Unveiling Insights into the Commercial Lending Market: A Comprehensive Analysis

Delving into the intricate realms of the 'Commercial Lending Market' Maximize Market Research, a renowned Business Consultancy Firm, unveils a detailed analysis shedding light on the dynamics, trends, and prospects within the industry. This comprehensive report encompasses key business insights, demand analysis, pricing dynamics, and a competitive landscape, providing a panoramic view of the Commercial Lending market landscape. Presenting a thorough overview of the Commercial Lending market to industry stakeholders is the report's main goal. The research presents the industry's historical and present state together with projected market size and trends, analyzing complex data in an easy-to-read manner. The study includes a thorough analysis of important competitors, including market leaders, followers, and recent entries, and it covers every facet of the industry.

Get a Free Sample of the Report by Clicking Here: https://www.maximizemarketresearch.com/request-sample/230608

Understanding the Scope and Methodology:

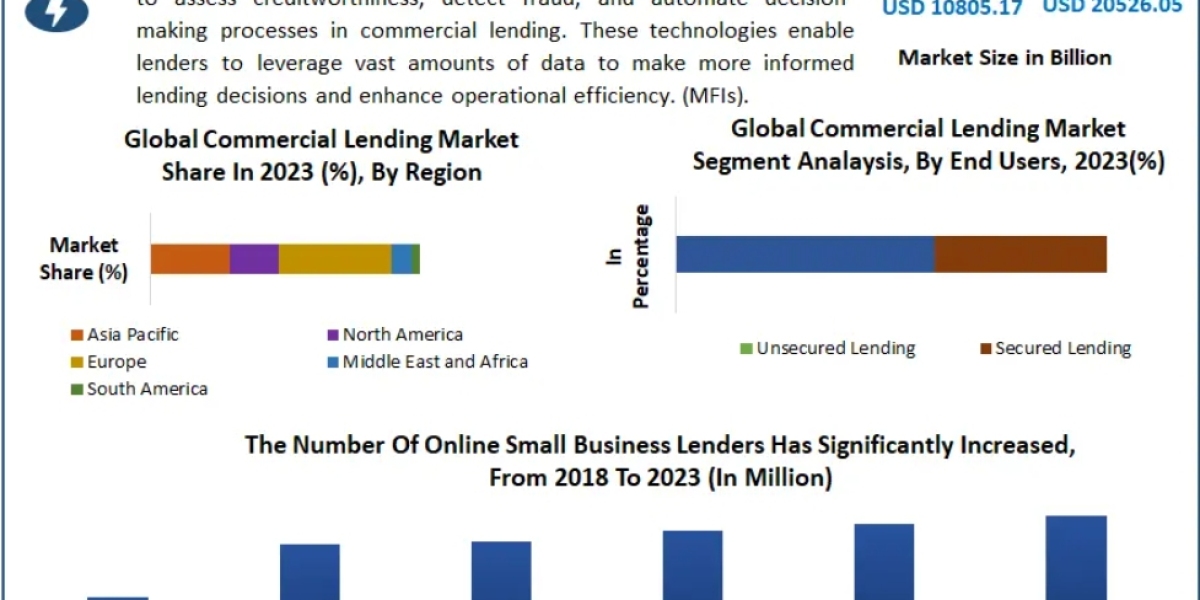

The scope of the Commercial Lending market research extends across various domains, ranging from wearable technologies to other innovative systems. This extensive analysis not only scrutinizes the current state of the Commercial Lending market but also delves into its underlying mechanics, encompassing major forces, obstacles, patterns, and opportunities shaping its growth trajectory. Moreover, the report meticulously segments the Commercial Lending market based on sub-segments and geographical nuances, offering invaluable insights into market size, revenue projections, and growth prospects up to 2030.

The methodology employed in this research adheres to rigorous standards, employing a meticulous process of data collection and analysis. Leveraging primary research methods such as surveys, interviews, and observations, data is garnered directly from industry experts, market participants, and stakeholders, ensuring the reliability and accuracy of the findings.

Regional Perspectives:

A comprehensive evaluation of the Commercial Lending market extends across various regions, including North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Through this regional lens, the report delineates the market status across diverse geographical landscapes, offering nuanced insights into regional trends and dynamics.

