Cell Culture Media Market Size & Trends

The global cell culture media market size was estimated at USD 4.73 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12.54% from 2024 to 2030. Cell culture media is generally a gel or liquid including compounds required to regulate and support the growth of cells or microorganisms used in the manufacturing of biopharmaceuticals. Culture media is a critical ingredient in biopharmaceutical manufacturing, aiding the growth of cells, and is the fastest-growing segment within this market. This growth is mainly driven by growing demand for biopharmaceuticals, favorable governmental policies, and increasing investment in R&D.

The outbreak of COVID-19 has improved demand for well-established cell-based vaccine production technologies. Moreover, it has given rise to a few scientific innovations, particularly in the production and testing of vaccine technology. For instance, Vero cell line originated from the African green monkey kidney and has been extensively used for viral vaccine manufacturing. It has also been used for the development of various SARS-CoV variants. ProVeroTM1 Serum-free Medium manufactured by Lonza Bioscience is a protein-free medium, of non-animal origin designed to support the growth of Vero cells and MDCK.

Gather more insights about the market drivers, restrains and growth of the Global Cell Culture Media Market

Detailed Segmentation:

Product Insights

Based on product, the serum-free media (SFM) segment held the highest market share of 36.0% in 2023. The use of serum-free media signifies a significant tool, which allows the researchers to perform specific applications or grow a specific cell type without using serum. Advantages of using serum-free media include increased growth and/or productivity, more consistent performance, better control over physiological sensitivity, and diminishing the risk of infection by serum-borne adventitious agents in the culture.

Application Insights

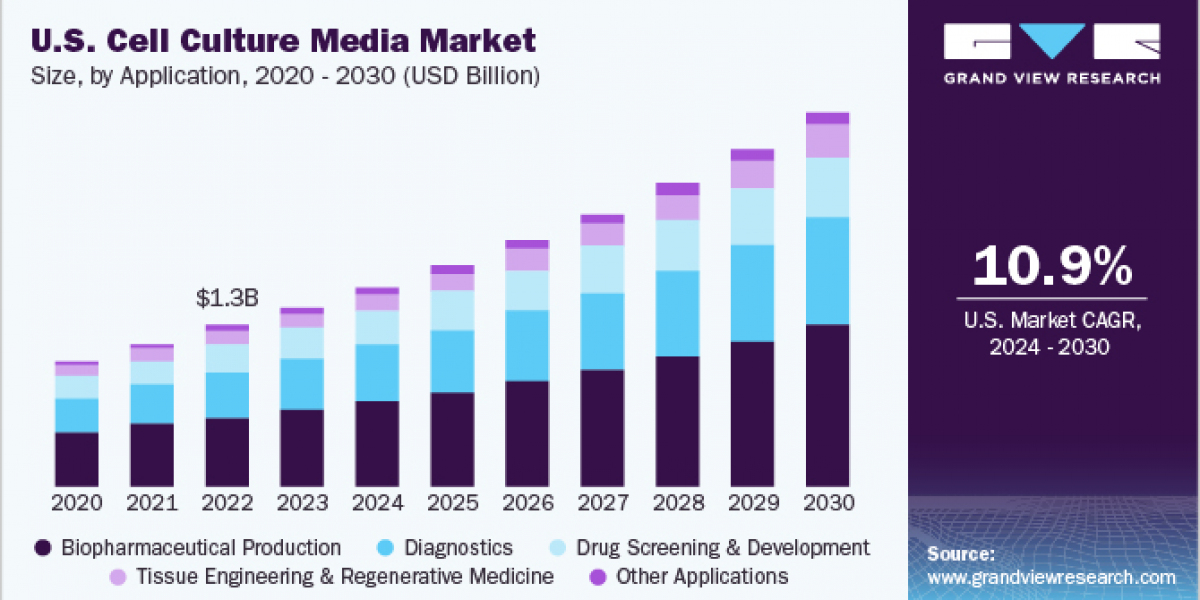

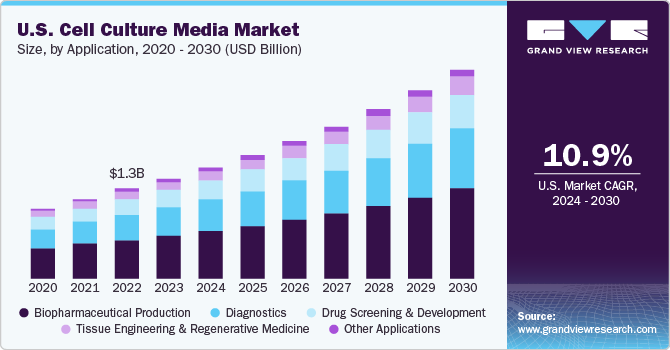

Based on application, the biopharmaceutical production segment dominated the market with a revenue share of 42.71% in 2023. The biopharmaceutical industry’s demand for more reproducible and better-defined media to meet the expanding production levels while reducing the risk of contamination in the downstream processes is significantly increasing the demand for this market.

