The automotive sector in the India has been growing swiftly since the past few years, attributed to the string economic growth and rapidly increasing disposable income of people. The lifestyle of people in the country has improved considerably, and owing a private vehicle has become a status symbol. This is why an increased number of people are now investing in automobiles. In addition to this, due to various government policies, the prices of electric vehicles have lowered considerably, thereby allowing a larger number of people to afford these vehicles.

It is not unusual then that the country has an abundance of recyclable and salvageable materials. The recycling and salvaging industry in India is still in a nascent stage, which is offering a number of opportunities to the companies operating in the Indian end-of-life vehicle (ELV) and dismantling market. In 2018, about 6.8 million vehicles in India reached their end-of-life. While the industry in India is at an initial stage currently, it is expected to witness considerable growth in the years to come. ELVs are dismantled into numerous different parts, and each individual part has a different market.

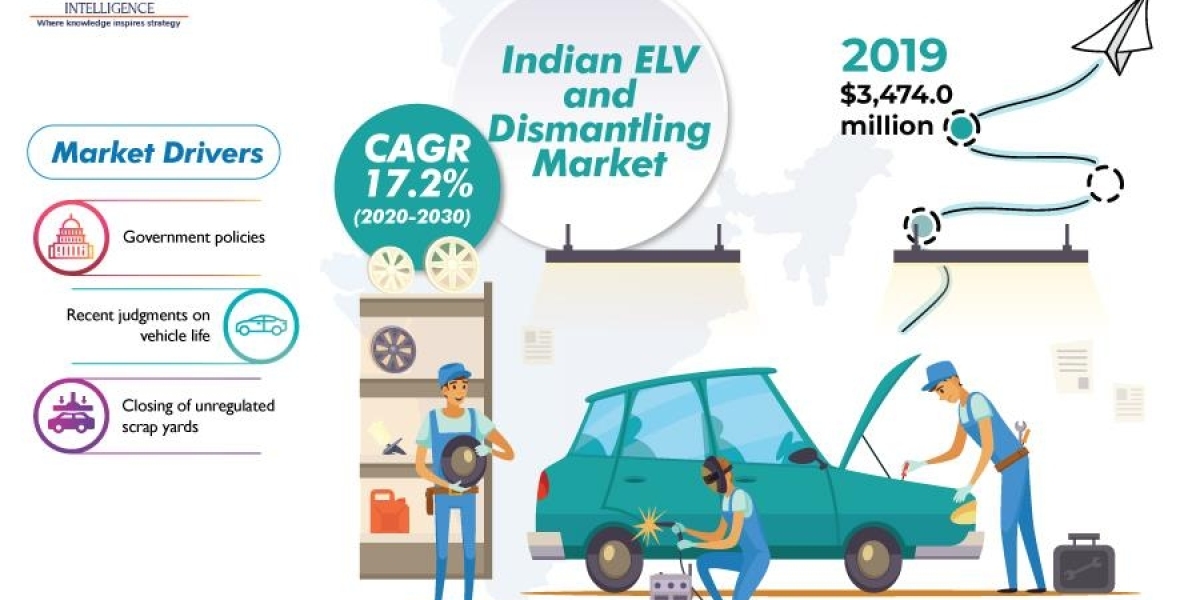

Government policies in the country are among the major factors that are resulting in the growth of the market. A number of state governments, along with the Ministry of Road Transport and Highways, Ministry of Steel, and Ministry of Heavy Industries & Public Enterprise, have led to the initiation of policy formulating process regarding setting up of scrap yards, so that transition from traditional to eco-friendly variants can be made. In addition to this, government bodies are staying committed to good manufacturing policies by encouraging and pushing adoption of environment-friendly and state-of-the-art technologies.

Owing to all these factors, the Indian ELV and dismantling market generated a revenue of $3,474.0 million in 2019 and is predicted to progress at a 17.2% CAGR during the forecast period (2020–2030).

When fuel is taken into consideration, the market is divided into diesel and petrol, between which, the diesel division is predicted to hold the major share of the market during the forecast period. This can be because several commercial vehicles, including heavy-duty variants, and passenger vehicles in the country run on diesel. On the basis of components, the market is categorized into glass, ferrous metal, battery, textile, tire, electrical and electronic equipment, non-ferrous metal, and plastic.

Among these, the ferrous category held the largest share of the Indian ELV and dismantling market in 2019, as per report by P&S Intelligence. This is due to the fact that 70% of an automobile is made up of steel and iron. Furthermore, metallic components are easy to separate from vehicles. Other than this, the electronic and electrical equipment category is predicted to grow at the fastest pace during the forecast period, which is owing to the surging integration of autonomous features in vehicles.