The die bonder equipment market is estimated to be worth US$ 4,415.3 million in 2023 and is set to surpass US$ 6,726.7 million by 2033. The adoption of die bonder equipment is likely to rise at a CAGR of 4.3% from 2023 to 2033.

Several drivers propel the die bonder equipment industry. The burgeoning demand for advanced semiconductor devices like microchips and sensors fuels the need for high-precision die bonding solutions. As consumer electronics, automotive technologies, and IoT devices evolve, die bonder equipment manufacturers witness a surge in orders for their cutting-edge machinery.

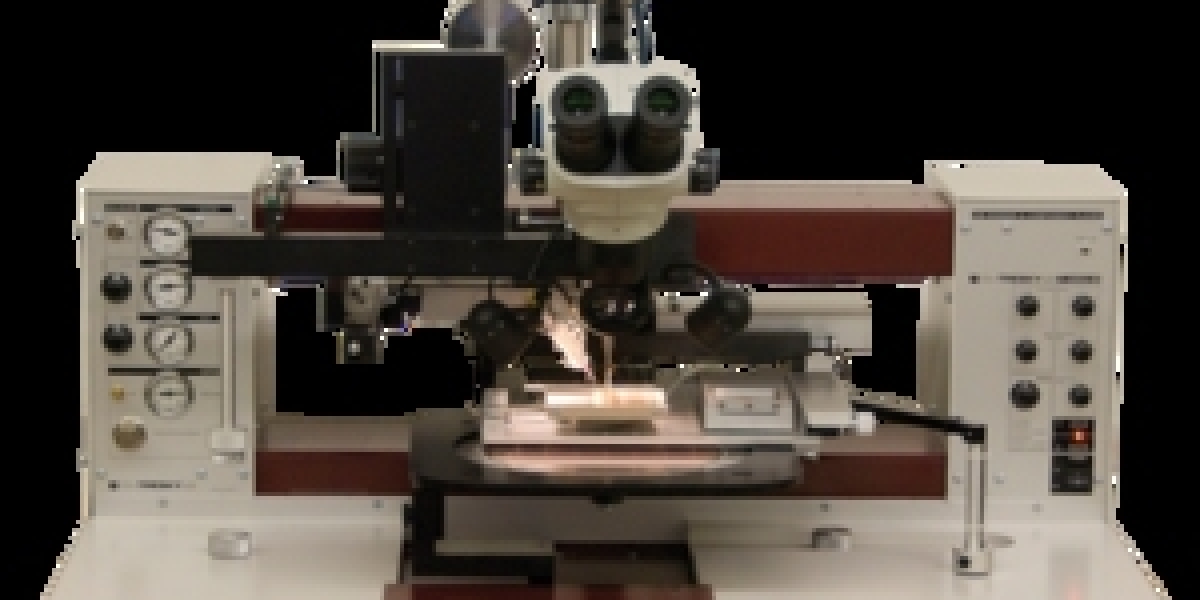

The trend of miniaturization and enhanced functionality in electronic components drives innovation in the die bonder sector. Manufacturers are under pressure to develop equipment that can handle smaller and more intricate die sizes, making die bonding a critical step in semiconductor manufacturing.

The rise of 5G technology and the increasing adoption of electric vehicles contribute significantly to the industry's growth. The demand for faster, more efficient die bonding processes to accommodate these technologies underscores the importance of die bonder equipment.

Accelerate Growth: Assess Market Potential with Our Comprehensive Market Overview - Request Our Sample Now:

https://www.futuremarketinsights.com/reports/sample/rep-gb-8458

Despite its growth prospects, the die bonder equipment industry faces several restraints. The high initial capital investment required to purchase advanced die bonder machinery can deter smaller manufacturers from entering the market. This cost barrier limits market competition and innovation, making it challenging for new players to establish themselves.

Stringent regulatory requirements impose compliance challenges for die bonder equipment manufacturers, particularly in the electronics and automotive sectors. Ensuring adherence to safety, quality, and environmental standards can be resource-intensive and time-consuming.

The die bonder equipment industry presents several lucrative opportunities. Materials, processes, and energy efficiency innovations can contribute to more sustainable semiconductor manufacturing, meeting the growing demand for green technologies.

Another significant trend is the adoption of Industry 4.0 principles, leading to smart and interconnected die bonder equipment development. These systems offer real-time monitoring, predictive maintenance, and remote operation capabilities, improving overall operational efficiency.

The industry is witnessing a shift toward hybrid bonding technologies, which enable the bonding of different materials and substrates. This trend aligns with the demand for versatile die bonder equipment accommodating diverse semiconductor applications.

"The rising emphasis on sustainable manufacturing practices and environmentally friendly technologies has opened doors for manufacturers to develop eco-conscious die bonder equipment," says an analyst at FMI.

Key Takeaways from the Die Bonder Equipment Market

· Fully automatic die bonders emerge as the dominating product type, with a 36.7% market share in 2023.

· Integrated Device Manufacturers retain a grip as the top end-user category, holding a significant market share of 67.20% in 2023.

· The United States holds a 2.3% market share in 2023, driven by its rising technology and manufacturing sector.

· Germany holds a 1.7% market share in 2023, leveraging its engineering excellence.

· The United Kingdom commands a 2.0% market share in 2023, fueled by emerging tech markets.

· China secures a substantial 4.9% market share in 2023.

· India accounts for a 5.2% market share in 2023, powered by its electronics manufacturing sector.

· Japan holds a 2.6% market share in 2023, emphasizing precision engineering.

Competition Outlook for the Die Bonder Equipment Market

The competition in the die bonder equipment industry is dynamic and characterized by several key players vying for market share and innovation. Leading companies such as Kulicke & Soffa Industries Inc., Palomar Technologies, Besi, ASM Pacific Technology Ltd., and Shinkawa Electric Co., Ltd. are at the forefront of die bonder equipment manufacturing. These industry giants continually invest in research and development to introduce cutting-edge technologies and equipment, aiming to meet the evolving demands of semiconductor and electronics manufacturers.

In addition to established players, the die bonder equipment sector also witnesses the emergence of innovative startups and smaller companies. These startups often focus on niche markets, offering specialized solutions catering to industry needs. Their agility and capacity to address unique customer requirements contribute to the industry's diversity.

Recent Developments in the Die Bonder Equipment Market

· Besi, a leading supplier of die bonder equipment, has launched its new B100 die bonder. The B100 die bonder is designed to meet the needs of the high-volume semiconductor packaging market.

· ASML, a leading lithography equipment supplier, has launched its new TWINSCAN NXE:5010XT die bonder. The TWINSCAN NXE:5010XT die bonder is designed to bond dies to a wide range of substrates, including substrates with uneven surfaces.

· Hermetic Solutions Group (HSG) acquired DiaCool's intellectual property from RHP Technologies in October 2022.

· Kulicke and Soffa obtained significant customer orders for its thermo-compression solution in October 2022. They successfully supplied its first Fluxless Thermo-Compression Bonder (TCB) to a significant client, maintaining its position in advanced LED Assembly.

Key Segments Profiled in the Die Bonder Equipment Industry Survey

By Product Type:

· Manual

· Semi-Automatic

· Fully Automatic

By Attachment Method:

· Epoxy

· Eutectic

· Soft Solder

· Flip Chip

By End User:

· Integrated Device Manufacturers (DMs)

· Outsourced Semiconductor Assembly and Test (OSAT)

By Region:

· North America

· Latin America

· Europe Die

· Asia Pacific

Middle East & Africa