Research Antibodies Market Size & Trends

The global research antibodies market size was valued at USD 1.59 billion in 2023 and is expected to grow at compound annual growth rate (CAGR) of 4.76% from 2024 to 2030. B cells are responsible for producing antibodies, which are essential components of the human immune system. These molecules are ideal probes for studying cells since they can attach themselves to particular molecules and can be employed to separate or identify important chemicals found in cells. These attributes of antibodies are anticipated to drive their adoption in various research applications in the near future. The outbreak of COVID-19 has created lucrative opportunities in the research antibodies market. Several leading pharmaceutical companies are investing heavily in R&D to create brand-new vaccinations, treatments, and testing tools for this pandemic.

The need for research antibodies has greatly increased as a result of theseintense R&D operations for the development of novel vaccination and therapy techniques. Additionally, a number of public and commercial entities are making significant efforts to fund the development of COVID-19 vaccines and therapeutics. For instance, in April 2020, Emergent BioSolutions, a biopharmaceutical company, received USD 14.5 million from the federal government to work on an antibody therapy study for COVID-19.

Gather more insights about the market drivers, restrains and growth of the Global Research Antibodies Market

Product Insights

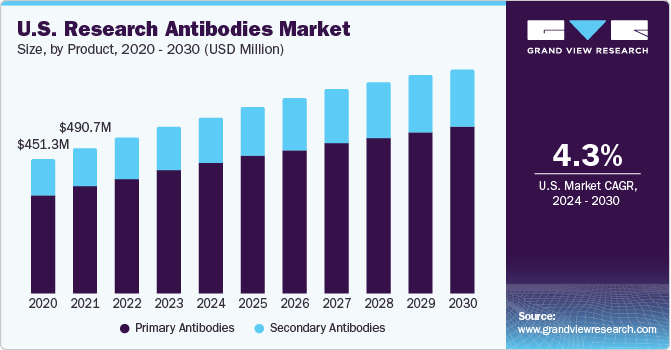

The primary antibodies segment captured the highest revenue share of 74.46% in 2023, and is also projected to grow at the fastest rate throughout the forecast period. This can be attributed to increasing availability of primary antibodies using rabbit, mouse, goat, and other species as host, and the wide range of utility offered by such antibodies for applications in the R&D space. Also, owing to the usage of primary antibodies for frequently performed laboratory procedures, such as staining and imaging, the segment is predicted to grow at an exponential rate.

Type Insights

Monoclonal antibodies segment accounted for the dominant share of the market in 2023, due to a sharp increase in the number of cancer research projects that demand high specificity antibodies. As monoclonal antibodies can efficiently adhere to or block antigens on cancer cells, these are employed in the identification and development of new medicines for various cancer types. This factor is expected to expand the growth prospects for the segment in the near future.

Technology Insights

Western blotting segment accounted for the largest market share in 2023, due to the widespread availability and adoption of the technique. In addition, due to the increased accuracy that the western blotting technique offers, it is typically chosen over alternative technologies for applications involving the detection of important protein entities. These attributes are expected to positively affect the segment growth.

Source Insights

The rabbit source segment held the largest market share in 2023. Rabbits are extensively used for antibody production, owing to several advantages such as higher affinity antibodies provided by rabbits as compared to those obtained from other animal hosts. Furthermore, higher specificity provided by these antibodies makes them ideal for detection of small molecules, hormones, toxins and other biologically important substances.

Application Insights

Oncology segment accounted for the largest market share in 2023, owing to rise in prevalence of cancer in key geographies. According to the American Cancer Society, in 2021, over 1.9 million new cancer cases were estimated to be recorded in the U.S. Additionally, over 608,570 cancer deaths were also recorded in the same year in the U.S. As a result, more research antibodies will likely be used for designing and evaluation of new diagnostic and therapeutic approaches for mitigation of cancer.

End-use Insights

The academic & research institutions segment captured the highest revenue share in 2023 and is projected to grow at the fastest growth rate throughout the forecast period. This can be attributed to the increase in scientific initiatives by such centers for development of novel therapies and tests for chronic diseases.