Type Insights

Based on type, the liquid media segment captured the highest revenue share of 62.9% in 2023. An increasing number of biologics and biosimilars manufacturers, both downstream and upstream, are switching from premixed powders to liquid media owing to factors such as rapid mycobacterial growth and high rate of isolation. Moreover, it eradicates a few process steps, and also reduces the probability of hazardous exposure, and makes manufacturing and development more flexible and simpler than powdered media. In addition, ready-to-use liquid media also eliminates the need for mixing containers, balances, and installation of water for injection (WFI) loop which is needed for mixing powder media.

End-use Insights

The pharmaceutical and biotechnology companies segment captured the highest revenue share of 34.25% in 2023. The expansion of the current manufacturing capacities for biopharmaceuticals drives the demand for cell culture products. For instance, in September 2020, Cytiva announced the expansion of its manufacturing capacity and hiring personnel in significant areas to support the growth of the biotechnology industry. The company has planned investment of around USD 500 million for five years to increase the manufacturing capacity.

Regional Insights

North America dominated the regional market with a revenue share of 37.58% in 2023. This major share can be attributed to the growth in the pharmaceutical and biotechnology industries, mounting approvals for cell culture-based vaccines, and rising incidence of diseases such as cancer coupled with investments and funding in cell-based research.

Key Cell Culture Media Company Insights

Key players in cell culture media market are implementing various strategies including partnership, merger and acquisition, geographical expansion, and strategic collaboration to expand their market presence. In July 2023, Merck KGaA invested USD 24.38 million to boost cell culture media production in the U.S. This development expanded the production capacity of the Lenexa facility to manufacture cell culture media.

In September 2023, Celltrion invested USD 94.5 million to construct a facility with an annual production capacity of 8 million vials in Songdo, Incheon. The new development is expected to increase the bioreactor capacity to 600,000 L and will be operational in 2027. In March 2023, Samsung Biologics announced that it would commence the construction of a fifth plant holding a capacity of 180,000 liters. Post completion, Samsung Biologics will maintain its global biomanufacturing capacity leadership with a total of 784,000 liters.

Browse through Grand View Research's Biotechnology Industry Research Reports.

- Research Antibodies Market Size, Share & Trend Analysis Report By Product (Primary Antibodies), By Type (Monoclonal Antibodies), By Technology, By Source, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Preparative And Process Chromatography Market Size, Share & Trends Analysis Report By Product (Process Chromatography, Preparative Chromatography), By End-use (Food, Nutraceutical), By Type, And Segment Forecasts, 2023 - 2030

Key Cell Culture Media Companies:

The following are the leading companies in the cell culture media market. These companies collectively hold the largest market share and dictate industry trends.

- Sartorius AG

- Danaher

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- FUJIFILM Corporation

- Lonza

- BD

- STEMCELL Technologies

- Cell Biologics, Inc.

- PromoCell GmbH

Cell Culture Media Market Segmentation

Grand View Research has segmented the global cell culture media market on the basis of on product, application, type, end-use, and region:

Cell Culture Media Product Outlook (Revenue, USD Million, 2018 - 2030)

- Serum-free Media

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically Defined Media

- Other Cell Culture Media

Cell Culture Media Application Outlook (Revenue, USD Million, 2018 - 2030)

- Biopharmaceutical Production

- Diagnostics

- Drug Screening And Development

- Tissue Engineering And Regenerative Medicine

- Other Applications

Cell Culture Media Type Outlook (Revenue, USD Million, 2018 - 2030)

- Liquid Media

- Semi-solid And Solid Media

Cell Culture Media End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Pharmaceutical And Biotechnology Companies

- Hospitals And Diagnostic Laboratories

- Research And Academic Institutes

- Other End-users

Cell Culture Media Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Order a free sample PDF of the Cell Culture Media Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database