Liquid Biopsy Market Size & Trends

The global liquid biopsy market size was estimated at USD 10.42 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.60% from 2024 to 2030. The market for liquid biopsy is witnessing growth due to factors such as the growing prevalence of cancer, technological advancements in cancer diagnostics, and rising preference for minimally invasive cancer diagnostics. Moreover, ongoing research for liquid biopsy assays and tests, aided with the rising adoption and development of multi-cancer early detection tests, provides opportunity for growth of overall market.

With the onset of COVID-19 pandemic, cancer diagnoses were delayed due to reduced diagnostic services and screening programs. Cancer patients are facing many challenges amid the pandemic, such as susceptibility to severe infection and interruption of cancer or usual medical care. The negative impact is likely to be stronger in low- and middle-income countries with poor infrastructure, limited resources, scarcity of medical supplies & personal protective equipment, and shortage of healthcare providers & organized care teams, resulting in a lack of ability to provide & deliver critical care.

Gather more insights about the market drivers, restrains and growth of the Global Liquid Biopsy market

Detailed Segmentation:

Technology Insights

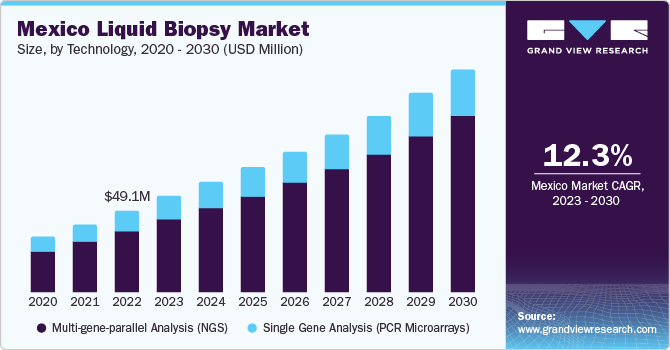

The multi-gene-parallel analysis (NGS) segment held the largest market revenue share of 75.68% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. NGS technology allows detection of various tumor-causing mutations and identification of potential emergence of post-treatment resistance mechanisms from pre-existing clones. Rapid developments in NGS technology have led to significant cost reductions in sequencing with high accuracy. Furthermore, key players operating in the market are developing innovative products to meet growing demand for diagnosis and maintain their position with an expanded product portfolio, thus driving the market growth.

Biomarker Insights

Circulating Nucleic Acids biomarker segment held the largest market share of 35.96% in 2023,attributable to widespread applications associated with ctDNA in liquid biopsy. Translational cancer researchers are identifying ctDNA from tumors using liquid biopsy. The discovery of ctDNA offers new opportunities in future liquid biopsy applications for cancer diagnosis by acting as a possible biomarker. ctDNA has been suggested as an alternative source in cancer patients for molecular profiling of tumor DNA, as opposed to invasive techniques. A new technique for early detection and monitoring of cancer has been made possible by the aberrant ctDNA identification from cancer cells.

Application Insights

Cancer application segment dominated the overall market with a revenue share of 86.26% in 2023, owing to rising adoption of liquid biopsy in detection of cancer aided by the rising prevalence of cancer globally. Liquid biopsy technology is one of the most evolving technologies in diagnostics and has made considerable headway in recent years, showing a significant growth in adoption in clinical applications. This approach is a fast-emerging precision oncology tool that allows for longitudinal monitoring and less invasive molecular diagnostics for therapy purposes. Furthermore, in June 2022, Elypta raised USD 21 million for development of MCED test with LEVANTIS-0087A study in progress for MCED.

End-use Insights

The hospitals and laboratories end-use segment dominated the market in 2023 with a revenue share of 42.33% in 2023. Hospitals are preferred for care due to availability of various services under one roof. The benefit of hospitals conducting cancer diagnosis is that they can offer results for tests even in emergencies. Liquid biopsy is helping doctors by giving them a highly precise cancer diagnosis in a shorter turnaround time, thereby reducing the treatment lag time. Cancer patients in hospitals undergo routine monitoring for analysis of resistance to treatment. Chemotherapy has long been a successful and dependable cancer treatment. Chemotherapy may be used to treat cancer or to improve quality of life by symptom management. In addition, chemotherapy can improve the efficacy of other treatments like surgery or radiation therapy.

Clinical Application Insights

Therapy selection segment dominated the overall market in 2023 with a revenue share of 33.76%. The market's growth is attributed to selection of treatment options that can be affected by liquid biopsies to improve patient outcomes. Cancer is the second leading cause of mortality in the U.S. and most expensive disease to cure. Several advancements in cancer detection and biomarkers have been developed to aid the study of cancer progression and creation of successful treatment options. Liquid biopsies can assist in improving cancer therapies by enabling early intervention, enhancing treatment control, and moving decision-making away from reactionary acts and toward more proactive early interventions. Early detection is also facilitating market growth.

