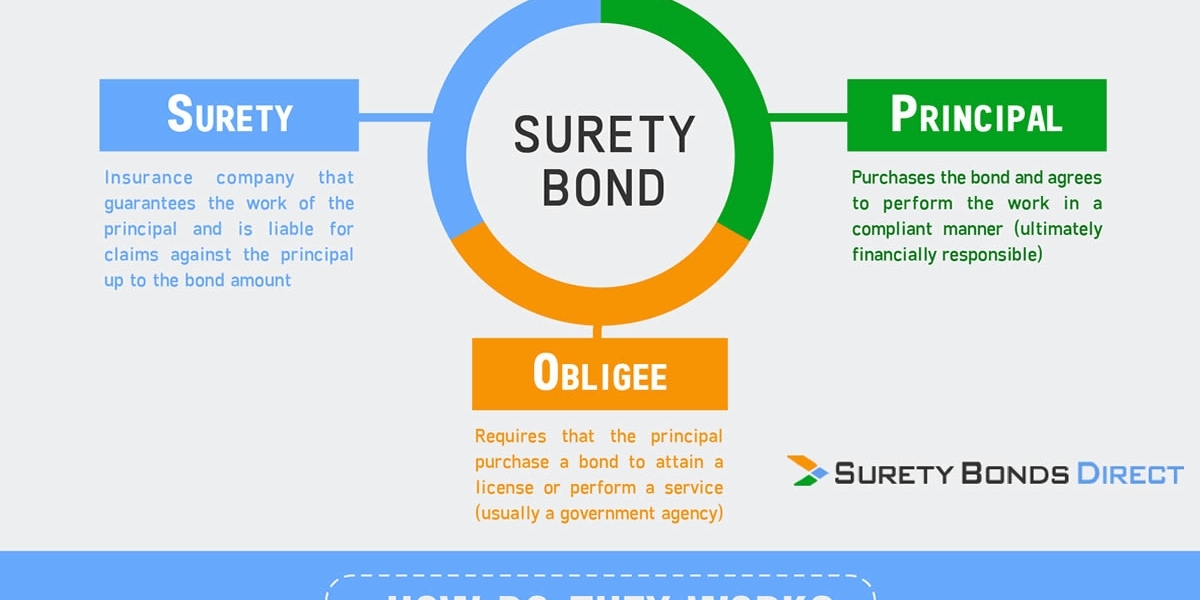

In the realm of financial transactions, the term surety bond holds significant importance. A surety bond, often referred to simply as a bond, Evergreen Surety is a contractual agreement among three parties: the principal, the obligee, and the surety. This agreement serves as a guarantee that the principal will fulfill their obligations to the obligee, providing financial compensation in case of default.

Surety bonds play a crucial role in various industries, ranging from construction and real estate to legal and governmental sectors. They ensure that projects are completed as promised and that contractual obligations are met. For instance, in construction projects, a contractor may be required to obtain a surety bond to assure the project owner that they will deliver the work according to the terms of the contract. If the contractor fails to do so, the surety steps in to fulfill the obligations or compensate the obligee.

The primary purpose of a surety bond is to provide financial protection and assurance to the obligee, who relies on the principal to fulfill their obligations. It acts as a safeguard against financial loss and mitigates risks associated with non-performance or default. Additionally, surety bonds enhance trust and credibility in business transactions, as they demonstrate the principal's commitment to honoring their contractual agreements.

There are various types of surety bonds tailored to specific needs and industries. Performance bonds, payment bonds, bid bonds, and license bonds are among the most common types, each serving a distinct purpose. Performance bonds ensure that projects are completed as per the contract, while payment bonds guarantee payment to subcontractors and suppliers. Bid bonds provide assurance that a contractor will honor their bid, and license bonds are required for obtaining licenses or permits.

In conclusion, surety bonds are essential instruments in financial transactions, providing assurance, protection, and accountability. They uphold the integrity of contracts, foster trust among stakeholders, and mitigate risks associated with non-performance. Understanding the role and significance of surety bonds is vital for businesses and individuals involved in various industries, ensuring smooth and secure transactions.