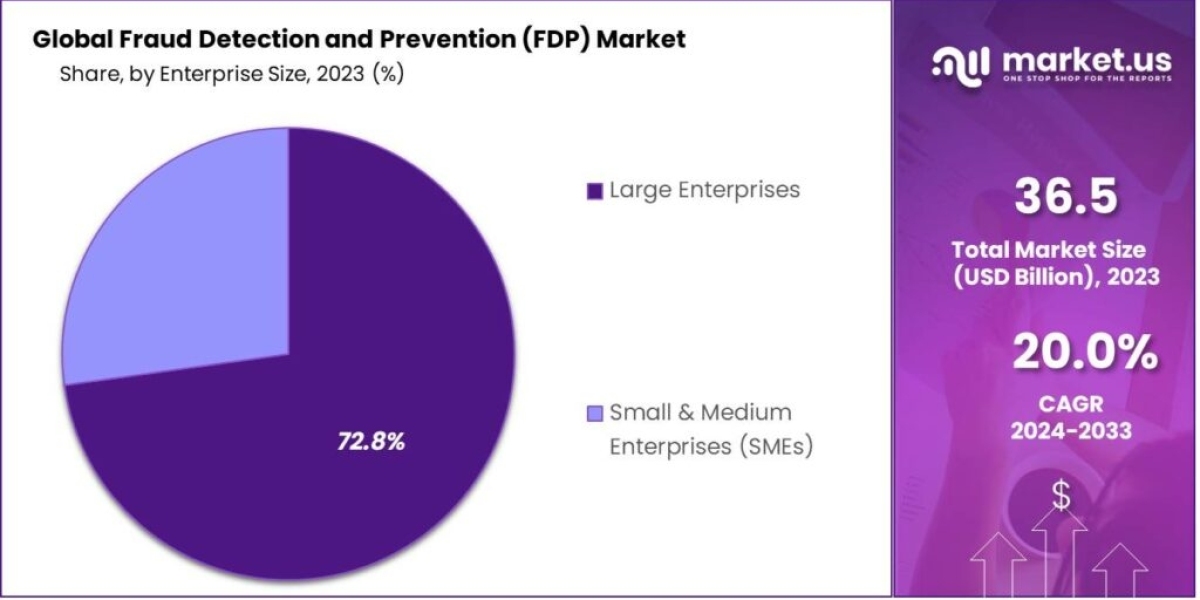

FDP systems are essential across various sectors including banking, insurance, and e-commerce. They analyze vast amounts of data to detect anomalies and prevent unauthorized transactions, thereby safeguarding sensitive information and financial assets.The FDP market is fueled by several factors, including the growing adoption of digital transactions, the rise of e-commerce, and the increasing sophistication of fraudsters. As more transactions and interactions move online, the risk of fraud escalates, necessitating robust FDP measures

Read more @https://market.us/report/fraud-detection-and-prevention-fdp-market/

Growth Factors:

Increasing Digital Transactions: The rise of online payments and digital commerce has expanded the scope for fraud, driving the demand for robust FDP solutions.

Technological Advancements: Innovations in AI and ML enable more accurate and real-time fraud detection, enhancing the effectiveness of prevention measures.

Regulatory Requirements: Stringent regulations and compliance standards mandate organizations to implement comprehensive FDP strategies, boosting market growth.

Restraint:

Despite its growth, the FDP market faces challenges

Cost Constraints: Implementing sophisticated FDP systems can be costly, especially for smaller businesses with limited resources.

Complex Fraud Patterns: Cybercriminals continuously evolve their tactics, making it challenging for FDP solutions to keep pace with new threats.

Opportunity:

There are significant opportunities in the FDP market:

Growing Awareness:Increasing awareness about the risks associated with fraud stimulates demand for advanced FDP technologies.

Global Expansion: As businesses expand globally, there is a rising need for scalable and adaptive FDP solutions that can operate across different regions and regulatory environments.

Challenges:

Technological Complexity: Integrating AI and ML into FDP systems requires expertise and investment in advanced technology infrastructure.

Data Management: Managing and analyzing large volumes of data from diverse sources can pose logistical and security challenges.

Conclusion:

In conclusion, while the FDP market offers substantial growth opportunities driven by technological advancements and regulatory pressures, it must navigate challenges such as cost constraints and evolving fraud tactics. By innovating and adapting to new threats, FDP providers can continue to enhance security measures and safeguard against financial losses in an increasingly digital world.