In Malaysia's dynamic business landscape, mastering the intricacies of taxation is essential for financial efficiency and sustainable growth. business tax Malaysia This comprehensive guide empowers entrepreneurs and corporations with actionable strategies and expert insights to navigate Malaysia's business taxation landscape effectively, unlocking avenues for financial optimization and long-term success.

Introduction: Amidst Malaysia's economic vibrancy, understanding its tax system is paramount for business success. This guide serves as a compass, offering practical strategies and expert guidance to decode Malaysia's business tax terrain with confidence and precision.

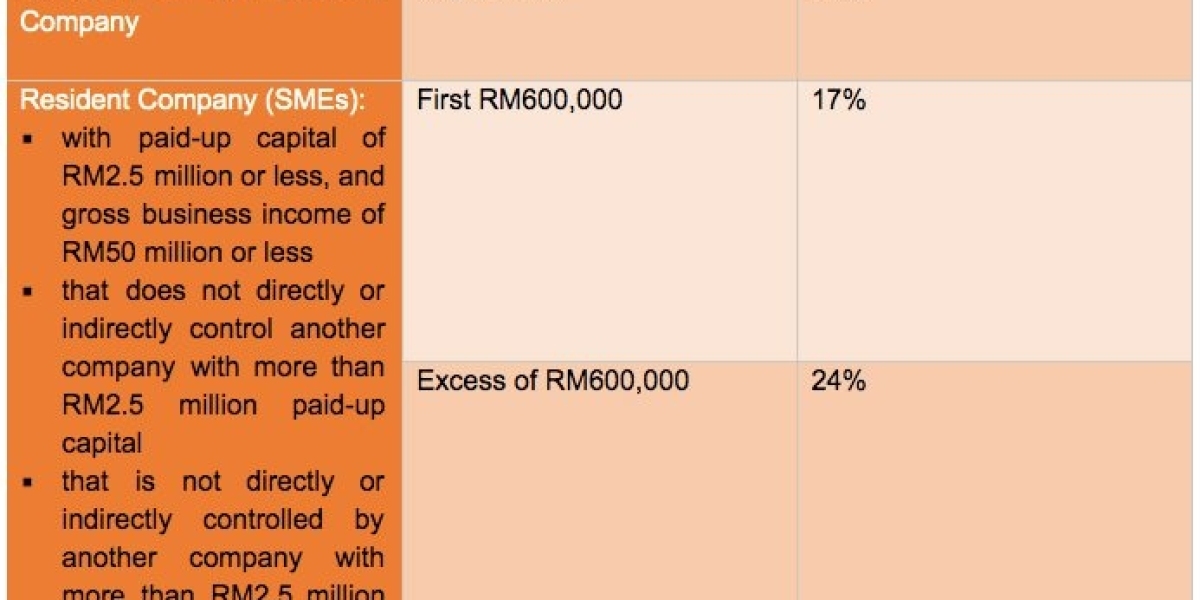

Corporate Tax Essentials: Resident companies face a flat corporate tax rate of 24%, with similar rates applicable to non-residents based on their income sources. Strategic tax planning and exploration of deductions are crucial for optimizing tax liabilities and strengthening financial resilience.

Transitioning from GST to SST: The shift from GST to SST has reshaped Malaysia's tax landscape. Understanding these changes is vital for ensuring compliance and adapting business strategies to align with regulatory shifts.

Navigating Withholding Tax and Stamp Duty: Withholding tax obligations and stamp duty considerations are integral to business transactions in Malaysia. A comprehensive understanding of these aspects is vital for managing risks and maintaining compliance standards during transactions.

Maximizing Tax Incentives and Reliefs: Malaysia offers various tax incentives and reliefs to spur economic growth and incentivize investment. Identifying and leveraging these opportunities, such as pioneer status and industry-specific incentives, can optimize tax positions and enhance competitiveness.

Excellence in Compliance and Reporting: Compliance with tax regulations is non-negotiable for businesses in Malaysia. Timely filing, accurate record-keeping, and adherence to reporting requirements are imperative for maintaining regulatory compliance and fostering trust with stakeholders.

Conclusion: Mastering business taxation in Malaysia requires strategic planning, proactive measures, and a commitment to compliance. By embracing tax dynamics, leveraging incentives, and prioritizing compliance efforts, businesses can navigate Malaysia's tax landscape successfully, ensuring financial efficiency and long-term prosperity in the competitive business arena.