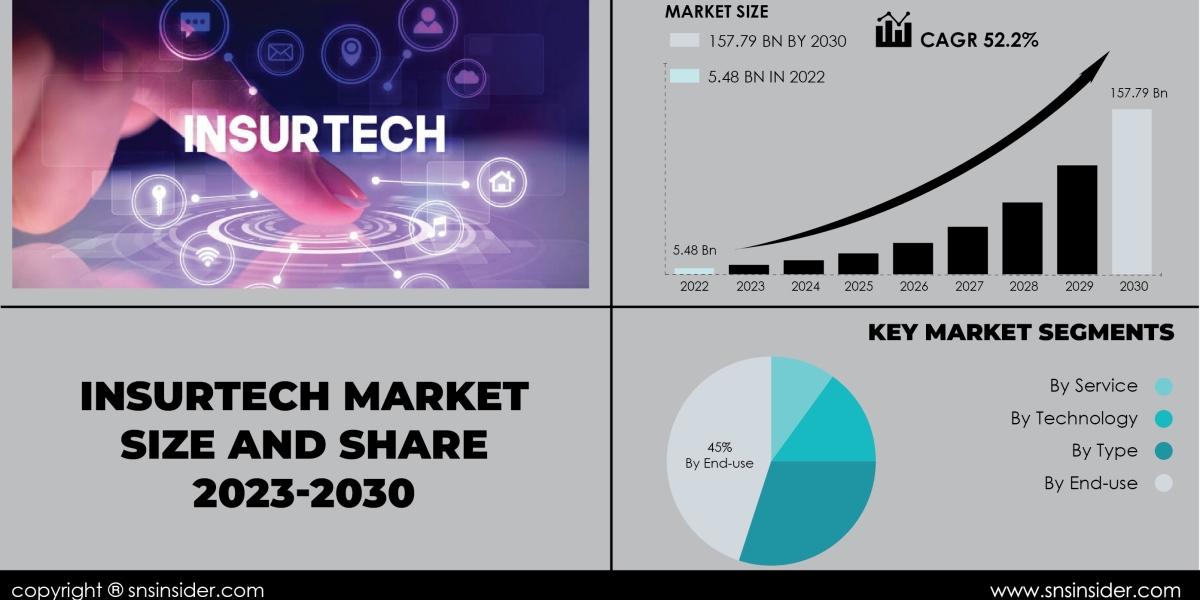

Insurtech Market Scope and Overview

The Insurtech Market is experiencing rapid transformation as technology-driven startups disrupt traditional insurance models, enhance customer experiences, and drive innovation across the insurance value chain. With offerings spanning digital distribution, AI-driven underwriting, and claims processing automation, insurtech companies enable insurers to streamline operations, mitigate risks, and deliver personalized products and services to policyholders. As insurers embrace digital transformation initiatives and the demand for data-driven insights and customer-centric solutions rises, the insurtech market is witnessing increased adoption and investment. Moreover, with advancements in telematics, IoT sensors, and blockchain technology, insurtech providers are poised to deliver enhanced value propositions and business models, driving further disruption and innovation in the insurtech market.

The Insurtech Market continues to witness rapid evolution and transformation, shaped by recent events and economic uncertainties. In light of these challenges, the latest Insurtech Market Forecast serves as a strategic resource, providing comprehensive analysis and insights to help stakeholders navigate complexities and capitalize on emerging opportunities. With its in-depth competitive analysis, market segmentation, regional outlook, and evaluation of growth opportunities, the forecast equips businesses with the knowledge needed to drive strategic decisions and achieve sustainable success in the Insurtech Market.

Get a Sample Report of Insurtech Market @ https://www.snsinsider.com/sample-request/2800

Some of the Major Key Players Studied in this Report are:

- Majesco

- Oscar Insurance

- Quan Template

- Shift Technology

- Trov Insurance Solutions

- Wipro Limited

- ZhongAnInsurance

- OutSystems

- Damco Group

- DXC Technology Company

- Insurance Technology Services

- Others

Competitive Analysis

The Insurtech Market is characterized by intense competition, with various players striving to gain market share and differentiate themselves. The Insurtech Market Forecast conducts a rigorous competitive analysis, profiling key players, their market positioning, and strategic initiatives. By understanding the competitive landscape, stakeholders can identify areas of opportunity and develop strategies to enhance their market presence and gain a competitive edge.

