The global solar tracker market was valued at approximately USD 4.41 billion in 2022 and is projected to experience significant growth, with a compound annual growth rate (CAGR) of 26.2% from 2023 to 2030. This growth is largely driven by rising concerns about energy conservation and the ongoing transition from non-renewable to renewable energy sources, which is expected to greatly increase the demand for solar energy and consequently, for solar trackers over the forecast period.

Solar trackers utilize a variety of electrical components, including actuators, motors, and sensors, to adjust the positioning of solar cells. This adjustment allows solar panels to concentrate sunlight more effectively, thereby maximizing energy capture. The solar radiation collected by these systems is converted into electricity, which is utilized across various end-user segments. The increasing acceptance of solar power as a practical source for commercial energy generation is gaining momentum, driven by the declining costs of solar photovoltaic (PV) panels. This trend is expected to further enhance the growth of the solar tracker market.

Gather more insights about the market drivers, restrains and growth of the Solar Tracker Market

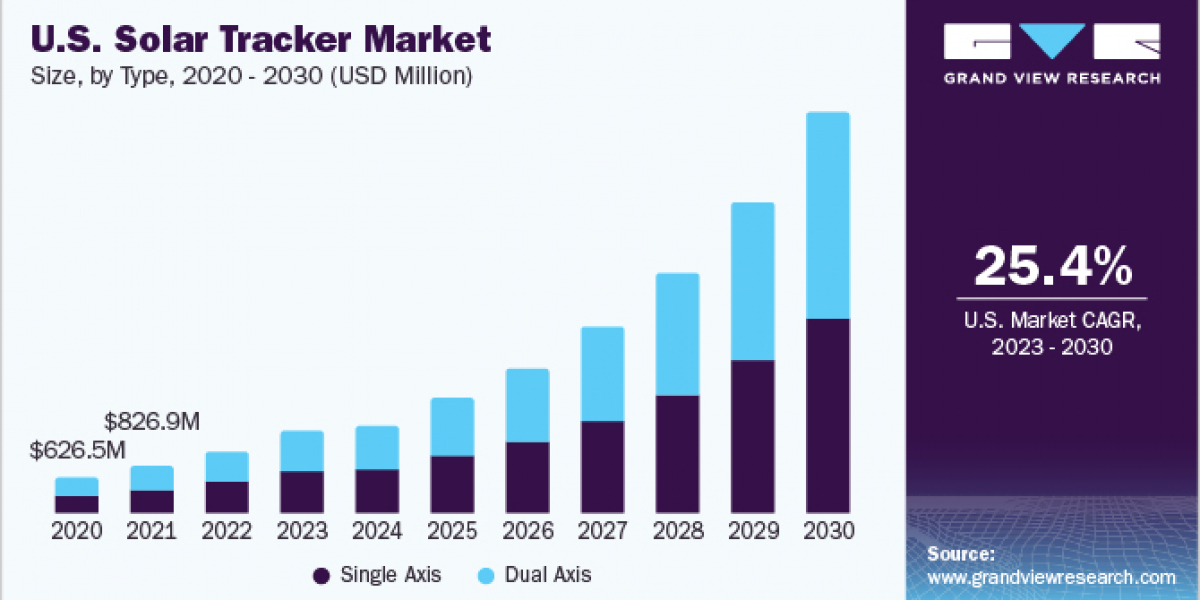

In the United States, solar PV technology has rapidly emerged as one of the fastest-growing renewable energy sources in recent years. The government’s increased focus on renewable energy initiatives has spurred the development of PV cells, positioning them as a sustainable and reliable option for energy generation. Additionally, the expansion of capacity in the U.S. has led to a decrease in the levelized cost of electricity (LCOE), making solar PV increasingly competitive with traditional energy sources. Supportive policies from the U.S. government have played a crucial role in promoting the widespread adoption of solar energy.

Moreover, technological advancements aimed at developing innovative tracking systems by companies such as NEXTracker, Array Technologies, AllEarth Renewables, and Solaria are anticipated to drive market growth throughout the forecast period. The solar tracker market is marked by intense price competition, necessitating that manufacturers maintain operational efficiency and strategic acumen to thrive in this dynamic environment.

Technology Segmentation Insights

In 2022, photovoltaic (PV) technology emerged as the largest segment within the market, accounting for a substantial revenue share of approximately 91.52%. The compatibility of PV cells with standard photovoltaic module technologies is a key factor contributing to the dominance of this segment. Additionally, the rising electricity costs driven by supply-demand imbalances are expected to further increase the use of solar PV in both utility and non-utility applications.

The implementation of solar trackers on PV modules generally requires fewer design regulations compared to mirrors, lenses, and Fresnel collectors used in concentrated solar power (CSP) and concentrated photovoltaic (CPV) technology trackers. These advantages are likely to boost the adoption of solar trackers in PV technology throughout the forecast period. CPV is an emerging technology in the solar sector, known for producing low-cost solar power due to lower manufacturing expenses and reduced raw material requirements. This technology employs optics such as lenses to concentrate a significant amount of sunlight onto a small surface area of PV materials to generate electricity.

Concentrated Solar Power (CSP) systems harness the sun’s energy potential and have the capacity to provide reliable renewable energy to consumers worldwide, even during periods without direct sunlight. Recently, CSP has been increasingly competing with the more affordable PV solar power and the rapidly growing CPV technology.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.