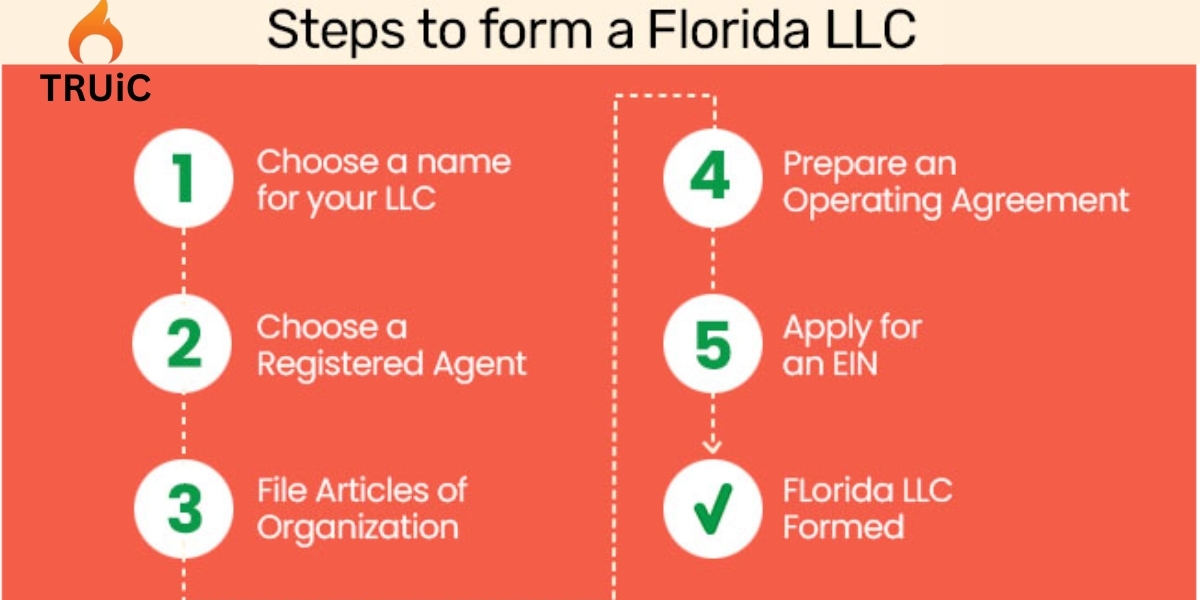

Starting an LLC in Florida is a straightforward process that can be completed in a few easy steps. An LLC offers many benefits, including liability protection for owners and flexible management structures. If you're considering starting an LLC (Limited Liability Company) in Florida, TRUiC can guide you through the process. Here are the steps you need to follow:

1. Choose a Name for Your LLC: The first step in starting an LLC in Florida is choosing a name for your business. The name you choose must be unique and not already in use by another business in Florida. You can check the availability of your chosen name on the Florida Division of Corporations website.

2. File Articles of Organization: To officially form your LLC, you need to file Articles of Organization with the Florida Division of Corporations. You can do this online or by mail. The Articles of Organization form requires you to provide basic information about your LLC, such as its name, address, and the names and addresses of its members.

3. Designate a Registered Agent: A registered agent is a person or company responsible for receiving legal documents on behalf of your LLC. In Florida, your LLC must have a registered agent with a physical address in the state. This can be you, another member of your LLC, or a registered agent service.

4. Create an Operating Agreement: While not required by law, it's a good idea to create an operating agreement for your LLC. This document outlines the ownership and management structure of your LLC, as well as the rights and responsibilities of its members.

5. Obtain an EIN: An EIN (Employer Identification Number) is a federal tax identification number used to identify your LLC for tax purposes. You can obtain an EIN from the IRS for free.

6. File Annual Reports: In Florida, LLCs are required to file an annual report with the Division of Corporations. The annual report includes information about your LLC, such as its name, address, and registered agent.

7. Comply with Other Tax and Regulatory Requirements: Depending on the nature of your business, you may need to obtain other licenses or permits to operate legally in Florida. You should also familiarize yourself with Florida's tax requirements for LLCs.

Starting an LLC in Florida is a relatively simple process that can be completed in a few easy steps. By following these steps with the assistance of TRUiC, you can protect your personal assets, enjoy tax benefits, and establish a solid foundation for your business in Florida.