In today's digital age, it's becoming increasingly important to be vigilant and protect yourself from various forms of fraud. One common method used by scammers is the production of fake bank statements. These counterfeit documents can be used to deceive individuals or institutions for personal gain. In this article, we will explore the telltale signs of a fake bank statement and provide you with the knowledge to spot them.

What is a Fake Bank Statement?

A fake bank statement is a document that has been forged or manipulated to resemble a legitimate bank statement. Scammers often use these statements to deceive individuals or organizations into believing they have a certain amount of money in their account when, in reality, they do not. This can be done for various reasons, such as applying for loans, renting properties, or even for personal validation.

How to Identify a Fake Bank Statement

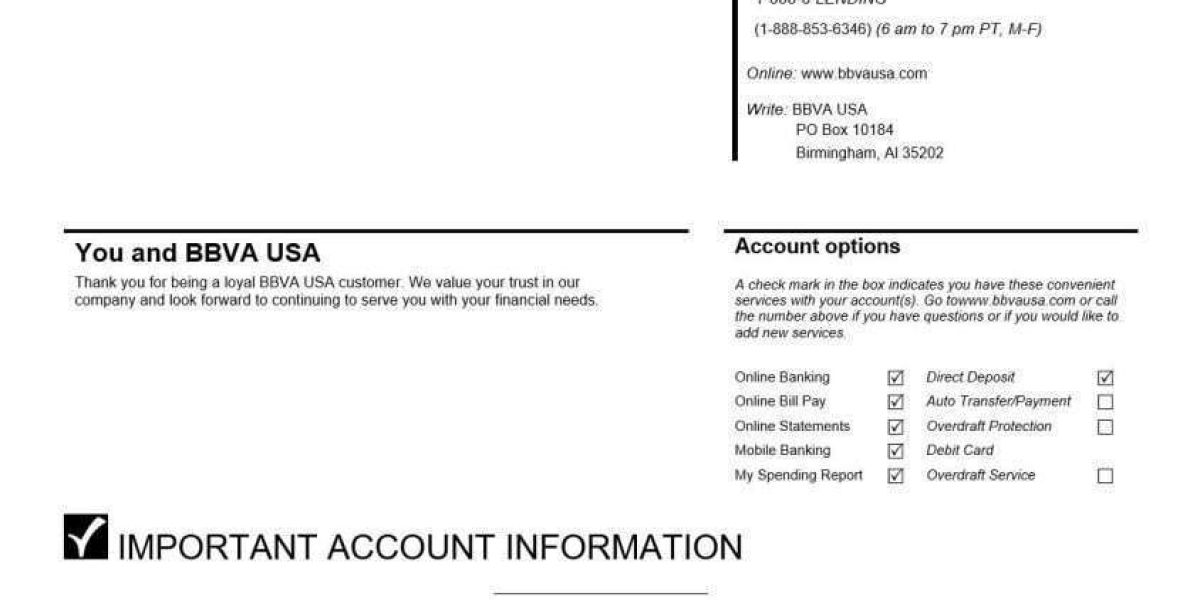

Inconsistencies in Formatting: One of the first signs of a fake bank statement is inconsistencies in formatting. Legitimate bank statements have a standard format that is followed by all financial institutions. Look out for irregular fonts, misaligned tables, or incorrect logos.

Lack of Transaction Details: A genuine bank statement contains detailed transaction information, including dates, descriptions, and amounts. If you notice a lack of transaction details or generic descriptions like "Payment" or "Deposit," it could be a red flag.

Missing or Incorrect Contact Information: Legitimate bank statements always include accurate contact information for the bank, such as the customer service hotline or branch address. If this information is missing or incorrect, it could indicate a fake statement.

Suspicious Account Activity: Take a close look at the account activity section of the statement. Look for any unusual or suspicious transactions, such as large withdrawals or deposits from unknown sources. If something seems off, it's worth investigating further.

Poor Quality Printing: Fake bank statements are often produced using low-quality printers or software. Look for signs of poor printing, such as smudged ink, blurred text, or uneven lines.

Incorrect Terminology: Pay attention to the language used in the statement. Banks have specific terminology for different types of transactions, and a fake statement may use incorrect or generic terms.

Check for Watermarks or Holograms: Legitimate bank statements often have watermarks or holograms to enhance security. These features are difficult to replicate and can be a good indicator of authenticity.

Conclusion

Spotting a fake bank statement can be challenging, but with the right knowledge and attention to detail, you can protect yourself from falling victim to fraud. Remember to always verify the authenticity of any financial documents before making any important decisions based on them. Stay vigilant and stay safe!