View a Brief Summary of the Report Here: https://www.maximizemarketresearch.com/request-sample/230608

Unraveling Market Segmentation:

Key to understanding the Commercial Lending market dynamics is a meticulous segmentation analysis. This report dissects the market into various segments and sub-segments, providing a granular view of its intricacies and nuances. By categorizing the market based on different parameters, it offers stakeholders a deeper understanding of market trends and opportunities.

by Service Type

Unsecured Lending

Secured Lending

by Providers

Banks

Non-banks

by Enterprise Size

Large Enterprises

Small & Medium-Sized Enterprises

According to Enterprise Size, Big businesses are said to control a substantial portion of the worldwide commercial finance sector, estimated at 70%, giving them significant influence in this area. They search for sizable loans for initiatives like construction projects and acquisitions since they have solid credit histories and trustworthy financial documentation. Furthermore, a variety of financial sources, including as bond sales, syndicated loans, and private debt placements, are often easily accessible to these organizations. These characteristics draw attention to the significant role that large corporations play in shaping the dynamics of commercial lending by highlighting their unique needs and significant impact on the financial system. Large firms are the main drivers of significant loan originations, which boosts lenders' profits. There is intense rivalry between large banks and specialist lenders to offer favorable rates and tailored solutions.

Key Player Insights:

In addition to market analysis, the report offers invaluable insights into key players within the Commercial Lending market. Through detailed profiles and strategic perspectives, it outlines the competitive landscape, highlighting market leaders, followers, and regional players. Moreover, competitive benchmarking enables stakeholders to gauge their performance vis-à-vis industry peers.

1. Huntington bank

2. Wells Fargo

3. Bank of China Limited

4. funding circle

5. Industrial Bank Co. Ltd

6. jp morgan chase

7. china development bank

8. Credit Suisse

9. Goldman Sachs

10. OnDecK

11. Banco Santander's A

12. Barclays Bank PLC

13. BNP Paribas S.A.

14. Citibank n a

15. Crédit Agricole S.A.

To Conduct Additional Research, Go Here: https://www.maximizemarketresearch.com/request-sample/230608

This detailed overview explores the dynamic global Commercial Lending market, covering its key drivers, trends, challenges, and opportunities. It includes thorough analyses using frameworks like Porter's Five Forces and PESTEL, along with supply chain insights and patent examination. Segmentation by type, end-user, and region offers a nuanced perspective, complemented by competitive analysis, company profiles, and revenue assessments. Methodological rigor and appendices bolster the credibility of this comprehensive market assessment.

Addressing Key Questions:

This comprehensive report addresses a myriad of key questions pertinent to the Commercial Lending market:

- What defines the Commercial Lending market?

- What was the market size in 2023?

- What growth trajectory does the Commercial Lending market forecast, including its CAGR and growth rate?

- What factors are expected to drive market growth?

- What segments constitute the Commercial Lending market, and what are their growth strategies?

- What emerging applications and trends are shaping the Commercial Lending market landscape?

- How can recent industry trends be leveraged to augment revenue streams?

- Who are the leading companies and what portfolios do they hold in the Commercial Lending market?

- Which segments and applications hold the highest growth potential?

- What are the key challenges and opportunities within the Commercial Lending market?

Key Offerings:

The report offers a plethora of offerings to aid stakeholders in making informed decisions:

- Historical market size and competitive landscape analysis (2018 to 2022)

- Pricing dynamics and regional price curves (2018 to 2022)

- Market size, share, and forecast by segment (2024–2030)

- Comprehensive market dynamics analysis, encompassing growth drivers, restraints, opportunities, and key trends by region

- Detailed market segmentation analysis by segment and region

- In-depth competitive landscape analysis, profiling key players strategically

- PESTLE analysis, Porter’s analysis, value chain, and supply chain analysis

- Legal aspects of business by region

- Lucrative business opportunities with SWOT analysis

- Recommendations for stakeholders to navigate the Commercial Lending market landscape effectively.

Click Here to View Additional Reports on Related Reports:

5G Connections Market https://www.maximizemarketresearch.com/market-report/global-5g-connections-market/107026/

Abrasive Blast Systems Market https://www.maximizemarketresearch.com/market-report/abrasive-blast-systems-market/77168/

About Maximize Market Research:

Maximize Market Research stands as a beacon of expertise in market research and consulting, boasting a team of professionals versed in diverse industries. From medical devices to automotive sectors, we offer a spectrum of services including industry estimations, trend analysis, market research, strategic advice, and client impact studies, among others.

Get in Touch:

For further inquiries or to access the full report, reach out to Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Bangalore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

In conclusion, Maximize Market Research’s comprehensive report on the Commercial Lending market provides a holistic view of its dynamics, offering stakeholders invaluable insights to navigate and capitalize on emerging opportunities within the industry.