Regional Insights

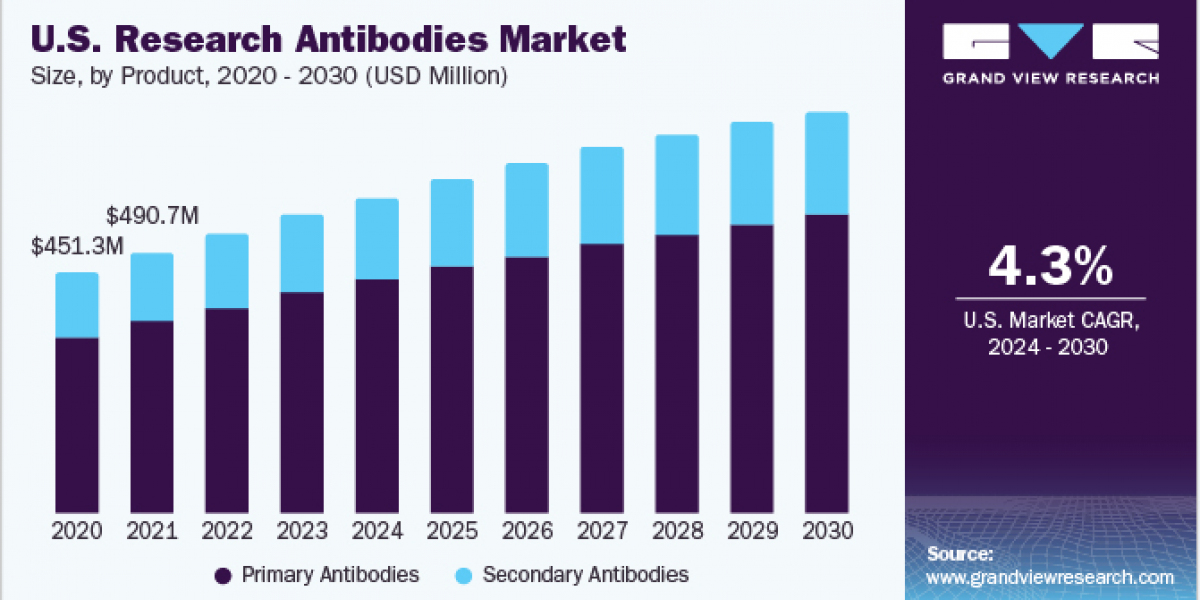

North America dominated the market in 2023 by capturing the largest revenue share of 39.15%. Growing emphasis on biomedical, stem cells, as well as cancer research, is a major contributor to its large market share. Presence of key players such as Thermo Fisher Scientific, Inc. and PerkinElmer, Inc. among others and increasing number of biotechnology & biopharmaceutical firms in the region that focus on life sciences innovation are expected to drive the market growth.

Browse through Grand View Research's Biotechnology Industry Research Reports.

- Downstream Processing Market Size, Share & Trends Analysis Report By Product (Chromatography Systems, Filters), By Technique (Purification, Formulation), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Cell Culture Media Market Size, Share & Trends Analysis Report By Product (Serum-free Media, Stem Cell Culture Media), By Type (Liquid Media, Semi-solid And Solid Media), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

Key Companies & Market Share Insights

Key players in this market are undertaking various strategic initiatives such as mergers, acquisitions, and collaborations to strengthen their market position and enhance their offerings across various geographical region. Strategic activities related to new product launch are also prominent in this market.

Key Research Antibodies Companies:

- Abcam Plc.

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Cell Signalling Technology, Inc.

- Santa Cruz Biotechnology Inc.

- PerkinElmer, Inc.

- Becton, Dickinson and Company

- Bio-Techne Corporation

- Proteintech Group, Inc.

- Jackson ImmunoResearch Inc.

Research Antibodies Market Segmentation

Grand View Research has segmented the global research antibodies market on the basis of product, type, technology, source, application, end-use, and region:

Research Antibodies Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Primary Antibodies

- Secondary Antibodies

Research Antibodies Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Monoclonal Antibodies

- Polyclonal Antibodies

Research Antibodies Technology Outlook (Revenue, USD Billion, 2018 - 2030)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

Research Antibodies Source Outlook (Revenue, USD Billion, 2018 - 2030)

- Mouse

- Rabbit

- Goat

- Others

Research Antibodies Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

Research Antibodies End Use Outlook (Revenue, USD Billion, 2018 - 2030)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

Research Antibodies Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- Thailand

- South Korea

- Singapore

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Order a free sample PDF of the Research Antibodies Market Intelligence Study, published by Grand View Research.

Recent Developments

- In July 2023, Bio-Techne Corporation announced the completion of acquisition of Lunaphore. The intent of this business decision was to augment the companies’ spatial biology leadership in the fields of translational and clinical research.

- In June 2023, Cell Signaling Technology (CST) announced its partnership with Lunaphore. This initiative was aimed at enabling the deployment of CST antibodies on the COMET platform by Lunaphore for strengthening fully-automated spatial biology.

- In April 2023, Abcam teamed up with Lunaphore to co-commercialize primary antibodies from Abcam. These antibodies were precisely validated for use on the COMET platform by Lunaphore.

- In February 2023, Cell Signaling Technology entered into a partnership with Bio-Techne. This deal was aimed at the inclusion of Bio-Techne’s Simple Western validation to CST antibodies.

- In March 2022, Sysmex America, Inc., expanded its reagents portfolio for single-color antibodies, cell stains and buffering solutions and introduced several new products in this domain.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database