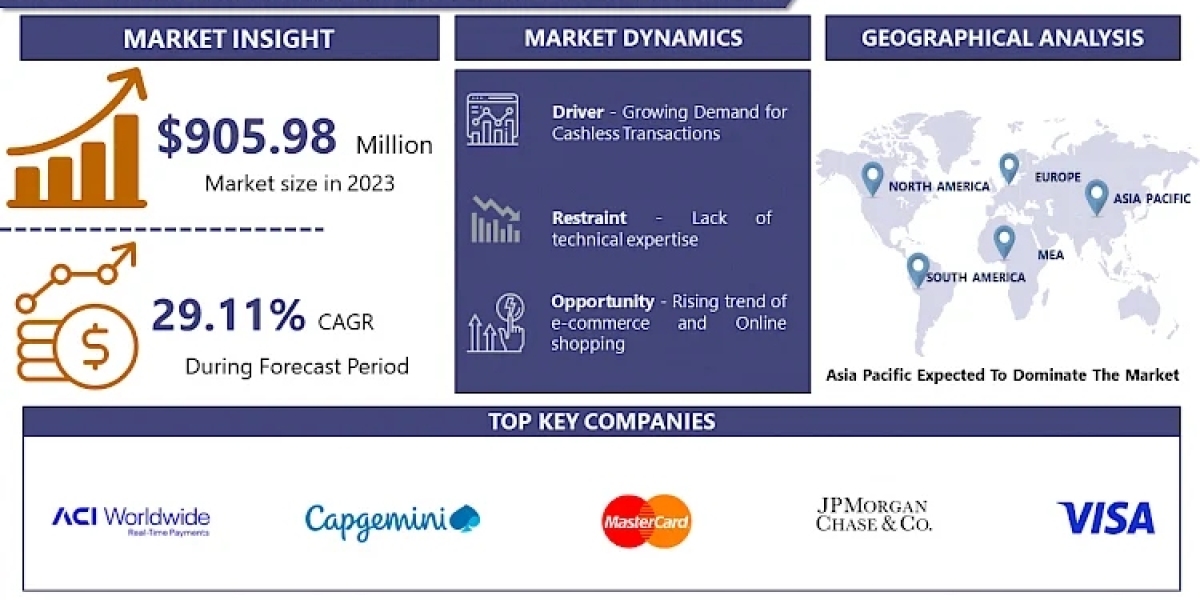

Faster Payment Service (FPS) Market Size Was Valued at USD 905.98 Million in 2023, and is Projected to Reach USD 9026.67 Million by 2032, Growing at a CAGR of 29.11% From 2024-2032.

The Faster Payment Service (FPS) is a UK-based initiative launched in to enable near-instantaneous money transfers between bank accounts. Prior to FPS, bank transfers often took several days, causing delays in transactions and financial planning. FPS revolutionized this process by allowing payments to be completed within seconds, including weekends and holidays. The service supports a wide range of payment types, including individual and business transactions, standing orders, and bill payments.

FPS works by connecting participating banks and building societies, leveraging a central infrastructure managed by a clearing organization. The key feature of FPS is its ability to process payments in real-time, which is particularly beneficial for urgent transactions. The widespread adoption of FPS has significantly improved cash flow management for businesses and provided consumers with a convenient and efficient way to handle their finances. It has also paved the way for the development of other real-time payment systems globally, reflecting a growing demand for faster and more efficient financial services.

Top Key Players:

ACI Worldwide (U.S.), FIS (U.S.), Fiserv, Inc. (U.S.), Wirecard (U.S.), Mastercard (U.S.), Temenos Headquarters SA (U.S.), Global Payments Inc. (U.S.), M & A Ventures, LLC (U.S.), Visa Inc. (U.S.), PayPal Holdings, Inc. (U.S.), Stripe, Inc. (U.S.), JPMorgan Chase & Co. (U.S.), Wells Fargo & Company (U.S.)

Get a Free Sample Report to know more about Type:

https://introspectivemarketresearch.com/request/16608

Introspective Market Research provide comprehensive market research studies, delivering valuable insights and strategic guidance to businesses worldwide. Our operations are driven by accurate analysis and extensive coverage of all the areas to offer reliable reports.

Our study encompasses major growth determinants and drivers, along with extensive segmentation areas. Through in-depth analysis of supply and sales channels, including upstream and downstream fundamentals, we present a complete market ecosystem.

Segmentation Analysis of Faster Payment Service (FPS) Market:

By Mode of Payment

- Single Immediate Payments

- Forward-Dated Payments

- Direct Corporate Access Payments

- Domestic P2P Payments

- Cross-Border P2P Payments

- Others

By Component

- Solutions, Payment Gateway

- Payment Processing

- Payment Security

- Services

By Deployment

- Cloud

- On-Premises

By Enterprise Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By End-User

- Banking and Financial Services

- Retail and E-commerce

- Healthcare

- Government and Utilities

- Travel and Hospitality

If You Have Any Query of Faster Payment Service (FPS) Market Report, Visit:

https://introspectivemarketresearch.com/inquiry/16608

By Region

- North America (U.S., Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, U.K., France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

- Middle East & Africa (Turkey, Saudi Arabia, Bahrain, Kuwait, Qatar, UAE, Israel, South Africa)

- South America (Brazil, Argentina, Rest of SA)

Market Dynamics:

Drivers:

The primary driver of the Faster Payment Service (FPS) is the growing demand for real-time payment capabilities. Consumers and businesses increasingly expect immediate access to funds, whether for personal transactions, payroll processing, or supplier payments. The rise of e-commerce and mobile banking has further heightened this need, as users seek seamless, on-the-go financial services. Regulatory support and initiatives, such as the UK’s Payment Services Regulations, also drive the adoption of FPS by encouraging banks and financial institutions to enhance their payment infrastructures. Additionally, the competitive banking landscape compels institutions to offer faster, more efficient services to attract and retain customers, further driving the proliferation of FPS.

Opportunities:

FPS presents numerous opportunities, particularly in enhancing customer experience and operational efficiency for banks and businesses. By enabling instant payments, FPS reduces transaction times and improves cash flow management, leading to greater financial agility for users. The service also opens avenues for innovative financial products and services, such as real-time payroll, instant loan disbursements, and enhanced digital wallets. For businesses, FPS can streamline payment processes, reduce reliance on credit, and improve supplier relationships by ensuring timely payments. Furthermore, the technology underlying FPS can be leveraged to develop and expand real-time payment systems in other regions, offering a scalable model for global financial innovation.

Direct Purchase this Market Research Report Now:

https://introspectivemarketresearch.com/checkout/?user=1&_sid=16608

About Us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Get in Touch with Us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1 773 382 1049