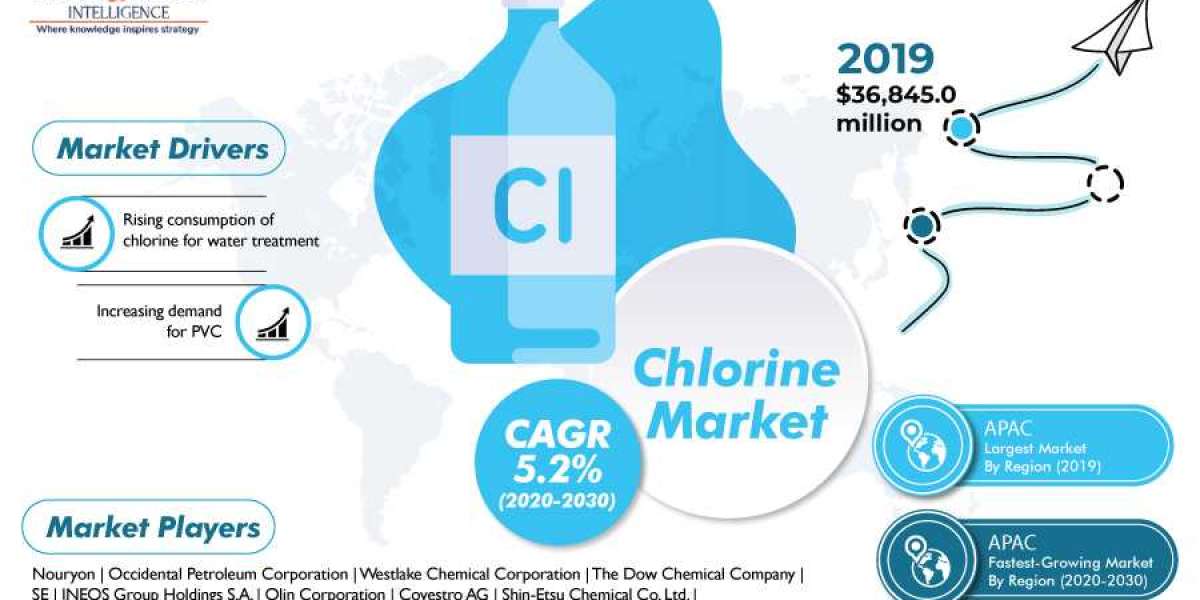

Growth drivers like soaring demand for polyvinyl chloride (PVC) and increasing consumption of chlorine for water treatment applications will escalate the chlorine market at a CAGR of 5.2% during 2020–2030. The market stood at $36,845.0 million in 2019 and it is projected to reach $63,121.6 million by 2030. Moreover, the adoption of this compound for treating water used for irrigation purposes and swimming pools, is increasing. Additionally, governments across the world are taking initiatives to regulate the supply of safe, treated, and clean water, thereby, facilitating the market growth.

The widescale applications of PVC in siding and piping in the building and construction sector, windshield system components in the automotive industry, and non-breakable containers in the medical industry will fuel the chlorine market in the foreseeable years. Increasing utilization of PVC in several end-use industries can be owed to the various advantageous features of PVC such as high melt viscosity and improved thermal stability. The production of PVC requires high volume of chlorine during the chlorination process, which, in turn, drives the demand for the compound.

The application type segment of the market is categorized into ethylene dichloride (EDC)/PVC, solvents, inorganic chemicals, chloromethanes, and isocyanates oxygenates. Among these, the EDC/PVC category dominated the market in 2019 and it is expected to continue its dominance throughout the forecast period. This is ascribed to the widescale application of chlorine in the chlorination process for the production of EDC/PVC. With the amplifying demand for EDC/PVC in end-use sectors like building and construction, electrical and electronics, and automotive, the demand for this chemical will rise in the coming years.

Thus, the widening application base of chlorine have encouraged key players of the chlorine market, such as Olin Corporation, Ercros SA, INEOS Group Holdings S.A., Occidental Petroleum Corporation, The Dow Chemical Company, Westlake Chemical Corporation, and Covestro AG, to expand their production capacities and geographical presence. For instance, Ercros SA announced its expansion plan in October 2019. The company completed the third expansion of the Vila-seca I factory, which produces chlorine and caustic soda, by starting a new electrolyzer that expands the plant’s capacity by an additional 26,000 tons per year.

Geographically, Asia-Pacific generated the highest revenue in the chlorine market in 2019, and it is expected to maintain its dominance in the forecast period as well. This can be ascribed to the high-volume consumption of chlorine in emerging economies of India, Thailand, and China for the production of EDC/PVC. These products are mostly used in the electrical and electronics, automobile, and building and construction sectors. Moreover, the amplifying usage of the compound in water treatment plants and pharmaceutical industry will give an impetus to the regional market growth.

Furthermore, the APAC chlorine market is also expected to witness the fastest growth during the forecast period. This can be primarily attributed to the surging awareness about water-borne diseases caused due to contaminated water and the understanding of detrimental effects caused by consuming it. Water treatment plants are using large quantities of chlorine to reduce the occurrence of water-borne diseases like meningitis, trachoma, and diarrhea. Moreover, the increasing application of the compound in the paper industry, owing to its lignin removing property, will boost the market growth in the foreseeable future.

Thus, the rising awareness regarding water-borne diseases and the increasing usage of PVC in several end-use industries will fuel the demand for chlorine in the future.