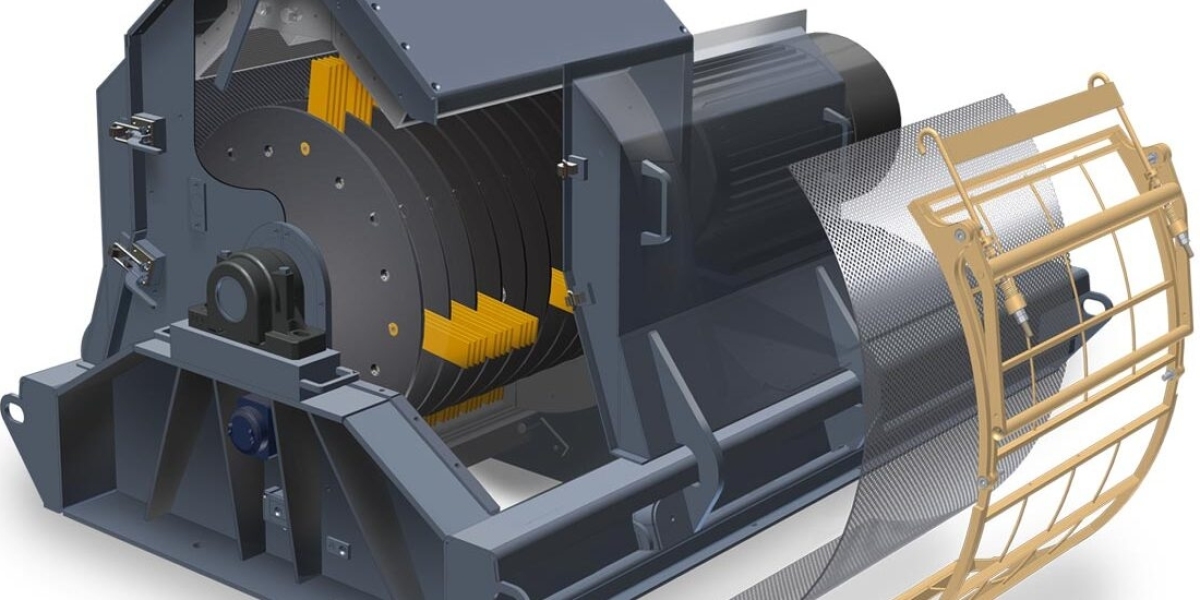

The Hammer Mill Market is currently experiencing robust growth, driven by its extensive applications across diverse sectors, including agriculture, mining, pharmaceuticals, and food processing. This versatile machinery plays a pivotal role in the size reduction of various materials, encompassing grains, minerals, and biomass, thereby rendering it indispensable in modern industrial processes. Within the agricultural sector, hammer mills are instrumental in efficiently crushing grains to produce animal feed.

According to Future Market Insights (FMI), the global hammer mill market is poised to reach a projected size of US$ 3,389.5 million in 2023. Over the ensuing decade, from 2023 to 2033, the global sales of hammer mills are anticipated to exhibit a notable compound annual growth rate (CAGR) of 5.3%. By the year 2033, it is projected that the total market value will reach an impressive US$ 5,677.3 million.

The burgeoning demand for processed food products and the rapid expansion of critical end-use sectors, notably agriculture and food & beverages, are pivotal factors propelling the global market's growth trajectory.

Hammer mills find indispensable utility in various sectors, contributing to the reduction in the size of materials such as grains, minerals, biomass, and more. They are particularly sought after in the agricultural, mining, pharmaceutical, and food processing industries, where their versatile capabilities are highly valued.

Gain a Competitive Edge: Get a Comprehensive Market Overview and Stay Ahead of the Curve - Download Our Sample Now@

https://www.futuremarketinsights.com/reports/sample/rep-gb-8860

Hammer mills represent versatile equipment capable of effectively handling a wide array of materials and tasks. Their applications encompass crushing, pulverizing, and grinding a diverse range of substances, spanning from grains and minerals to biomass and beyond.

Available in various sizes, hammer mills find utility in numerous industries, contributing significantly to the enhancement of production efficiency by achieving uniform material size reduction.