Market Segmentation

The Insurtech Market is multifaceted, comprising various segments based on a variety of factors. The Insurtech Market Forecast conducts a detailed segmentation analysis, providing insights into key market segments and their growth prospects. By understanding the nuances of market segmentation, stakeholders can tailor their strategies to target specific segments and capitalize on growth opportunities, driving market penetration and revenue growth.

Market Segmentation and Sub-Segmentation Included Are:

by Type:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

by Service:

- Consulting

- Support & Maintenance

- Managed Services

by Technology:

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

by End-use:

- Automotive

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Transportation

- Others

Regional Outlook

The Insurtech Market exhibits regional variations, with each geographic region presenting its unique set of opportunities and challenges. The Insurtech Market Forecast provides a comprehensive regional outlook, analyzing market trends, regulatory frameworks, and growth drivers in key geographic regions. By gaining insights into regional dynamics, stakeholders can tailor their strategies to target specific markets and capitalize on growth opportunities, driving market expansion and revenue growth.

Impact of Recession

The recent onset of a global recession has introduced additional challenges for businesses operating in the Insurtech Market. Economic downturns typically lead to reduced consumer spending, impacting demand for Insurtech Market. However, recessions also spur innovation and efficiency as businesses seek to streamline operations and optimize resources. The Insurtech Market Forecast evaluates the potential impacts of recessionary pressures on market dynamics, helping stakeholders navigate challenges and capitalize on emerging opportunities amidst economic uncertainties.

Impact of Recent Events

Recent events, such as the Russia-Ukraine conflict and the COVID-19 pandemic, have introduced unprecedented challenges and disruptions to global markets. Supply chain disruptions, fluctuating commodity prices, and geopolitical uncertainties have heightened volatility and injected uncertainty into the market. The Insurtech Market Forecast assesses the impact of these recent events on market stability, trade dynamics, and investment sentiment, providing insights to help stakeholders mitigate risks and adapt to evolving market conditions.

Growth Opportunities

Despite the challenges posed by economic uncertainties and recent events, several growth opportunities exist in the Insurtech Market. Technological advancements are driving the adoption across industries, enabling organizations to gain insights, improve decision-making, and drive innovation. Changing consumer preferences and the demand for personalized experiences are also fueling market growth, driving organizations to invest in Insurtech Market to meet evolving customer needs. Additionally, regulatory reforms and initiatives promoting data transparency and privacy are creating opportunities for market expansion, driving adoption across sectors.

Conclusion

In conclusion, the Insurtech Market Forecast provides invaluable insights and strategic guidance for industry stakeholders navigating the complexities of the Insurtech Market amidst recent events and economic uncertainties. By providing comprehensive analysis of competitive dynamics, market segmentation, regional outlook, and growth opportunities, the forecast equips businesses with the knowledge needed to make informed decisions and drive strategic initiatives. Despite the challenges posed by economic uncertainties and recent events, the Insurtech Market remains resilient, offering opportunities for innovation, expansion, and value creation. By leveraging insights from the Insurtech Market Forecast, stakeholders can unlock their full potential and achieve sustainable success in a dynamic and competitive market environment.

Check for Discount @ https://www.snsinsider.com/discount/2800

Table of Contents - Major Key Points

- Introduction

- Research Methodology

- Market Dynamics

- Impact Analysis

- COVID-19 Impact Analysis

- Impact of Ukraine- Russia war

- Impact of Ongoing Recession on Major Economies

- Value Chain Analysis

- Porter’s 5 Forces Model

- PEST Analysis

- Insurtech Market Segmentation, by Type

- Insurtech Market Segmentation, by Service

- Insurtech Market Segmentation, by Technology

- Insurtech Market Segmentation, by End-use

- Regional Analysis

- Company Profile

- Competitive Landscape

- USE Cases and Best Practices

- Conclusion

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Website: https://www.snsinsider.com

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.