Product Insights

The instruments product segment dominated the market in 2023 with a revenue share of 46.47%, attributed to the launch of new instruments and the advancement of existing products. For instance, in 2022, Tempus added xF+, a liquid biopsy panel made of 523 genes, a brand-new non-invasive test that focuses on pathogenic mutations in cfDNA, to its array of comprehensive genomic profiling services.

Sample Type Insights

Blood sample segment held the largest market share of 71.69% in 2023 and is projected to maintain its dominance over the forecast period. Blood-based liquid biopsy has remarkable advantages over traditional biopsy methods. Blood-based liquid biopsies are non-invasive, painless, and have no risk. In addition, it reduces time taken and cost for diagnosis. Exomes, CTCs, cfDNAs, and microvesicles in a blood sample can be detected, thus increasing adoption of blood-based liquid biopsy. Circulating biomarkers play a vital role in understanding tumorigenesis and metastasis, which help determine tumor dynamics for treatment and disease progression.

Regional Insights

North America dominated the market with a revenue share of 50.76% in 2023, owing to high cancer prevalence, rapid technological advancements, and growing government initiatives. Moreover, the market is led by the U.S. owing to more investments and presence of several biotechnology companies developing advanced tests. Various organizations, including the American Society of Clinical Oncology (ASCO), are working to support the deployment of liquid biopsy, which is expected to increase revenue in this market. The market is expected to grow during the forecast period owing to intense competition between biotechnology companies and increasing investments by governments in healthcare institutes to develop more sophisticated tests.

Key Companies & Market Share Insights

The presence of pipeline products in the liquid biopsy segment that are expected to launch in the coming years is anticipated to drive the market growth over the forecast period.

- In November 2023, Illumina Inc. announced the new TruSight Oncology 500 ctDNA v2, a new generation of its liquid biopsy assay for genomic profiling.

- In January 2023, Agilent Technologies, Inc. acquired Avida Biomed. This initiative is expected to provide it with rapid growth in the diagnostics and clinical research markets.

Browse through Grand View Research's Clinical Diagnostics Industry Research Reports.

- Breast Lesion Localization Methods Market Size, Share & Trends Analysis Report By Type (Wire Guided Localization, Radioisotope Localization, Magnetic Tracer, & Others), By Region, And Segment Forecasts, 2024 - 2030

- Hepatitis E Diagnostic Tests Market Size, Share & Trends Analysis Report By Type (ELISA HEV IgM Test, Rapid Diagnostics Test), By End Use (Hospitals, Blood Banks), By Region, And Segment Forecasts, 2024 - 2030

Key Liquid Biopsy Companies:

- ANGLE plc

- Oncimmune Holdings PLC

- Guardant Health

- Myriad Genetics, Inc.

- Biocept, Inc.

- Lucence Health Inc.

- Freenome Holdings, Inc.

- Hoffmann-La Roche Ltd.

- QIAGEN

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Epigenomics AG

Liquid Biopsy Market Segmentation

Grand View Research has segmented the global liquid biopsy market report based on sample type, biomarker, technology, application, end-use, clinical application, product, and region:

Liquid Biopsy Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

- Blood Sample

- Others

Liquid Biopsy Biomarker Outlook (Revenue, USD Million, 2018 - 2030)

- Circulating Tumor Cells (CTCs)

- Circulating Nucleic Acids

- Exosomes/ Microvesicles

- Circulating Proteins

Liquid Biopsy Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Multi-gene-parallel Analysis (NGS)

- Single Gene Analysis (PCR Microarrays)

Liquid Biopsy Application Outlook (Revenue, USD Million, 2018 - 2030)

- Cancer

- Reproductive Health

- Lung Cancer

- Prostate Cancer

- Breast Cancer

- Colorectal Cancer

- Leukemia

- Gastrointestinal Cancer

- Others

- Others

Liquid Biopsy End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals and Laboratories

- Specialty Clinics

- Academic and Research Centers

- Others

Liquid Biopsy Clinical Application Outlook (Revenue, USD Million, 2018 - 2030)

- Therapy Selection

- Treatment Monitoring

- Early Cancer Screening

- Recurrence Monitoring

- Others

Liquid Biopsy Product Outlook (Revenue, USD Million, 2018 - 2030)

- Instruments

- Consumables Kits and Reagents

- Software and Services

Liquid Biopsy Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Order a free sample PDF of the Liquid Biopsy Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world's most expansive market research database