The burgeoning agriculture and food & beverage sectors are experiencing a notable surge in the adoption of hammer mills, thereby propelling the global market forward. This trend is driven by the increasing demand for processed foods, a consequence of population expansion and economic growth.

To meet this escalating demand, hammer mill manufacturers are strategically investing in the development of efficient and scalable production facilities. These investments encompass optimizing production processes, ensuring stringent quality control measures, and augmenting production capacity to meet the diverse requirements of customers.

In addition to domestic markets, prominent companies are actively exploring opportunities for market expansion in high-potential regions such as India and Japan. They are further demonstrating their commitment to sustainability by introducing innovative, energy-efficient solutions and fostering partnerships with reputable distributors.

Key Takeaways of Global Hammer Mill Market Study

· The global hammer mill industry is projected to exceed a valuation of US$ 5,677.3 million by 2033.

· By mill type, lump breaker segment is expected to hold a market share of around 5% in 2023.

· Based on application, coarse milling segment is likely to dominate the global market with a share of around 64% during the assessment period.

· Tier-1 Players account for around 25% to 30% of the overall market.

· Europe currently holds around 37% share of the global hammer mill industry.

· East Asia holds about 4% share of the global market.

· Hammer mill demand in the United States market is projected to rise at a steady pace through 2033.

“Growing popularity of solar-based hammer mills that harness the power of solar energy is expected to revolutionize the global hammer mill industry during the projection period. These mills offer a game-changing solution for processing grains, maize, rice, and other crops into essential commodities like flour and animal feed. Not only do they provide a sustainable alternative to diesel-powered mills, which rely on costly fuel imports and contribute to environmental pollution, but they also pave the way for affordable and accessible entrepreneurship in rural communities.” says a lead Future Market Analyst.

Who is Winning?

Hosokawa Micron Powder System, Andritz, Buhler Group, Schenck Process Holding Ltd GmbH, Hosokawa Micron Corp, L.B. Bohle Maschinen & Verfahren GmbH, and others are few of the leading hammer mill manufacturers profiled in the report.

These key companies are focusing on introducing cost-effective and automated solutions to meet changing end user requirements. They are also utilizing strategies such as agreements, partnerships, mergers, acquisitions, and collaborations to strengthen their market presence. For instance,

· In November 2022, Buhler launched a new hammer mill series with improved features that offer significant energy savings and flexibility while maintaining product quality & safety standard.

Find More Valuable Insights

The research report analyzes the market demand trends of the global hammer mill market. The market estimation and growth projection are based on factors like end-use industries development, COVID-19 crisis impact, replacement ratio, and rate of Urbanization.

As per Future Market Insights’ (FMI) research scope, the hammer mill market has been studied and segmented on the basis of mill type, capacity, application, end use, & Region. The report provides qualitative and quantitative information on various players in this market. This report also tracks the supply and demand sides of the market.

Global Hammer Mill Market by Category

By Mill Type:

· Full Circle Screen

· Gravity Discharge

· Horizontal In-Feed

· Lump Breaker

· Pneumatic Discharge

By Capacity:

· Upto 1 Ton/hr.

· 1–3 Ton/hr.

· 3–6 Ton/hr

· 6-10 Ton/hr

· 10–50 Units/hr.

· 50–150 Units/hr.

· 150–300 Units/hr.

· Above 300 Units/hr.

By Application:

· Fine Milling

· Ultra Fine Milling

· Coarse Milling

By End Use:

· Agriculture

· Food & Beverages

· Metals & Mining

· Energy and Power

· Scrap Recycling

· Chemicals

· Pharmaceuticals

By Country:

· Canada

· Brazil

· Mexico

· Rest of Latin America

· Germany

· Italy

· France

· United Kingdom

· Spain

· BENELUX

· Russia

· Rest of Europe

· China

· Japan

· South Korea

· India

· ASEAN

· Australia and New Zealand

· Rest of South Asia & Pacific

· GCC Countries

· Türkiye

· Northern Africa

· South Africa Rest of Middle East and Africa

![Erectax Testosterone Booster [Aktualisiert 2024] & Bestellung zum Verkaufspreis](https://f002.backblazeb2.com/file/yoosocial/upload/photos/2024/09/sLAg5nzSw9PHw6Lmab74_28_8b132ee2bfd8e02c864b0fbb837a4a34_image.jpg)