Owning a home is a significant milestone for many, but the journey to homeownership involves navigating through the complexities of mortgages. One powerful tool that can aid in this process is the Mortgage Calculator.

Mortgage Calculator

It's an online tool that helps you estimate your monthly mortgage payments based on various factors such as loan amount, interest rate, and loan term. This tool empowers potential homebuyers to make informed decisions about their financial commitments.

The Basics of Mortgages

1. Understanding Mortgage Components

Principal Amount

The principal amount is the initial loan amount borrowed to purchase the home. This forms the basis for your mortgage calculations.

Interest Rate

The interest rate is the cost of borrowing money. It directly influences your monthly payments and the total amount paid over the life of the loan.

Loan Term

The loan term is the duration over which you'll repay the mortgage. Common terms are 15, 20, or 30 years, each affecting the monthly payments differently.

2. The Role of Mortgage Calculators

Navigating Calculators

1. Inputting Information

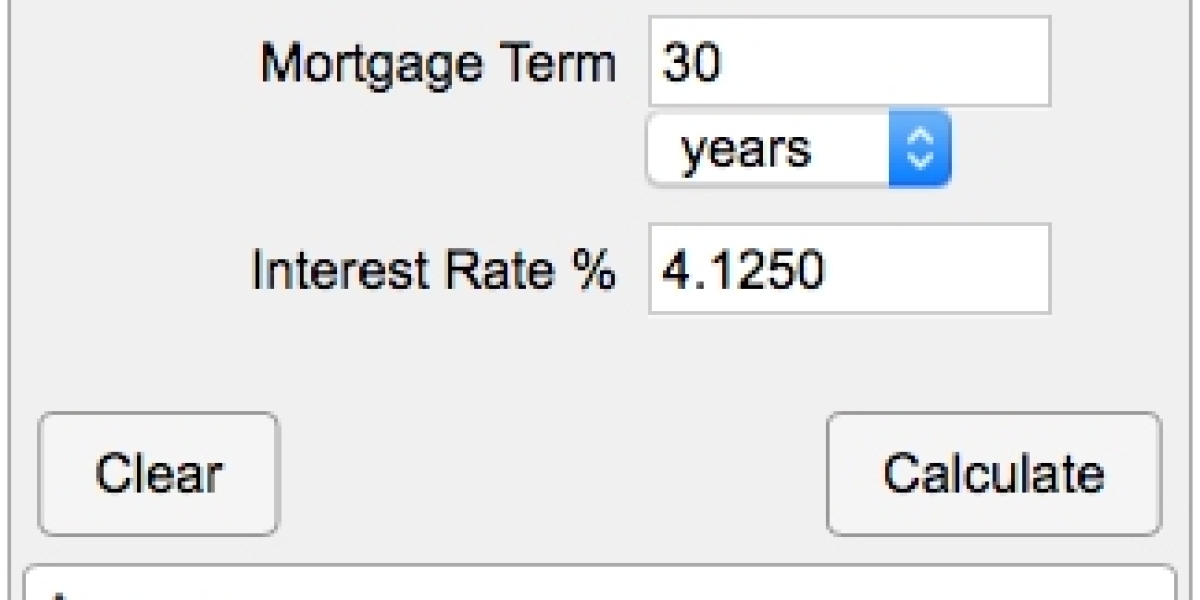

Most prompt users to input the loan amount, interest rate, loan term, and sometimes additional details such as property taxes and homeowners insurance.

2. Monthly Payment Calculation

The calculator then processes this information to provide an estimate of your monthly mortgage payment. This figure is crucial for budgeting and assessing affordability.

3. Exploring Scenarios

One of the key benefits is the ability to explore various scenarios. It can quickly show the financial implications.

1. Financial Planning

It empowers individuals to plan their finances effectively. By knowing potential monthly payments, you can align your budget accordingly.

2. Comparison Shopping

It allows you to compare different scenarios side by side, aiding in the decision-making process.

3. Avoiding Surprises

Hidden costs can be detrimental to your financial stability. It helps you foresee potential expenses, ensuring a transparent view of your homeownership journey.

Integrating Calculators into Your Home Buying Process

1. Early Exploration

Start using in the early stages of your home buying journey. It provides a preliminary understanding of what you can afford and sets realistic expectations.

2. Consultation Tool

They are valuable during consultations with lenders. They help you ask informed questions and understand the lender's calculations.

3. Decision Support

When faced with various mortgage options, a calculator acts as a decision support tool. It allows you to make choices aligned with your financial goals.

Conclusion

In the intricate realm of homeownership, it emerges as a beacon of financial clarity. By understanding the components of mortgages and utilizing these calculators wisely, individuals can embark on their home buying journey with confidence. Unlocking homeownership becomes a navigable path, allowing you to make decisions that resonate with your financial well-being. As you embark on this exciting journey, remember that knowledge is your greatest ally, and a mortgage calculator is a powerful tool in your arsenal.