Banking as a Service Market Scope and Overview

The Banking as a Service Market continues to captivate industry stakeholders with its ever-evolving dynamics, presenting a tapestry of opportunities and challenges for businesses worldwide. Today, we are thrilled to announce the release of a groundbreaking research report that offers unparalleled insights into the intricacies of the Banking as a Service Market. With a focus on market segmentation, competitive landscape, regional outlook, and strategic objectives, this report promises to be a cornerstone resource for industry professionals seeking to navigate the complexities of the Banking as a Service Market effectively.

In an era defined by rapid technological advancements, changing consumer preferences, and global interconnectedness, the Banking as a Service Market emerges as a focal point of innovation and disruption. As businesses strive to stay ahead of the curve and seize emerging opportunities, understanding the nuances of the Banking as a Service Market becomes imperative. This research report aims to provide a comprehensive analysis that equips stakeholders with actionable insights and strategic recommendations to thrive in the dynamic landscape of the Banking as a Service Market.

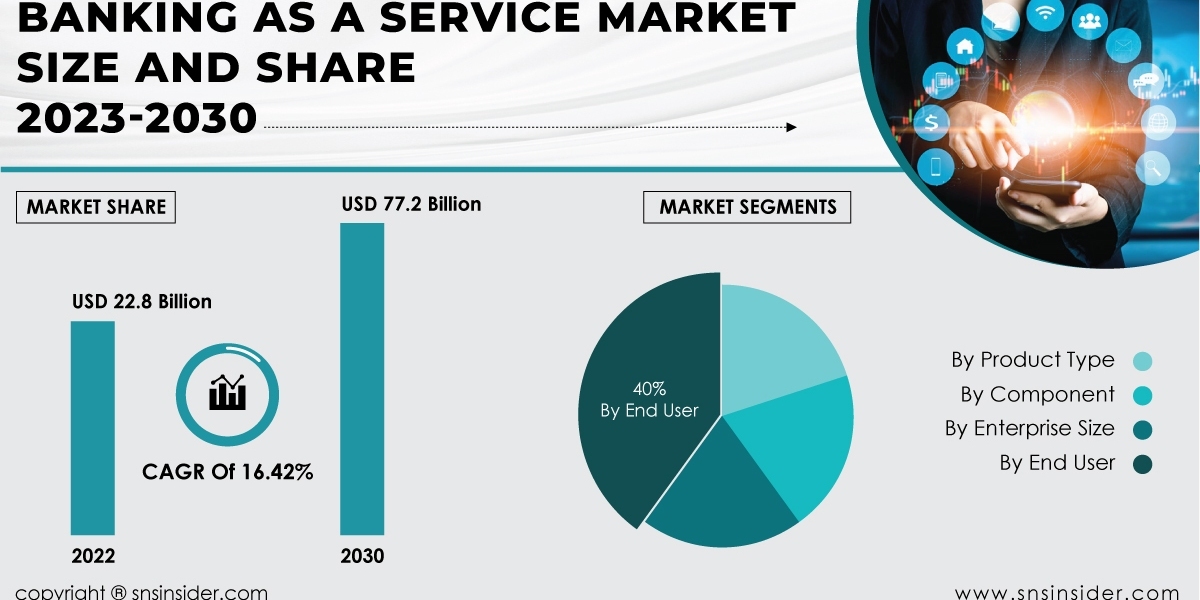

“According to SNS Insider, the Banking as a Service Market size was estimated at USD 22.8 Bn in 2022, and is expected to reach USD 77.2 Bn by 2030, with a growing healthy CAGR of 16.42% over the forecast period 2023-2030.”

Get a Sample Report of Banking as a Service Market @ https://www.snsinsider.com/sample-request/3302

Key Players:

- Green Dot Bank

- Solarisbank AG

- PayPal Holdings

- Fidor Solutions AG

- Moven Enterprise

- The Currency Cloud Ltd

- Treezor

- Match Move Pay Pte Ltd

- Block

- Bnkbl Ltd

- Others

Market Segmentation

The Banking as a Service Market encompasses a diverse array of products, services, and solutions tailored to meet the needs of various consumer segments. Market players operate within distinct niches, each characterized by its unique set of demands and challenges. Understanding market segmentation is essential for businesses to identify target audiences, tailor their offerings, and allocate resources effectively to drive growth and profitability.

Market Segmentation and Sub-Segmentation Included Are:

By Product Type

- API

- Cloud-based BaaS

By Component

- Platform

- Services

By Enterprise Size

- Large

- SME

By End-User

- Banks

- FinTech Corporation

- NBFC

- Others

Competitive Landscape

In the fiercely competitive arena of the Banking as a Service Market, industry players vie for market share and differentiation. Established players leverage their expertise, resources, and brand reputation to maintain a competitive edge. However, disruptive newcomers and innovative startups continually challenge the status quo, introducing novel technologies and business models that reshape industry norms. A thorough analysis of the competitive landscape is critical for businesses to identify strengths, weaknesses, opportunities, and threats, enabling them to devise effective strategies to stay ahead of the competition.

Regional Outlook

Regional factors play a significant role in shaping the trajectory of the Banking as a Service Market, with nuances in regulatory frameworks, consumer preferences, and economic conditions influencing market dynamics. From developed economies to emerging markets, each region presents unique opportunities and challenges for businesses. Understanding regional trends and forecasts is essential for businesses to tailor their strategies and capitalize on growth opportunities in specific markets.

Key Objectives of the Research Report

- Provide a comprehensive analysis of market segmentation, including key consumer segments, market size, and growth prospects.

- Conduct an in-depth examination of the competitive landscape, identifying key players, their market share, and strategies for success.

- Analyze regional trends and forecasts, highlighting opportunities and challenges across different geographic markets.

- Offer strategic recommendations and actionable insights to help businesses capitalize on emerging trends, mitigate risks, and drive sustainable growth in the Banking as a Service Market.

Conclusion

As the Banking as a Service Market continues to evolve and redefine industry norms, staying abreast of market trends and dynamics is essential for businesses seeking to thrive in this dynamic landscape. This research report offers a comprehensive analysis of market segmentation, competitive landscape, regional outlook, and strategic objectives, providing stakeholders with invaluable insights and actionable recommendations to navigate the complexities of the Banking as a Service Market successfully. With a deep understanding of market dynamics and strategic foresight, businesses can seize opportunities, mitigate risks, and drive sustainable growth in the ever-changing landscape of the Banking as a Service Market.

Table of Contents- Major Key Points

- Introduction

- Research Methodology

- Market Dynamics

- Impact Analysis

- COVID-19 Impact Analysis

- Impact of Ukraine- Russia war

- Impact of Ongoing Recession on Major Economies

- Value Chain Analysis

- Porter’s 5 Forces Model

- PEST Analysis

- Banking As a Service Market Segmentation, by Product Type

- Banking As a Service Market Segmentation, by Component

- Banking As a Service Market Segmentation, by Enterprise Size

- Banking As a Service Market Segmentation, by End-User

- Regional Analysis

- Company Profile

- Competitive Landscape

- USE Cases and Best Practices

- Conclusion

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Website: https://www.snsinsider.com/

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports