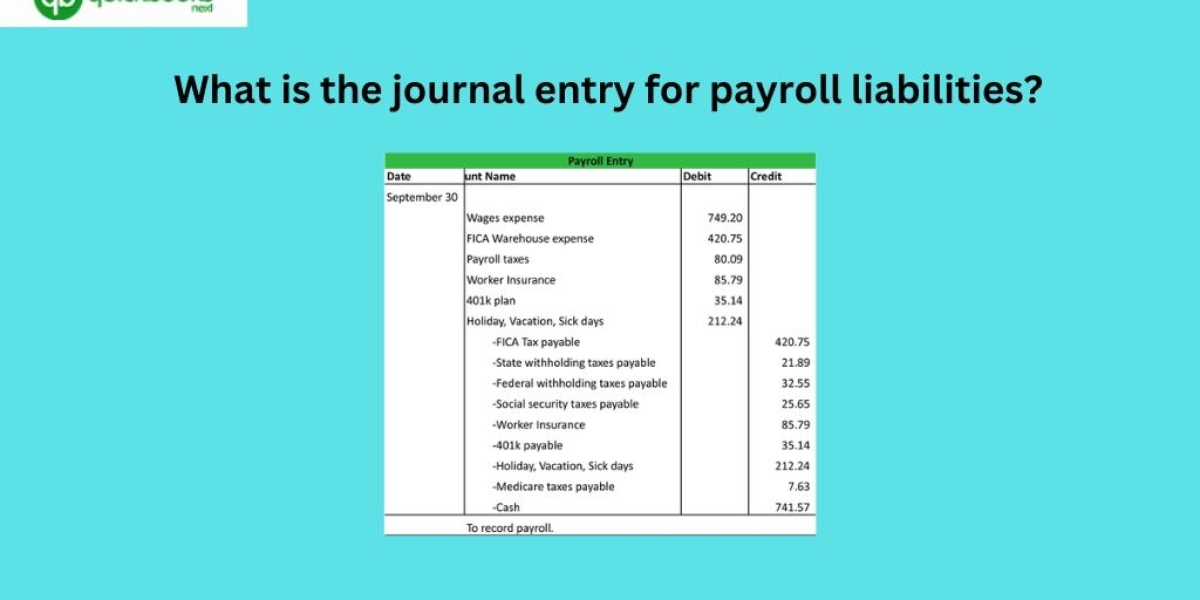

Journal Entry for Employee Wages

The journal entry to record employee wages typically involves debiting the wages expense account and crediting the wages payable (or accrued wages) account. This entry reflects that the company has incurred an expense through the payment of wages, and simultaneously, it has created a liability because these wages are due but not yet paid.

For example, if a company owes $10,000 in wages to its employees for the last pay period, the journal entry would look something like this:

Debit

- Wages Expense $10,000

Credit

- Wages Payable $10,000

This entry ensures that the company's income statement reflects the cost of employee wages for that period, and the balance sheet accurately shows the owed wages as a current liability.

To adjust payroll liabilities in QuickBooks, follow these steps: First, navigate to the "Lists" menu and select "Chart of Accounts." Find and double-click on the liability account you need to adjust. Click on the "Adjust Balance" button at the top of the register window. In the "Adjust Balance" window, enter the correct

balance for the liability account and select an appropriate adjustment account (usually a payroll expense account). Add a memo to explain the reason for the adjustment, then click "OK" to save the changes. This adjustment will create a journal entry to correct the liability balance. Remember to consult with your accountant or payroll specialist before making significant adjustments to ensure accuracy and compliance with tax regulations.

Journal Entry for Employer Payroll Taxes

Employer payroll taxes are an additional burden on the employer, over and above the wages paid to employees. These taxes include the employer's share of Social Security and Medicare taxes, as well as federal and state unemployment taxes. Recording these taxes requires a separate journal entry to ensure that they are accurately reflected in the company's financial records.

The journal entry to record employer payroll taxes typically involves debiting payroll tax expense and crediting the respective payroll tax payable accounts. This entry recognizes the accrual of these taxes as an expense for the company and increases the liability for these yet-to-be-paid taxes. For instance, if the employer's payroll tax obligation for a given period is $2,000, the journal entry would look like this:

Debit

- Payroll Tax Expense $2,000

Credit

- Payroll Taxes Payable $2,000

This entry ensures that the financial statements accurately reflect the employer's payroll tax obligations, providing a comprehensive view of the company's financial commitments.